Business Valuation - Valuation Multiples

Business valuation is a fundamental process in finance and investments as it determines a company's intrinsic value. This knowledge is essential for making informed decisions regarding acquisitions, mergers, financing, stock investments, and other key financial processes.

Key Concepts:

Market capitalization is the total market value of a publicly traded company. It is calculated by multiplying the stock price by the total number of outstanding shares of the company. This indicator reflects the company's size in market terms and is used by investors to classify and compare companies within a sector or market.

Market Capitalization = Stock Price × Outstanding Shares

For example, if a company has 1 million outstanding shares and the stock price is $50, its market capitalization will be $50,000,000.

The enterprise value (EV), however, adjusts market capitalization by subtracting cash and adding debt, providing a more realistic perspective of the company's true value.

EV = Market Capitalization – Cash/Equivalents + Debt

Source: @BrianFeroldi (X), https://brianferoldi.kit.com/99

1. Price-to-Sales Ratio (P/S):

The Price-to-Sales (P/S) ratio is calculated by dividing a company's market price per share by its revenue per share or dividing the company’s market capitalization by its total revenue. Mathematically:

P/S Ratio = Revenue per Share / Price per Share

Or:

P/S Ratio = Total Revenue / Market Capitalization

1.1 Advantages of the P/S Ratio:

- Applicable to Non-Profitable Companies:

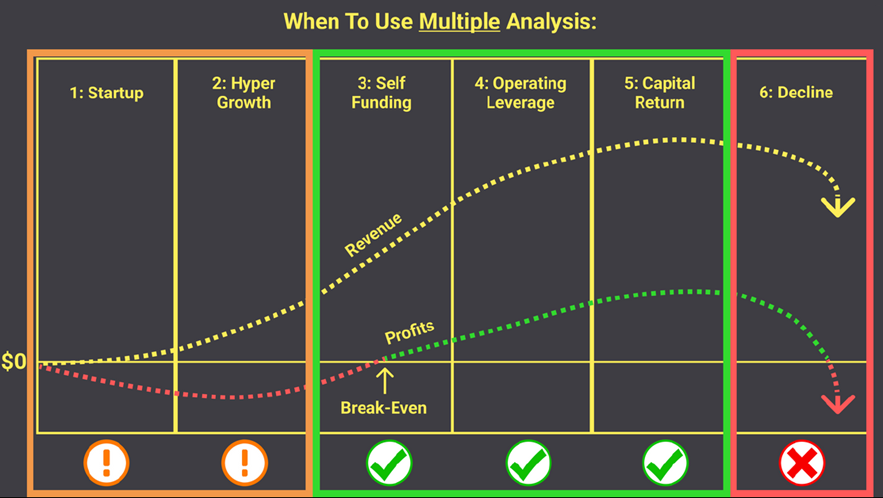

Unlike other ratios, such as the Price-to-Earnings (P/E) ratio, the P/S ratio can be used for companies that generate revenue but do not yet post profits.

- Sector Comparisons:

It is particularly useful for comparing companies within the same sector, especially in high-growth industries.

- Less Manipulable:

Revenue figures are harder to manipulate than earnings, making this metric more reliable.

1.2 Limitations of the P/S Ratio:

- Lacks Context on Profitability:

-

- It does not reflect operational profitability. A company may have high revenues but low or negative profit margins.

-

- Ignores Debt:

-

- A company with a low P/S ratio and high debt might be riskier than another with a high P/S ratio but low debt.

-

- Variability by Sector:

-

- In some sectors, such as technology, P/S ratios tend to be higher due to growth potential, whereas in mature sectors, such as utilities, they are typically lower.

-

1.3 P/S by Industry:

|

Industry |

P/S Level |

Characteristics |

|

Retail/Consumer Goods |

0.5x to 1.5x |

Low margins. |

|

Software and Technology |

5x or higher |

High margins and growth potential. |

|

Energy |

0.3x to 1x |

High revenue but low margins. |

|

Healthcare and Biotechnology |

3x to 10x |

Disruptive potential and regulatory dependency. |

2. Price-to-Earnings Ratio (P/E):

The Price-to-Earnings (P/E) ratio is one of the most widely used valuation metrics in fundamental analysis. It measures the relationship between a company's stock price and its earnings per share (EPS). It helps assess whether a stock is overvalued or undervalued based on its earnings.

P/E Ratio = EPS / Stock Price

Or:

P/E Ratio = Net Earnings / Market Capitalization

2.1 Advantages of the P/E Ratio:

- Broad Applicability:

-

- It can be applied to most profitable companies.

