⛏️Mining Industry

1. Introduction to the Mining Sector

1.1. A Pillar of Civilization: History and Economic Importance

Mining is not an invention of the industrial era, but one of the oldest and most fundamental economic activities of humanity, with roots stretching back millennia. The oldest known mine, the Lion Cave in Eswatini, dates back 43,000 years, demonstrating that the extraction of resources from the earth has been intrinsic to human development since its dawn. From the use of flint for prehistoric tools to the extraction of copper and tin that ushered in the Bronze Age, a society's ability to harness mineral resources has dictated its technological progress, economic power, and cultural influence.

The economic importance of mining has evolved, but it has never diminished. In ancient times, metals like gold and silver not only served for ornamentation but also formed the basis of the first monetary systems. During the Industrial Revolution, coal and iron ore became the engines of global growth, fueling factories, building railways, and enabling urbanization on an unprecedented scale. Today, mining remains the backbone of the global economy, although its focus has shifted. Virtually everything that surrounds us in daily life comes, directly or indirectly, from mining: the aggregates for the cement in our buildings, the metals for the vehicles that transport us, the fuels for the energy we consume, and the minerals for our food packaging.

In the modern era, the sector's relevance has intensified and diversified. The mining industry is a key contributor to the Gross Domestic Product (GDP) of resource-rich nations and a pillar of industrial exports globally. However, its role transcends macroeconomic figures. Mining has become the indispensable enabler of the two greatest transformations of our time: the digital revolution and the energy transition. Gold, for example, is not only a safe-haven asset but also a crucial conductor in the microchips of all our electronic devices, from smartphones to laptops. Even more critically, the transition to a low-carbon economy depends entirely on a massive supply of specific minerals. Electric vehicles, solar panels, wind turbines, and all the associated power grid infrastructure require vast quantities of copper, lithium, nickel, cobalt, and rare earth elements.

This paradigm shift means that the mining industry is no longer simply a provider of raw materials, but a strategically vital sector for the technological and environmental future of the planet. Its importance is no longer measured solely in tons extracted or its contribution to GDP, but in its ability to enable the global megatrends that will define the 21st century. This strategic centrality makes it a focus of attention for investors, governments, and society at large, presenting a complex and opportunity-rich investment landscape.

1.2. Characteristics: Cyclicality, Capital Intensity, and Long-Term Value

Investing in the mining sector requires a deep understanding of its unique characteristics, which drastically differentiate it from most other industries. These intrinsic traits define both the risks and potential opportunities and have shaped the business models and valuation strategies specific to the sector.

-

Capital Intensity and High Initial Risk: Mining is one of the most capital-intensive industries in the world. Mining projects demand massive initial investments that can amount to billions of dollars for exploration, evaluation, and infrastructure construction. These investments are made with considerable risk, especially in the initial phases. The exploration stage is inherently speculative; a company can invest millions in drilling without finding an economically viable deposit, thus losing all the invested capital.

-

Prolonged Investment Cycles: From initial discovery to the first production of metal can take 10 to 15 years or more. This long gestation period means that capital is tied up for a long time before a single dollar of revenue is generated, exposing the project to changes in market conditions, technology, and the political environment for over a decade.

-

Cyclical Nature and "Price Takers": The sector is notoriously cyclical, with its profitability closely tied to global economic cycles and the volatility of commodity prices. Most mining companies are "price takers," meaning they have no control over the selling price of their products; this is determined by global commodity markets. A small mismatch between global supply and demand can cause extreme price fluctuations, making revenues and cash flows highly volatile.

-

Finite and Geographically Fixed Resources: Unlike a factory that can be built anywhere, mineral deposits are finite, non-renewable, and fixed in their geographic location. This introduces a set of geopolitical and logistical risks. The company is at the mercy of the political, regulatory, and social environment of the host country. Furthermore, as a mine operates, its reserves are depleted, and often the quality of the ore (grade) decreases, meaning more rock must be mined and processed to produce the same amount of metal, leading to an increase in operating costs over time.

This unique combination of high capital intensity, long lead times, extreme cyclicality, and inherent geopolitical risk often makes traditional business models and valuation metrics inadequate. A manufacturing company can adjust its production to demand and has some control over its prices. A mining company, in contrast, invests billions and waits years for a return, fully exposed to commodity prices it cannot control.

