The Oil and Gas Industry

The oil and gas industry is a cyclical sector highly dependent on macroeconomic factors such as global supply and demand, geopolitical conditions, and energy market stability. Understanding its structure and business models is key to assessing its long-term viability and profitability.

In this document, we will analyze the main concepts, types of reservoirs, industry segments, key metrics, and valuation methods used in investing in oil and gas companies.

1. Cyclical Nature and Influencing Factors

The oil and gas sector is characterized by high volatility due to its dependence on:

- Global supply and demand: Affected by economic growth and energy policies.

- Geopolitical conditions: Conflicts in producing countries can significantly impact prices.

- Climatic factors: Hurricanes or harsh winters can affect production and distribution.

- Technological advancements: New extraction techniques such as fracking can change market dynamics.

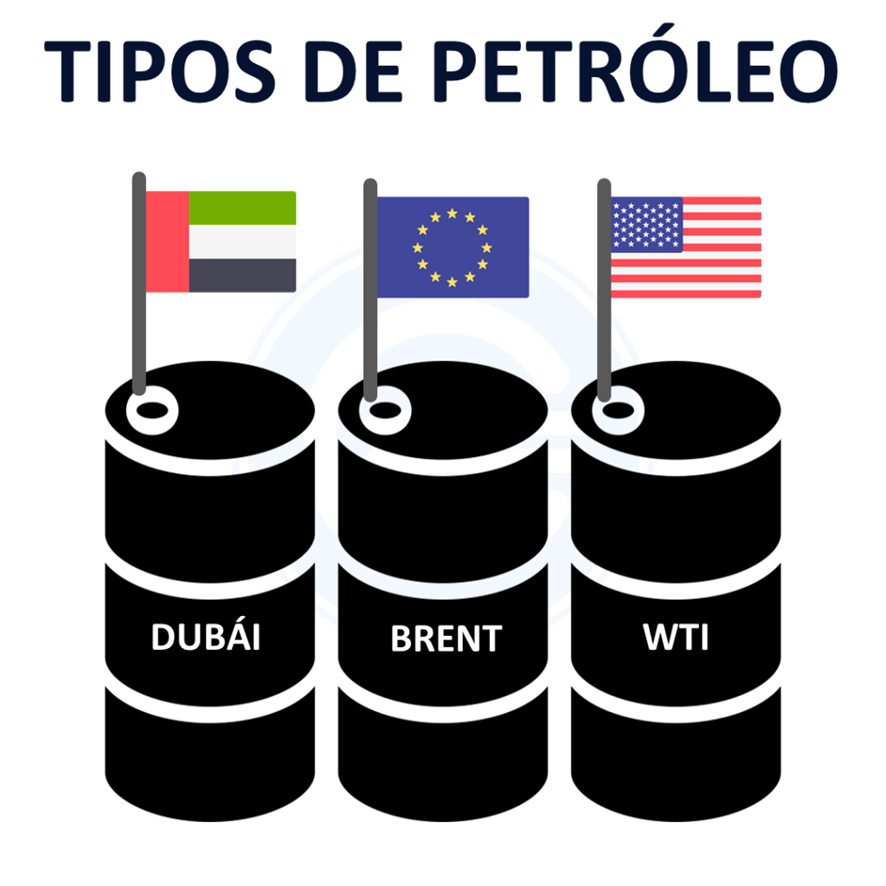

1.1 The price of crude oil is determined in two main markets:

-

West Texas Intermediate (WTI): Represents oil produced in the U.S.

-

Brent Crude: A global benchmark based on oil from the North Atlantic.

2. Types of Reservoirs

2.1 Oil Sands

Extraction of very heavy oil embedded in sand and its processing into refinable synthetic crude.

2.2 Pre-Salt Deepwater

Deepwater reservoirs located beneath layers of salt, making extraction more challenging.

2.3 Shale Gas

Gas trapped in low-porosity rock formations, extracted through hydraulic fracturing (fracking).

2.4 Shale Oil

Oil encapsulated in low-porosity rock formations, also extracted through fracking.

