Pharmaceutical Industry

The pharmaceutical sector is a highly specialized and diverse industry, ranging from large multinational corporations with extensive research and development (R&D) capabilities to emerging biotechnology companies seeking to revolutionize medicine. Each segment of the sector has its own dynamics, risks, and opportunities, making it essential to understand its fundamentals before investing in it.

1. Types of Pharmaceutical Companies

1.1 Big Pharma

Large pharmaceutical companies dominate the industry with massive R&D budgets, representing up to 20% of their sales. These companies typically have extensive product portfolios, including both branded and generic drugs.

1.2 Biotech (Biotechnology)

Highly innovative companies developing advanced therapies based on genetic engineering, cell therapies, and biological molecules. Many of them are not profitable and depend on the success of their research.

1.3 Specialty Pharma

Smaller companies that market specialized drugs, over-the-counter (OTC) medications, or generics. The market assigns them lower valuation multiples, around 7-8 times EV/EBITDA.

1.4 Generics

Manufacturers that produce equivalent versions of drugs whose patents have expired. Their business model is based on low production costs and economies of scale.

1.5 Plasma Companies

Companies that produce blood plasma derivatives to treat rare diseases, such as Grifols.

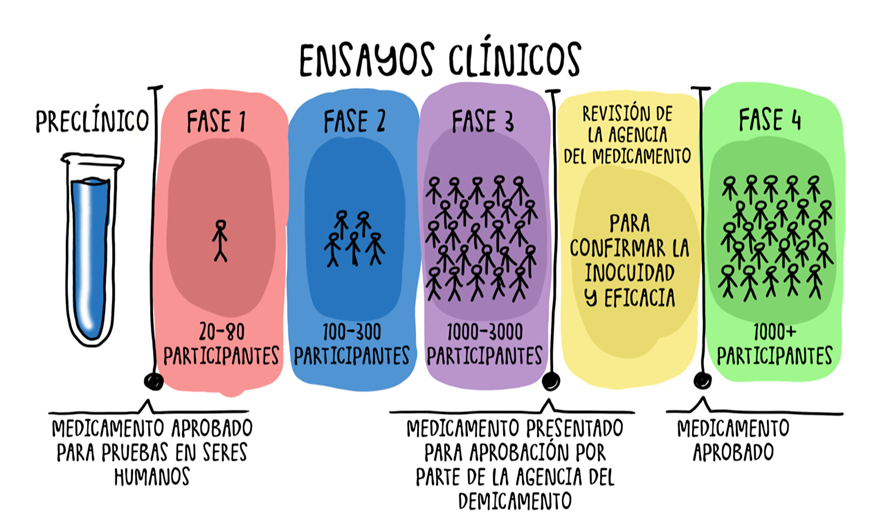

2. Drug Development Process

The development of a drug is a long and costly process, taking 10-12 years and costing billions of dollars. Only about 2.5% of studied molecules reach commercialization.

2.1 Discovery

Unmet medical needs are identified, and candidate molecules are sought.

2.2 Preclinical Phase

Laboratory and animal testing to assess the toxicity and viability of the compound.

2.3 Clinical Phases

- Phase I: Tested on 20-100 healthy subjects for 6 months to 1 year. Only 20% progress to the next phase.

- Phase II: Evaluated in 100-300 patients to determine the appropriate dosage (up to 26 months). Only 50% advance.

- Phase III: Studied in more than 1,000 patients for 3-6 years to assess efficacy and safety. Only half of the drugs reach regulatory approval.

2.4 Regulatory Evaluation

Regulators analyze clinical data and approve or reject the drug. In some cases, they may request additional studies.

2.5 Commercialization and Phase IV

Once approved, the drug is marketed with high margins until the patent expires. Its safety continues to be monitored in Phase IV.

3. Key Investment Factors

3.1 Pipeline

The pipeline refers to a company's set of drugs in development. Investors should focus on those in Phase II and III, as they have a higher probability of success.

3.2 Target Market Value

Some diseases have larger markets and intense competition, while rare diseases allow for higher margins due to their exclusivity.

3.3 Regulatory Impact

Each country has its own regulatory authority (FDA in the U.S., EMA in Europe), which can affect a drug’s approval in different markets.

3.4 Mergers and Acquisitions

The pharmaceutical sector is prone to mergers and acquisitions due to the high R&D costs. Large pharmaceutical companies often acquire promising biotech firms.

4. Pharmaceutical Company Valuation

4.1 Valuation Methods

- P/E Ratio (Price-to-Earnings): Used for established pharmaceutical companies, compared to historical averages.

- DCF (Discounted Cash Flow): Used to value biotech firms with growth potential. Typically assumes a WACC of 8.5% and a 2% growth rate.

- SOP (Sum of Parts): Values each business unit separately and sums them.

4.2 Key Valuation Factors

- Pipeline and product diversification.

- Active patents and expirations.

- Cost structure and profit margins.

- Debt levels and interest rate sensitivity.

5. Glossary of Key Terms

- ANDA (Abbreviated New Drug Application): Application to approve a generic drug without repeating efficacy studies.

- Accelerated Development: Fast-track approval for critical drugs.

- Biological Drugs: Biotech-based medications that are more complex to manufacture.

- Drug Lag & Drug Loss: Delays and losses in drug approval.

- Ethical Drugs: Prescription medications.

- IND (Investigational New Drug): Application to start human trials.

- NCE (New Chemical Entities): New molecules under investigation.

- NDA (New Drug Application): Request for approval of a new drug.

- Complete Response Letter: Regulator’s document explaining a rejection with the possibility of reevaluation.

- Drug Label & Black Boxes: Warnings on approved drugs about adverse effects.

- Orphan Drug Act: Regulation incentivizing the development of drugs for rare diseases.

- OTC (Over-the-Counter): Non-prescription medications.

- PDUFA (Prescription Drug User Fee Act): 10-month deadline for drug approval in the U.S.

- Market Exclusivity: Market protection without a patent for approximately 7 years.

- Composition of Matter: Patent covering a drug’s chemical structure.

- Method of Use: Patent covering the drug’s mechanism of action.

6. Conclusion

The pharmaceutical sector presents significant investment opportunities but also carries high risks due to regulatory uncertainty and development costs. It is crucial to analyze the pipeline, target market, and financial stability before investing in a company in this sector.

Moreover, the success of a pharmaceutical company depends not only on its current sales but also on its ability to innovate and develop new drugs to ensure future growth.