This extreme risk profile has been the catalyst for innovation within the sector. It has created a "financing gap" that traditional financial instruments like debt (too risky if prices fall) or equity (too dilutive for early-stage projects) cannot always fill efficiently. It is precisely in this gap that alternative business models, such as royalty and streaming companies, have emerged and thrived, offering capital solutions tailored to the industry's unique challenges. Similarly, valuing a mining company based on its profits from the last year is often useless. Its true value lies in the long-term potential of its assets in the ground, which has led to the primacy of specific valuation methodologies like the Net Asset Value (NAV) of reserves.

1.3. Extraction Methods: From the Earth to the Market ⛏️

Once a deposit has been identified and its exploitation determined to be economically viable, the extraction phase begins. The choice of extraction method is one of the most critical decisions in the life of a mine, as it directly impacts the project's profitability, safety, and environmental footprint. The decision fundamentally depends on the depth, shape, and size of the mineral deposit.

Below are the three most common extraction methods:

1.3.1. Open-Pit Mining

This method is applied when mineral deposits are located near the surface. It is the most common extraction method worldwide, especially for minerals such as coal, copper, iron ore, and oil sands.

-

How it works?

-

Stripping: The top layer of vegetation and soil (known as overburden) is removed to expose the ore.

-

Drilling and blasting: Holes are drilled into the rock and filled with explosives to fracture the material.

-

Loading and hauling: Large excavators and shovels load the fractured ore into large-tonnage trucks, which transport it to processing plants.

-

-

Advantages:

-

Higher mineral recovery: Allows for the extraction of almost the entire deposit.

-

Lower operating costs: Generally more economical than underground mining.

-

Greater safety: With no underground tunnels, the risks of collapses and ventilation problems are reduced.

-

-

Disadvantages:

-

Greater environmental impact: Causes significant landscape alteration and generates large volumes of waste.

-

Sensitivity to weather conditions: Rain, snow, and wind can affect operations.

-

1.3.2. Underground Mining

This is used when minerals are located at great depths, making open-pit mining unfeasible. This method is common for extracting gold, silver, diamonds, and other high-grade minerals.

-

How it works?

-

Access: Tunnels, shafts, and ramps are built to access the mineral deposit.

-

Extraction: Various techniques, such as cut-and-fill or block caving, are used to extract the ore from the veins.

-

Transport: The ore is transported to the surface via elevators or conveyor belts.

-

-

Advantages:

-

Less surface impact: Alters the landscape less and generates less visible waste.

-

Selectivity: Allows for selective extraction of the areas with the highest mineral concentration.

-

-

Disadvantages:

-

Higher operating and capital costs: Requires a greater initial investment and has higher production costs.

-

Lower mineral recovery: Some of the ore must be left as structural support to prevent collapses.

-

Greater safety risks: Workers are exposed to risks such as collapses, floods, and the accumulation of toxic gases.

-

1.3.3. Dredging

This method is used for the extraction of minerals from bodies of water, such as rivers, lakes, and continental shelves. It is commonly used to extract gold, diamonds, tin, and other heavy minerals that have accumulated in riverbeds and on coastlines.

-

How it works?

-

Dredges, which are vessels equipped with excavation devices (such as buckets or suction pumps), are used to extract sediments from the bottom of the water body.

-

The extracted material is processed on board the dredge or at a plant on land to separate the valuable minerals.

-

-

Advantages:

-

Access to unconventional deposits: Allows for the exploitation of resources that would not be accessible by other methods.

-

Continuous operations: Can operate 24 hours a day, 7 days a week.

-

-

Disadvantages:

-

Environmental impact on aquatic ecosystems: Can affect water quality, aquatic life, and coastal habitats.

-

Conflicts with other water uses: Can interfere with fishing, navigation, and other recreational activities.

-

High costs: Requires a significant investment in specialized equipment.

-

Each of these methods has its own implications in terms of cost, efficiency, and environmental impact, and choosing the right method is a key factor for the success of any mining operation.

2. The Life Cycle of a Mine 🔄

The journey of a mineral deposit from a simple geological anomaly to a profitable mining operation and, finally, a reclaimed piece of land, is a long, costly, and risk-filled process. This life cycle can be divided into four main stages, each with its own objectives, activities, and risk profiles. Understanding this progression is fundamental for any investor, as it explains the structure of the industry, the different types of companies that operate within it, and why certain forms of financing are more suitable for each phase.