3. Industry Segments

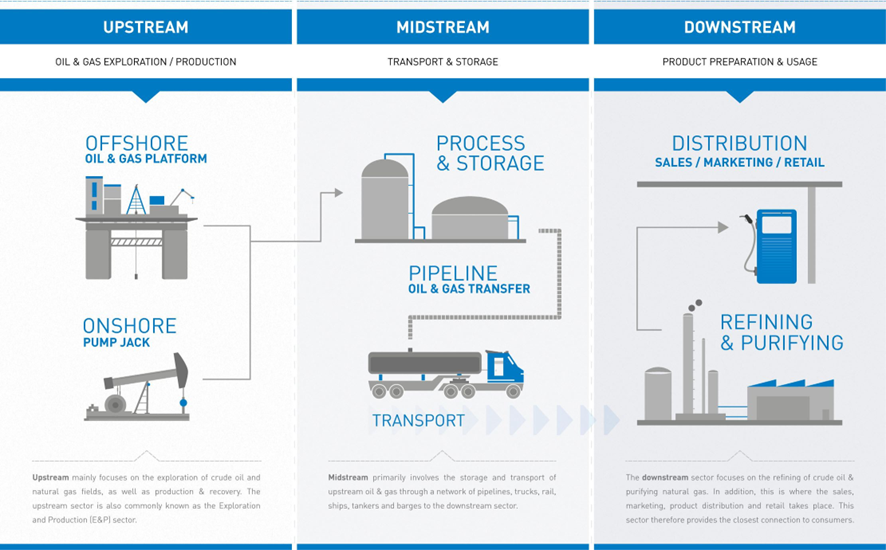

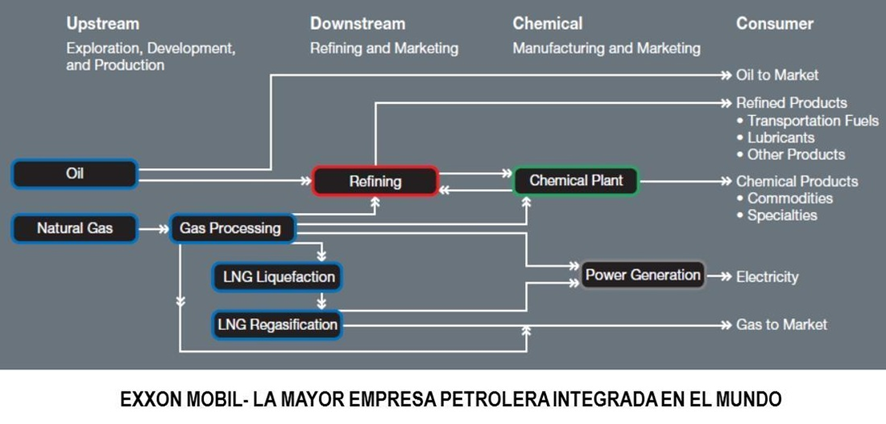

3.1 Upstream (Exploration and Production)

This is the most capital-intensive and high-risk phase. It involves:

- Exploration of new reservoirs.

- Extraction and production of crude oil.

Companies in this segment must balance capital costs with their Return on Invested Capital (ROIC) to ensure profitability.

3.2 Midstream (Transportation and Storage)

This segment involves the distribution of crude oil from wells to refineries through:

- Pipelines and gas pipelines.

- Maritime and land transportation.

3.3 Downstream (Refining and Distribution)

The transformation of crude oil into finished products such as gasoline, diesel, and plastics. Key characteristics include:

- Lower returns on investment.

- High dependence on refining margins.

3.4 Oilfield Services

Companies specializing in providing support to the industry, such as:

- Drilling rig rentals.

- Geological mapping.

- Specialized transportation.

4. Key Factors in Evaluating Oil Companies

4.1 Production Costs

- Cash Cost of Production: The cash expense to produce an additional barrel.

- Marginal Cost of Production: The extraction cost for new projects.

If the crude oil price falls below the cash cost, the company may operate at significant losses.

4.2 Reserve Replacement Ratio

Measures the company's ability to replenish extracted reserves. A ratio above 100% indicates reserve growth.