- Facilitates comparisons across companies of varying sizes within the same sector.

-

- Easy Interpretation:

-

- A high P/E ratio often reflects expectations of future growth.

- A low P/E ratio may indicate an undervalued company or structural issues.

-

- Price-Profit Relationship:

-

- It provides a clear measure of how many years an investor would take to recover their investment if profits remained constant.

-

- Comparability:

-

- Ideal for comparing similar companies within a sector, offering a quick perspective on relative valuation.

-

2.2 Limitations of the P/E Ratio:

- Not Applicable to Unprofitable Companies: It cannot be calculated if net earnings are negative.

- Ignores Growth: A low P/E ratio does not always indicate a good opportunity; it may reflect weak growth prospects.

- Manipulable: Net earnings can be subject to aggressive accounting practices, distorting the ratio.

- Economic Cyclicality: P/E ratios tend to expand during bull markets and compress during bear markets.

2.3 P/E by Industry:

|

Sector |

P/E Range |

Characteristics |

|

Technology |

25x to 40x |

High growth expectations. |

|

Consumer Staples |

15x to 20x |

Stability and moderate margins. |

|

Energy & Utilities |

10x to 15x |

Low volatility, stable income. |

|

Healthcare & Biotech |

20x to 30x |

Disruptive potential, regulatory dependency. |

2.4 Forward P/E vs. Trailing P/E:

- Trailing P/E:

-

- Based on earnings from the past 12 months.

- Reflects a company’s historical performance.

-

- Forward P/E:

-

- Uses estimates of future earnings.

- Provides insights into growth expectations.

-

2.5 Factors Influencing P/E:

- Growth Rate: High-growth companies typically have higher P/E ratios.

- Capital Structure: Companies with high debt may have low P/E ratios due to financial risk.

- Sector Outlook: Disruptive or innovative sectors often justify higher P/E ratios.

- Economic Cycle: P/E ratios compress during recessions and expand in bull markets.

2.6 P/E and PEG Ratio:

The PEG ratio (Price/Earnings/Growth) evolves the P/E ratio by factoring in earnings growth:

PEG = Growth Rate of EPS (%) / P/E Ratio

- PEG < 1: Indicates the stock is undervalued relative to its growth.

- PEG > 1: Suggests the stock may be overvalued.

2.7 Warning Signs with P/E Ratios:

- Extremely Low P/E: Could signal a value trap, reflecting fundamental issues or declining sectors.

- Extremely High P/E: Often indicates overvaluation or unrealistic growth expectations.

2.8 P/E in Cyclical Companies:

- Low P/E During Booms Can Be Misleading:

-

- Industries like automotive or raw materials may have artificially low P/E ratios during boom cycles due to peak earnings.

-

- High P/E During Recessions May Indicate Opportunity:

-

- Depressed earnings during downturns can result in high P/E ratios, signaling a potential recovery opportunity if fundamentals remain strong.

-

- Timing Is Crucial: Evaluate the P/E ratio in the context of the industry cycle:

- Boom: High earnings lead to low P/E (be wary of “bargains”).

- Recession: Low earnings lead to high P/E (consider recovery potential).

- Use Adjusted Metrics:

-

- Instead of relying solely on trailing P/E, consider forward P/E or normalized earnings over a full business cycle to account for volatility.

-

- Compare Historical Averages:

-

- For cyclical companies, comparing current P/E ratios to their historical industry averages provides a clearer context.

-

Example:

- Company A (Steel Industry): During a boom, earnings surge, and its P/E drops to 5x, appearing undervalued. However, if the market reverses, earnings and stock price may both decline.

- Company B (Same Industry): During a downturn, earnings fall, and the P/E rises to 30x. If the market conditions improve, earnings could recover, justifying the high P/E ratio.

3. Enterprise Value/EBITDA (EV/EBITDA):

The EV/EBITDA ratio is one of the most commonly used valuation metrics in fundamental analysis. It is particularly valuable because it combines Enterprise Value (EV), which accounts for both market capitalization and net debt, with EBITDA, a key indicator of operational profitability before interest, taxes, depreciation, and amortization.

EV/EBITDA = Enterprise Value (EV) / EBITDA

3.1 Advantages of the EV/EBITDA Ratio:

- Accounts for Capital Structure:

-

- By incorporating net debt into EV, this ratio provides a complete view of the total value of the company.

-

- Neutralizes Accounting Differences:

-

- EBITDA removes the effects of accounting policies like depreciation and amortization, enabling more precise comparisons.