2.1. Stage 1: Prospecting and Exploration (The High-Risk Hunt)

This is the initial and highest-risk phase of the entire mining cycle. Its objective is to discover new mineral deposits.

-

Prospecting: This is the large-scale search. Geologists use regional maps, satellite imagery, geophysical, and geochemical surveys to identify "anomalies"—that is, geological areas that show promising characteristics for the existence of a deposit. At this stage, knowledge is general, and the goal is to narrow down vast tracts of land to more manageable areas of interest.

-

Exploration: Once a promising area is identified, detailed exploration begins. This phase seeks to confirm the presence of mineralization and delineate the geometry (size and shape) and quality (ore grade) of the deposit. The primary tool here is drilling, through which rock cores are extracted from the subsurface for laboratory analysis. The results of these drillings are crucial and generate enormous market interest, as they can either confirm or disprove a project's potential.

The risk at this stage is immense. The vast majority of exploration projects fail. Statistics show that only 1 in every 5,000 to 10,000 exploration prospects becomes a producing mine. All the investment made in this phase, which can amount to tens or hundreds of millions of dollars, is high-risk capital that can be completely lost if economic results are not found. This stage is almost exclusively the domain of "Junior" mining companies, entities specializing in exploration that take on this risk in the hope of a discovery that will multiply their value.

2.2. Stage 2: Evaluation and Construction (Creating the Asset)

If exploration yields positive results, the project moves to a rigorous evaluation phase to determine its economic viability before committing the massive capital required for construction.

-

Feasibility Studies: A sequence of increasingly detailed engineering studies is conducted: the Preliminary Economic Assessment (PEA), the Pre-Feasibility Study (PFS), and finally, the Definitive Feasibility Study (FS). These reports analyze all aspects of the project: the most suitable mining method (open-pit or underground), the design of the processing plant, logistics, capital (CAPEX) and operating (OPEX) costs, metal prices, environmental requirements, and financial profitability. The goal of this phase is to convert "mineral resources" (a concentration of ore with reasonable prospects for eventual economic extraction) into "mineral reserves" (the part of a resource that is economically mineable with current technology and prices).

-

Construction: A positive feasibility study and securing the necessary financing and permits give the green light to the construction phase. This is the stage of maximum capital investment. All necessary infrastructure is built: the mine itself, processing plants, access roads, power lines, worker camps, and tailings dams for waste. In open-pit mines, a crucial part of this phase is "pre-stripping," which involves the removal of millions of tons of waste rock (with no commercial value) to expose the ore beneath. This phase can last between two and four years, depending on the scale and complexity of the project.

2.3. Stage 3: Production and Operation (Generating Cash Flow)

This is the stage where the mine comes to life and begins to generate returns on the initial investment.

-

Operation: The mine systematically extracts the ore and sends it to the processing plant. The goal is to operate as efficiently and safely as possible, meeting the production plans established in the feasibility study. Management's focus shifts from construction and development to controlling operating costs and optimizing processes.

-

Revenue Generation: During this phase, the company finally sells its product (metal concentrates, cathodes, gold bars, etc.) and generates revenue and cash flow. This cash flow is used to pay down debt, cover operating costs, fund future expansions, and ultimately, distribute dividends to shareholders. The mine's profitability during this phase will largely depend on commodity prices and its ability to keep operating costs under control.

2.4. Stage 4: Closure and Reclamation (Fulfilling the Obligation)

Every mine has a finite lifespan. Once the economically mineable reserves are depleted, the operation must be closed responsibly.

-

Closure Planning: Modern regulations require that closure planning begins from the initial project design ("design for closure"). Companies must submit detailed closure and reclamation plans and provide financial assurances to ensure that there will be sufficient funds to carry out this work, even if the company were to go bankrupt. This reclamation liability is a significant liability on a mining company's balance sheet.

-

Closure Activities: Closure involves dismantling all facilities and equipment, physically stabilizing the disturbed areas (such as open pits and waste rock dumps), long-term management of water quality, and revegetating the area to return it to a safe and environmentally stable state. The goal is to leave a positive legacy and minimize the long-term environmental impact.

The mining life cycle functions as a "risk-reduction funnel." The exploration phase is a filter with an astronomical failure rate, which justifies the high potential returns sought by investors in junior companies. Each successfully completed stage (a good drill result, a positive feasibility study, obtaining permits) reduces the project's risk and increases its value. The transition from being an "exploration company" to a "producing company" is the most significant de-risking event, radically transforming the company's profile, its valuation, and its access to cheaper forms of capital.

