Stock Buybacks

Stock buybacks are one of the most commonly used financial strategies by companies to manage their capital structure and enhance shareholder value. While they can be seen as a sign of confidence in the company itself, they can also have side effects that need to be carefully analyzed.

1. Definition of Stock Buybacks

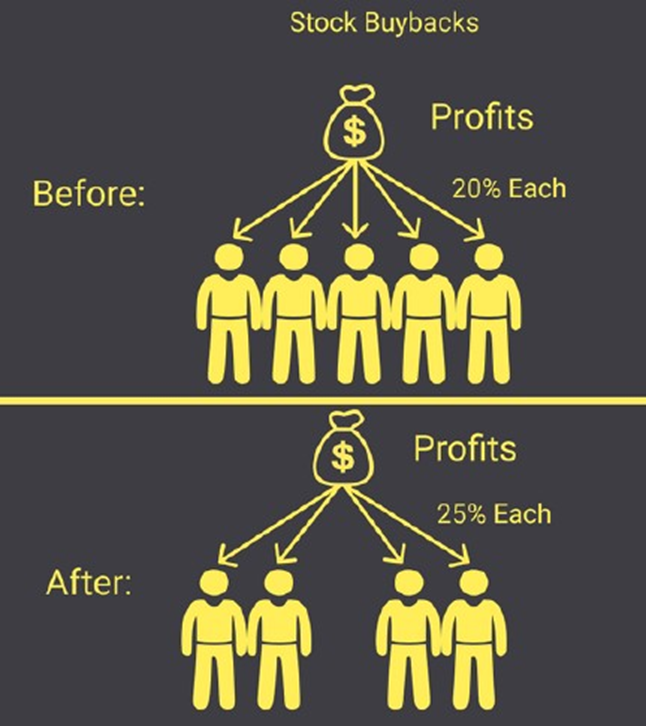

A stock buyback is a financial transaction in which a company repurchases its own shares from the market, thereby reducing the number of outstanding shares.

This process can be carried out through:

- Direct market purchases: The company acquires its shares like any other investor.

- Tender offer to shareholders: A specific price is offered to shareholders for them to sell their shares.

- Dutch auction: A price range is set, and shareholders bid at the price they are willing to sell.

- Agreement with major shareholders: The company negotiates the buyback directly with majority shareholders.

2. Uses of a Stock Buyback

Companies undertake stock buybacks for various reasons, including:

- Enhancing earnings per share (EPS): By reducing the number of outstanding shares, net income is distributed among fewer shares, increasing EPS.

- Lowering the Price-to-Earnings ratio (P/E): If the stock price remains constant and EPS increases, the stock may appear more attractive in terms of valuation.

- Optimizing the capital structure: It allows for an adjustment in the balance between debt and equity.

- Returning capital to shareholders: It serves as an alternative to dividends for rewarding shareholders.

- Signaling confidence in the company: It can indicate that the company believes its shares are undervalued.

- Mitigating dilution impact: Companies issue new shares to raise capital or as part of employee compensation plans. Buybacks can counteract this dilution.

3. Advantages of Stock Buybacks

Stock buybacks can offer several benefits, such as:

- ✅Increase in stock value: Reducing the number of shares can raise the price per share if demand remains constant.

- ✅Tax efficiency: In many cases, buybacks have tax advantages over dividends.

- ✅Flexibility: Unlike dividends, which create an expectation of recurring payments, buybacks can be adjusted based on market conditions.

- ✅Less dilution for existing shareholders: Prevents shareholders from seeing their ownership stake reduced due to new share issuances.

4. Disadvantages of Stock Buybacks

Despite their benefits, stock buybacks also present risks and drawbacks that must be considered:

- ❌Inefficient use of capital: If the company spends large sums on buybacks instead of investing in growth, its long-term competitiveness may suffer.

- ❌Excessive debt: Some companies take on debt to finance buybacks, potentially jeopardizing their financial stability.

- ❌Perception of manipulation: In some cases, executives may use buybacks to artificially inflate the stock price in the short term.

- ❌Possible negative equity: If a company repurchases too many shares and is left with little equity, it could enter "negative equity," a risky situation for its sustainability.

5. Successful Stock Buyback Cases

- Apple: The company has conducted one of the largest buybacks in history, returning value to shareholders without compromising its growth.

- Berkshire Hathaway: Warren Buffett has used buybacks selectively when he believes his company's stock is undervalued.

6. Failed Stock Buyback Cases

- General Electric: Spent billions on buybacks before its financial situation worsened, leaving the company without capital to address its problems.

- IBM: Engaged in aggressive buybacks instead of investing in innovation, affecting its long-term competitiveness.

Negative Equity and Its Risk in Buybacks

Negative equity occurs when a company has repurchased so many shares that its net equity becomes negative. This can be due to:

- Excessive debt: The company borrows money to repurchase shares, and its liabilities exceed its assets.

- Lack of accumulated reserves: The buyback is carried out without considering balance sheet strength.

- Recessions or crises: If a company faces revenue declines after conducting buybacks, it may find itself in a weak financial position.

A classic example is McDonald's in 2016, when it was reported that the company had reached negative equity due to its aggressive buyback program financed by debt. Despite its profitability, the company had to adjust its strategy to avoid greater risks.

Conclusion

Stock buybacks are a powerful tool for corporate capital management, but they must be implemented prudently. While they can benefit shareholders in the short term, excessive or improper use can compromise a company's financial stability.

Source: @BrianFeroldi (X), https://brianferoldi.kit.com/99