-

- Applicable to Companies with Accounting Losses:

-

- Useful for valuing companies with net losses (where P/E is inapplicable) as long as they generate positive operational cash flow.

-

- Cross-Sector Comparisons:

-

- Particularly helpful for comparing companies in capital-intensive sectors like energy or telecommunications.

-

3.2 Limitations of the EV/EBITDA Ratio:

- Ignores CapEx and Debt Structure:

-

- Does not account for significant capital expenditures or differences in long-term debt structures.

-

- Excludes Taxes:

-

- Tax rates, which affect net profitability, are not reflected in EBITDA.

-

- Does Not Represent Actual Cash Flows:

-

- While it eliminates non-cash items, it does not reflect the net operational cash flow available to shareholders and creditors.

-

- Sector Dependency:

-

- The "normal" EV/EBITDA levels vary widely between sectors.

-

3.3 EV/EBITDA by Industry:

|

Sector |

EV/EBITDA Range |

Characteristics |

|

Technology |

15x to 25x |

High growth expectations, low capital intensity. |

|

Consumer Staples |

8x to 12x |

Stable revenues, moderate margins. |

|

Energy & Utilities |

5x to 10x |

Capital-intensive, stable income, low volatility. |

|

Healthcare & Biotech |

10x to 20x |

Disruptive potential, reliance on innovation. |

|

Industry & Manufacturing |

7x to 11x |

Capital-intensive, tied to economic cycles. |

3.4 How to Use EV/EBITDA in Analysis:

- Compare to Industry Averages:

-

- Evaluate whether the company’s ratio aligns with the sector average.

-

- Consider Context:

-

- Adjust analysis based on capital structure and capital expenditure (CapEx).

-

- Analyze Ratio Trends:

-

- A rising EV/EBITDA ratio may indicate overvaluation or margin expansion.

-

- Complement with Cash Flows:

-

- Assess the conversion of EBITDA into operating cash flow.

-

3.5 Warning Signs with EV/EBITDA:

- Extremely Low EV/EBITDA: May reflect operational problems or a declining sector.

- Extremely High EV/EBITDA: Indicates high growth expectations or potential overvaluation.

4. Enterprise Value/EBIT (EV/EBIT):

The EV/EBIT ratio (Enterprise Value/Earnings Before Interest and Taxes) is a widely used valuation metric in fundamental analysis. It measures how much investors are paying for a company’s operating profits before accounting for financial costs and taxes. This ratio is especially useful for comparing companies with different capital structures.

EV/EBIT = Enterprise Value (EV) / EBIT

4.1 Advantages of the EV/EBIT Ratio:

- Independent of Capital Structure:

-

- By including the total value of the company (including debt), this ratio enables comparisons between companies with varying levels of leverage.

-

- Better than P/E for Indebted Companies:

-

- Excludes the effects of interest, focusing on operational efficiency.

-

- Useful for Sector Comparisons:

-

- Facilitates comparisons across companies within the same sector, irrespective of tax policies or leverage.

-

- Accounts for Debt and Cash:

-

- Unlike other ratios such as P/E, it incorporates the company’s debt and liquidity.

-

4.2 Limitations of the EV/EBIT Ratio:

- Ignores Depreciation and Amortization:

-

- Companies with asset-heavy operations (e.g., manufacturing, energy) may report lower EBIT due to high depreciation costs.

-

- Excludes Tax Impact:

-

- Does not reflect the impact of different tax rates, which can distort comparisons between companies operating in different jurisdictions.

-

- Bias Due to CapEx Differences:

-

- Does not account for the company’s reinvestment needs, which may affect earnings sustainability.

-

- Sector Dependency:

-

- “Normal” EV/EBIT levels vary significantly across industries.

-

4.3 EV/EBIT by Industry:

|

Sector |

EV/EBIT Range |

Characteristics |

|

Technology |

20x to 30x |

High growth expectations, relatively low CapEx. |

|

Consumer Staples |

12x to 18x |

Operational stability, predictable income. |

|

Energy & Utilities |

8x to 12x |

Capital-intensive, stable revenues. |

|

Healthcare & Biotech |

15x to 25x |

Innovation-driven, reliant on regulatory approval. |

|

Industry & Manufacturing |

10x to 15x |

Cyclical, moderately capital-intensive. |

4.4 Relation to EBITDA:

- EV/EBIT: Includes depreciation and amortization, relevant for asset-heavy industries.

- EV/EBITDA: Excludes depreciation and amortization, useful for comparing companies in less capital-intensive sectors.