This progression explains the entire industry ecosystem: junior companies, which are agile and have a high-risk tolerance, conduct the initial exploration. The large companies ("Majors"), with strong balance sheets and a lower cost of capital, often acquire successful projects from the juniors to take them through construction and operation—phases that, although less risky than exploration, are still enormously complex and costly.

|

Stage |

Main Objective |

Key Activities |

Dominant Risk |

Typical Duration |

Key Players |

|

1. Prospecting & Exploration |

Discover an economically viable mineral deposit. |

Geological studies, geophysics, geochemistry, drilling. |

Geological Risk: The deposit may not exist or may not be economic. |

3-10 years |

Junior Companies |

|

2. Evaluation & Construction |

Confirm viability and build the mining infrastructure. |

Feasibility studies (PEA, PFS, FS), permitting, financing, mine and plant construction. |

Financing & Execution Risk: Obtaining capital and building on time and on budget. |

2-5 years |

Advanced Juniors |

|

3. Production & Operation |

Extract and process the ore profitably and safely. |

Mining, processing, cost control (AISC), sale of metals. |

Operational & Market Risk: Efficiency of the operation, fluctuations in metal prices. |

10-50 years |

Majors, Mid-Tiers |

|

4. Closure & Reclamation |

Decommission the operation and restore the environment. |

Dismantling facilities, stabilizing landforms, water management, revegetation. |

Long-Term Liability Risk: Closure costs exceeding provisions. |

5-10 years |

Operators: |

3. Business Models in the Mining Industry 🏢

The mining industry is not a monolith. Within it coexist different types of companies, each with a very distinct business model, risk profile, and value proposition for the investor. Understanding these differences is essential for building a well-founded mining investment portfolio.

3.1. The Titans: Majors and Mid-Tiers (Integrated Producers)

At the top of the pyramid are the "Majors" or "Seniors"—the large multinational mining corporations (like BHP, Rio Tinto, Vale, Newmont)—and the "Mid-Tiers," which are medium-sized but still significant production companies.

These companies are the pillars of the industry. Their business model is based on the operation of multiple large-scale mines, often diversified by geography and mineral type. They are integrated companies that manage the entire life cycle of their assets, from advanced exploration and development to production and, in some cases, marketing.

Their main strength lies in their scale, diversification, and financial soundness. They possess robust balance sheets that give them access to cheaper sources of capital (bank debt, bonds) and the technical and operational capacity to develop and manage complex, long-life mining projects. They often mitigate the very high risk of initial exploration by acquiring promising projects that have already been "de-risked" by junior companies. For an investor, Majors and Mid-Tiers offer a more stable and less volatile exposure to the mining sector, often accompanied by the payment of consistent dividends.

3.2. The Explorers: Junior Miners (High Risk and High Reward)

At the opposite end of the spectrum are the "Junior" mining companies. These are small companies, often with a market capitalization of less than $500 million, whose main business is high-risk exploration.

Juniors are the discovery engine of the industry. They take on the risk that large companies often prefer to avoid: the search for new deposits in unexplored land ("greenfield") or the re-evaluation of old mining areas ("brownfield"). They are, in essence, the outsourced R&D department of the mining sector.

Their business model is inherently speculative. Most are pre-revenue companies that depend on raising capital in the markets to finance their drilling campaigns. Their value lies not in cash flows (which they do not have), but in the geological potential of their concessions. Success is extremely rare, but a single major discovery can generate exponential returns for investors, either because the stock value soars or because the junior is acquired by a larger company at a significant premium.

Investing in juniors is a high-risk, high-reward bet. The risks are multiple: geological failure (drilling results are disappointing), financing risk (inability to raise more capital), jurisdictional risk (political instability in the country where they operate), and management risk (the quality and experience of the management team are absolutely paramount).

3.3. The Financiers: Royalty and Streaming Companies

Between the operators (Majors) and the explorers (Juniors) exists a third, unique, and increasingly popular business model for investors: Royalty and Streaming companies. These companies do not operate mines; they are specialized financiers that provide capital to mining companies in exchange for a share of a mine's future production or revenue.