4.3 Reserves and Useful Life

Reserves are classified as:

- 1P (Proven Reserves): Extraction probability above 90%.

- 2P (Proven + Probable Reserves): 50% probability.

- 3P (Proven + Probable + Possible Reserves): 10% probability.

5. Valuation Methods

5.1 EV/BOE

Compares Enterprise Value (EV) with barrels of oil equivalent produced daily (BOE/day).

- 1 barrel (bbl) = 42 U.S. gallons.

- Prefixes used: Mbbl (1,000 barrels), MMbbl (1 million barrels).

5.2 NAV (Net Asset Value)

Values the company based on its reserves and net assets. Typically, a 50% discount is applied to NAV.

5.3 RLI (Reserve Life Index)

Measures the estimated duration of current reserves at the current production rate.

5.4 Key Multiples

- EV/Adjusted Cash Flow from Debt.

- Adjusted PER.

- EV/EBITDA (Maximum recommended: 6x in a normalized cycle).

- FCF (Maximum recommended: 10x).

For pure exploration companies, valuation should be based on the Net Present Value (NPV) of reserves.

6. Risks and Final Considerations

6.1 External Factors

- Increasingly strict environmental regulations.

- Energy transition and development of renewable sources.

- Impact of geopolitical crises and OPEC agreements.

6.2 Dependence on Crude Oil Prices

Oil companies are highly correlated with commodity prices, which can drastically affect profitability.

6.3 Company Selection

It is essential to choose low-cost producers with a strong management team and clear strategies to mitigate market volatility.

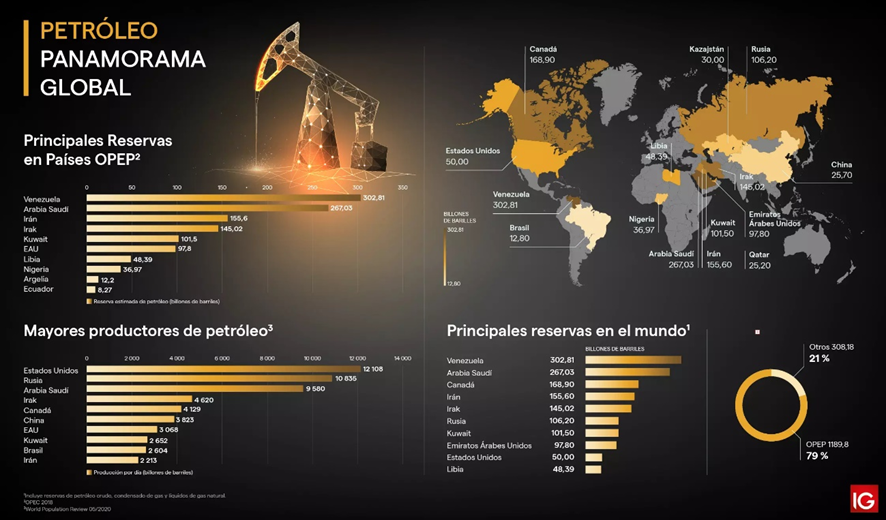

OPEC and Its Influence

The Organization of the Petroleum Exporting Countries (OPEC) is a cartel formed by some of the world's largest oil producers. Its main objective is to coordinate and unify the oil policies of its members to ensure stable and profitable prices for producers.

History and Members

Founded in 1960, OPEC currently consists of 13 countries, including Saudi Arabia, Iran, Iraq, and Venezuela. There is also a group known as OPEC+, which includes other producers such as Russia.

Impact on Crude Oil Prices

OPEC influences oil prices by regulating production. When demand is low, the organization can cut supply to maintain higher prices, and vice versa. However, its decisions can be affected by the production levels of non-member countries, such as the United States.

7. Conclusion

The oil and gas industry, is complex and requires in-depth analysis, to properly evaluate investment opportunities. Due to its cyclical nature, investors must consider factors such as production costs, reserves, reservoir lifespan, and the macroeconomic environment.

Success in investing in this sector lies in selecting companies with low operating costs, good capital management, and well-defined strategies to mitigate the effects of crude oil price volatility.