5. Valor Empresa/Flujo de Caja Libre (EV/FCF):

El ratio EV/FCF (Enterprise Value/Free Cash Flow) es una métrica clave para evaluar la valoración de una empresa basada en su capacidad de generar flujo de caja libre (FCF). A diferencia de otros ratios centrados en ganancias contables, este ratio pone énfasis en el flujo de efectivo real disponible para los accionistas y acreedores, proporcionando una visión más precisa de la salud financiera de la empresa.

EV/FCF = Valor de la Empresa (EV) / Flujo de Caja Libre (FCF)

5.1 Ventajas del Ratio EV/FCF

- Medida Real de Rentabilidad:

-

- El FCF refleja el efectivo generado por el negocio, eliminando el ruido de las ganancias contables.

-

- Independiente de la Estructura Contable:

-

- Es menos susceptible a prácticas contables agresivas en comparación con métricas basadas en ingresos o ganancias.

-

- Ideal para Empresas con Alto CapEx:

-

- Especialmente útil en industrias donde los gastos de capital representan una parte significativa de las operaciones.

-

- Perspectiva Completa:

-

- Al incorporar tanto deuda como efectivo, el EV/FCF ofrece una visión integral del valor de la empresa en relación con su capacidad de generar efectivo.

-

5.2 Limitaciones del Ratio EV/FCF

- Variabilidad del FCF:

-

- Empresas con flujos de caja libre volátiles pueden tener ratios inconsistentes y difíciles de interpretar.

-

- Sensibilidad al CapEx:

-

- Una empresa con gastos de capital temporalmente altos puede parecer menos atractiva según este ratio, aunque esté invirtiendo en crecimiento futuro.

-

5.3 EV/FCF por Sectores

|

Sector |

EV/FCF Típico |

|

Tecnología y Software |

20x o más (alto crecimiento, bajos CapEx). |

|

Consumo Masivo |

10x a 15x (flujos constantes, bajo CapEx). |

|

Energía y Recursos Naturales |

5x a 10x (alto CapEx, flujos cíclicos). |

|

Industria y Manufactura |

8x a 12x (flujos más estables, moderado CapEx). |

|

Salud y Biotecnología |

15x a 25x (altas expectativas de crecimiento). |

5.4 Relación con EV/EBITDA:

o EV/FCF: Mide el efectivo real disponible después de inversiones en CapEx.

o EV/EBITDA: Excluye CapEx y partidas no monetarias, ideal para evaluar la eficiencia operativa.

5.5 Señales de Advertencia con EV/FCF

- EV/FCF Muy Alto:

-

- Puede reflejar sobrevaloración o dependencia de flujos de caja no recurrentes.

-

- FCF Negativo:

-

- Empresas con FCF negativo no pueden calcular este ratio, lo que sugiere que están reinvirtiendo todo su efectivo o enfrentan dificultades financieras.

-

- Volatilidad en el FCF:

-

- Un FCF altamente volátil puede dificultar la interpretación del ratio y señalar riesgos operativos.

-

6. Precio/Valor Contable (P/Book Value):

El ratio Precio/Valor en Libros (P/B) mide la relación entre el precio de mercado de una acción y el valor contable, de los activos netos, por acción de la empresa. Es ampliamente utilizado para evaluar si una acción está sobrevalorada o infravalorada en función de los activos netos de la empresa. Es particularmente útil en industrias donde los activos físicos y el capital tangible son componentes clave.

P/B= Precio de Mercado por Acción / Valor en Libros por Acción

O bien:

P/B = Total Capitalización de Mercado / Valor en Libros

6.1 Ventajas del Ratio P/B

- Útil en Empresas Intensivas en Activos:

-

- Ideal para evaluar empresas en sectores como banca, energía, manufactura o bienes raíces, donde los activos tangibles son clave.

-

- Medida Conservadora:

-

- Representa el valor contable neto, proporcionando un piso teórico para el valor de la empresa.

-

- Indicador de Seguridad Financiera:

-

- Un P/B bajo puede indicar que la empresa está respaldada por activos significativos en relación con su precio de mercado.

-

6.2 Limitaciones del Ratio P/B

- No Considera Activos Intangibles:

-

- Empresas con grandes proporciones de activos intangibles (como marcas o patentes) pueden tener un P/B alto que no refleja su verdadero valor.

-

- Desactualización del Valor Contable:

-

- Los activos en los libros suelen estar registrados a su costo histórico, lo que puede subestimar el valor real de ciertos activos.