3.3.1. The Royalty vs. Streaming Model: A Detailed Breakdown

Although often grouped together, the royalty and streaming models have key differences in their structure:

-

Streaming (Streaming Agreement): In a streaming agreement, the financing company makes an upfront cash payment to the miner (the "deposit"). In return, it obtains the right to purchase a certain percentage of the future production of a specific metal (e.g., 25% of the silver produced at a copper mine) at a fixed, deeply discounted price relative to the market price (e.g., $4 per ounce of silver, or 20% of the spot price at the time of delivery). Settlement is made through the physical delivery of the metal. This model is ideal for a miner to monetize a by-product that the market is not adequately valuing in its stock.

-

Royalty: In a royalty agreement, the financing company receives a percentage of the mine's gross or net revenue. The most common type is the "Net Smelter Return" (NSR), which grants the royalty company a percentage of the revenue the mine receives from the smelter, after deducting certain costs such as transportation and refining. Settlement is made in cash. The royalty company never owns or handles the physical metal.

The royalty and streaming market is highly consolidated. The three giants of the sector—Wheaton Precious Metals, Franco-Nevada, and Royal Gold—represent approximately 80% of the total value of these contracts worldwide, giving them significant scale and bargaining power.

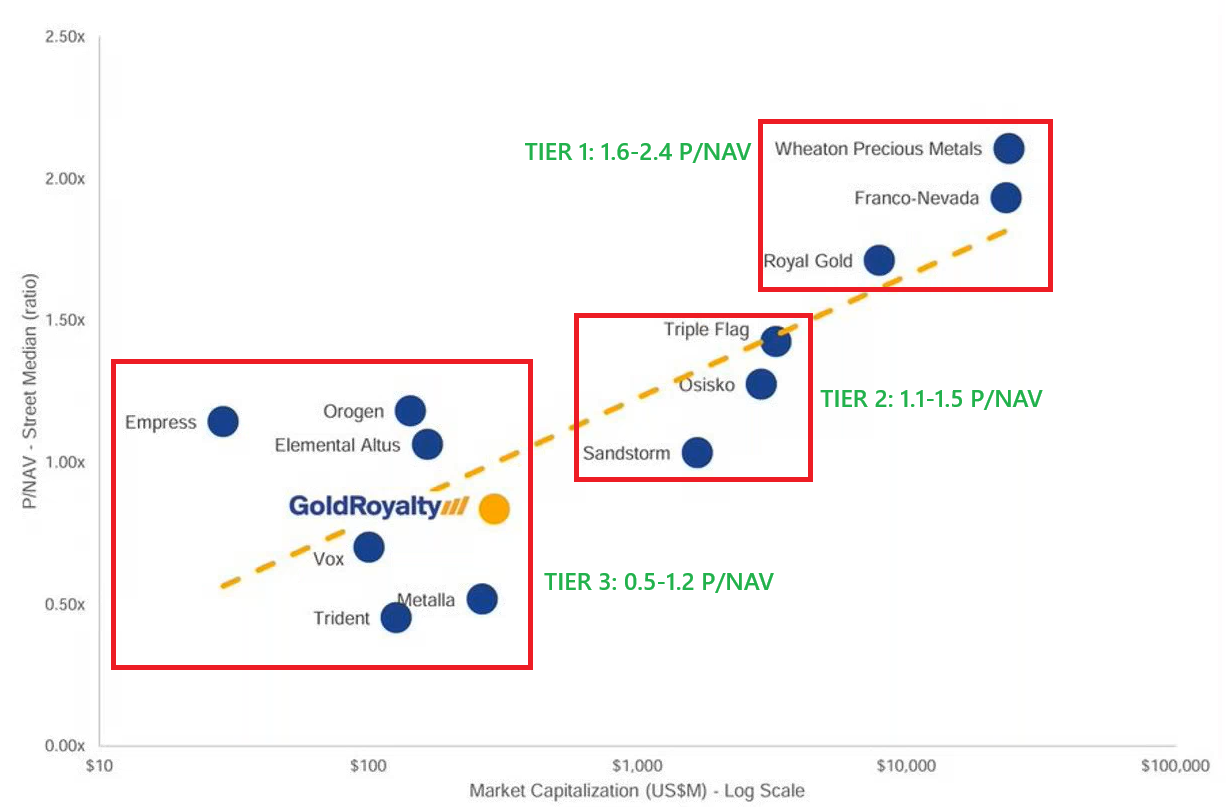

The following graph displays a scatter plot that analyzes and compares various competing companies in the gold royalty and streaming sector. It shows the relationship between a company's size (its market capitalization) and its stock market valuation (as measured by the P/NAV ratio). The larger the royalty company, the greater the liquidity of its stock, and the more institutional investors can participate, which in turn increases its valuation based on the P/NAV multiple.

Chart Axes

-

X-Axis (Horizontal): Market Capitalization: Represents the total market value of each company in millions of U.S. dollars (US$M). The scale is logarithmic, which allows for the effective visualization of companies with vastly different sizes, ranging from tens of millions to tens of billions. As you move to the right on this axis, the companies get larger.

-

Y-Axis (Vertical): P/NAV Ratio (Price to Net Asset Value): This measures the relationship between the share price (P) and the net asset value (NAV) per share. It is a key valuation metric in the sector.

-

A ratio > 1.0x means that the market values the company above the book value of its assets, which typically indicates confidence in its future growth, management quality, or assets.

-

A ratio < 1.0x suggests that the company is trading at a discount relative to the value of its assets.

-

Segmentation by Tiers

The chart groups the companies into three levels or "tiers," defined primarily by their P/NAV valuation ratio:

Trendline (orange and dashed)

This shows a clear positive correlation. As a company's market capitalization increases (moving to the right), its P/NAV ratio also tends to increase (moving up). This suggests that the market rewards the scale, diversification, and liquidity of larger companies with a higher valuation.

3.3.2. A Symbiotic Relationship: Benefits for Miners and Financiers

This business model has grown exponentially because it creates a win-win situation for both the mining company seeking capital and the royalty company providing it.

Benefits for Mining Companies:

-

Flexible Source of Capital: It provides crucial financing to build a mine, expand an existing operation, or reduce debt, especially when traditional capital markets (debt and equity) are inaccessible or expensive.

-

Less Risky than Debt: Unlike a bank loan, a royalty/streaming agreement has no fixed interest payments or strict repayment schedules. If the mine runs into trouble and halts production, payments to the royalty company also stop. This drastically reduces the risk of bankruptcy for the miner during low price cycles.

-

Non-Dilutive (or Less Dilutive): Unlike issuing new shares to raise capital, a royalty agreement on a specific asset does not dilute the ownership of shareholders in the parent company. It is a way to obtain financing without giving up ownership of the company.

Benefits for Royalty/Streaming Companies (and their Investors):

-

Direct Exposure to the Metal Price: Investors get direct upside leverage to commodity prices. If the price of gold goes up, the value of the royalty or stream increases proportionally.

-

No Exposure to Operational Risk: This is the most significant benefit. Royalty companies are not exposed to the risks and costs of mining operations: construction cost overruns, labor strikes, accidents, geotechnical problems, etc.

-

Fixed and Predictable Costs: Their main cost is the initial investment. From then on, their costs are minimal (small management teams) or contractually fixed (in the case of streams). This insulates them from the inflationary pressure that miners suffer in their operating costs (fuel, wages, explosives).

-

Free Exploration Optionality: The agreements usually cover the life of the mine. If the mining company invests in exploration and discovers new reserves, extending the life of the operation or increasing production, the royalty company benefits without having to invest an additional dollar. It is a powerful upside optionality.

-

Diversification: Large royalty companies hold portfolios with dozens, or even hundreds, of agreements on different mines, in different geographies, and with different operators. This greatly diversifies risk. The failure of a single mine has a limited impact on their total cash flow.

3.3.3. Resilience and Volatility: Performance During Commodity Cycles

The royalty/streaming business model demonstrates superior resilience during volatile commodity cycles, making it a particularly attractive investment option.

-

In a Bullish Price Cycle: When metal prices rise, mining companies see their revenues increase, but often their operating costs also increase due to inflation in energy, wages, and equipment. In contrast, a royalty company sees its revenue increase at the same rate as the metal price, but its costs remain virtually fixed. This leads to a massive expansion of its profit margins. They capture all the price advantage without suffering the disadvantage of rising operating costs.

-

In a Bearish Price Cycle: When prices fall, a miner's profitability is squeezed. If the price falls below its production cost (AISC), the mine begins to lose money and may be forced to reduce production or even shut down temporarily. The royalty company's revenue also decreases with the fall in price, but since it has no direct operating costs, it is protected from operating losses. Its main risk in this scenario is counterparty risk: the possibility that the mining company could go bankrupt and be unable to continue making its payments.