-

- Menos Relevante en Sectores con Activos Livianos:

-

- En industrias tecnológicas o de servicios, donde los activos tangibles son mínimos, el P/B tiene una utilidad limitada.

-

- Variabilidad en Sectores:

-

- Los niveles normales de P/B varían significativamente entre sectores.

-

6.3 P/B por Sectores

|

Sector |

P/B Típico |

|

Banca y Finanzas |

0.8x a 2x (enfocado en activos tangibles). |

|

Energía y Recursos Naturales |

0.5x a 1.5x (intensivo en capital físico). |

|

Consumo Masivo |

1x a 3x (dependiendo de márgenes y activos). |

|

Tecnología |

3x a 10x (grandes proporciones de activos intangibles). |

|

Bienes Raíces |

0.8x a 2x (basado en activos inmobiliarios). |

6.4 Señales de Advertencia con el P/B

- P/B Demasiado Bajo:

-

- Puede reflejar problemas fundamentales, como baja rentabilidad o deterioro de activos.

-

- P/B Elevado:

-

- Indica expectativas de crecimiento o valoración sobre activos intangibles, lo que puede no estar respaldado por los fundamentos.

-

- Discrepancias en el Valor Contable:

-

- Activos desactualizados o difícilmente liquidables pueden distorsionar el valor en libros.

-

7. Price-to-Net Asset Value (P/NAV):

Calculations:

7.1 Recommended Use Cases for P/NAV:

- Real Estate (REITs):

-

- Assesses real estate properties adjusted to market prices.

- Indicates if assets generate sufficient returns relative to valuation.

-

- Mining and Natural Resources:

-

- Evaluates reserves of minerals or oil adjusted to market prices.

- Helps identify discrepancies between the value of reserves and market capitalization.

-

- Energy:

-

- Values oil and natural gas reserves based on current commodity prices.

- Useful for extraction and production companies.

-

- Investment Funds:

-

- Evaluates portfolios of liquid assets or investments adjusted to market values.

-

7.2 Differences Between P/NAV and P/B:

- P/B (Price-to-Book):

-

- Based on the book value of net assets, recorded at historical cost.

- Does not adjust assets to current market values.

- More applicable in sectors like banking or manufacturing.

-

- P/NAV (Price-to-Net Asset Value):

-

- Based on the current market value of assets.

- Considers adjustments for reserves, properties, or investments at market prices.

- More relevant for industries with tangible assets and less so for those with intangible assets.

-

7.3 Limitations of the P/NAV Ratio:

- Reliance on Assumptions: NAV depends on subjective estimates like market prices, available reserves, and discount rates.

- Asset Price Volatility: In sectors like mining or energy, changes in commodity prices significantly affect NAV.

- Ignores Cash Flow Generation:Does not evaluate the company’s ability to generate recurring income from its assets.

- Limited Use in Intangible Asset Sectors: In industries with high intangible asset values (e.g., technology), P/NAV is irrelevant.

7.4 P/NAV by Industry:

|

Sector |

P/NAV Range |

Key Considerations |

|

Real Estate (REITs) |

0.7x to 1.5x |

Depends on property market values. |

|

Mining |

0.5x to 1.2x |

Tied to commodity price fluctuations. |

|

Energy (Oil & Gas) |

0.5x to 1.3x |

Adjusted based on reserves and crude prices. |

|

Investment Funds |

0.9x to 1.2x |

Reflects liquid assets or quoted investments. |

|

Banking |

0.8x to 1.5x |

Often evaluated using P/B rather than P/NAV. |

8. Private vs. Public Company Comparisons:

8.1 Publicly Traded Companies:

8.2 Private Transactions (Mergers & Acquisitions):

8.3 Key Comparison Factors:

A) Differences in Observed Multiples:

B) Adjustments in Analysis:

To properly compare multiples, differences should be adjusted:

8.4 Uses of Comparisons:

A) Valuation of Private Companies:

- Multiples of public companies are used as benchmarks for valuing private companies, adjusting for control premiums, illiquidity discounts, and sector differences.

B) Identifying Investment Opportunities:

- Significantly lower multiples in private companies may indicate investment opportunities.

- Conversely, extreme discrepancies in similar sectors could suggest potential overvaluation in public companies.

C) Evaluating Mergers and Acquisitions:

- Private transaction multiples are analyzed to value public companies and vice versa.

- For example, if the average EV/EBITDA multiple in private acquisitions within a sector is 10x, a public company with much higher multiples may be overvalued.