Although this business model insulates investors from operational risks, it does not make them completely immune to external risks. A subtle but critical risk is political and fiscal risk. Periods of extraordinarily high commodity prices are precisely the times when governments of mining countries are most inclined to seek a larger share of the windfall profits ("economic rents"). They can do this by imposing new taxes or increasing existing royalty rates. Although the royalty company's contract is with the miner, a new government tax on the mine's sales could reduce the basis on which the royalty is calculated or, in an extreme case, make the mine unprofitable, threatening the viability of the royalty's cash flow. Therefore, investors in royalty companies must analyze not only the quality of the assets and operators but also the political and fiscal stability of the jurisdictions where those mines are located.

3.4. Ore Buyers and Processors

In addition to the clearly defined business models of producers, explorers, and financiers, there is a category of companies with hybrid models that combine elements of the others. These companies are operators—they manage physical assets and metallurgical processes—but they avoid the geological risk of exploration and the development of a traditional mine. Their business focuses on acquiring and processing mineralized material from external sources. Two illustrative examples of this model are Amerigo Resources and Dynacor.

3.4.1 The Tailings Processor: Amerigo Resources

Amerigo's model consists of processing the tailings (waste or residue) from one of the world's largest copper mines, El Teniente, owned by the Chilean state-owned giant Codelco. Amerigo does not operate any mines; instead, it has built a processing plant that extracts the remaining copper and molybdenum from the tailings that Codelco's main operation discards.

-

Advantages of the model: This approach completely eliminates exploration risk and geological risk. The source of material is predictable and backed by a long-term contract with a top-tier producer. The company has direct, leveraged exposure to the price of copper, similar to a producer, but without the mining extraction costs.

-

Inherent risks: Unlike a royalty company, Amerigo is fully exposed to operational risk. Its profitability depends on the efficiency of its plant and is sensitive to cost inflation (energy, water, reagents). Furthermore, it has a very high counterparty and jurisdictional risk, as its entire business depends on a single asset, in a single country (Chile), and on the operational continuity of a single company (Codelco).

3.4.2 Dynacor Group

Dynacor operates a business model focused on purchasing gold ore from artisanal and small-scale miners (ASM) in Peru. The company does not have its own mine; instead, it manages a centralized processing plant (Veta Dorada) where artisanal miners can legally sell the ore they extract. Dynacor processes this ore and sells the resulting gold on the international market.

-

Advantages of the model: Like Amerigo, Dynacor eliminates the risk and very high costs of exploration and mine operation. Its success does not depend on a geological discovery. It provides direct exposure to the price of gold and can generate significant margins if it efficiently manages its plant and supply chain.

-

Inherent risks: Its main challenge is supply chain risk. It depends on a diffuse network of thousands of small miners for a steady supply of good-grade ore. It is exposed to the operational risk of its plant and to the jurisdictional and social risks associated with the artisanal mining sector in Peru. Unlike royalty companies, Dynacor's profitability is directly linked to its ability to manage processing costs.

4. Key Minerals for the Next Decade 💎

The future of the mining sector will be defined by the supply and demand dynamics of a set of strategic minerals. For the investor, it is crucial to understand not only what each metal is used for but also the structural forces that will drive its market in the coming years.

4.1. Gold (Au): The Monetary Metal and Safe Haven

Uses and Applications: Gold is unique among metals. While it has industrial uses, primarily as an excellent conductor in high-end electronics, and a large jewelry market, its fundamental value does not come from these applications. Gold is, first and foremost, a monetary asset and a store of value. Investors and, crucially, central banks, accumulate it to hedge against the devaluation of fiat currencies, inflation, and geopolitical instability.

Supply and Demand Dynamics: The demand for gold is multifaceted. Jewelry demand, led by consumer giants like China and India, remains significant. However, recent dynamics have been dominated by investment demand (bullion, coins, and ETFs) and, above all, by massive and sustained buying by the world's central banks. These institutions have been accumulating gold at a record pace, seeking to diversify their reserves away from the U.S. dollar and other traditional reserve assets. On the supply side, global mining production has remained relatively stagnant for years, and the recycling of old gold constitutes a significant portion of the total supply.

Investment Perspectives: The investment thesis for gold is not based on an industrial deficit but on macroeconomic factors. Its price tends to perform well in environments of negative real interest rates (when inflation is higher than nominal interest rates), a weak dollar, and high global uncertainty. The structural trend of central banks in emerging countries to increase their gold holdings is a powerful long-term tailwind that provides a solid floor for demand.

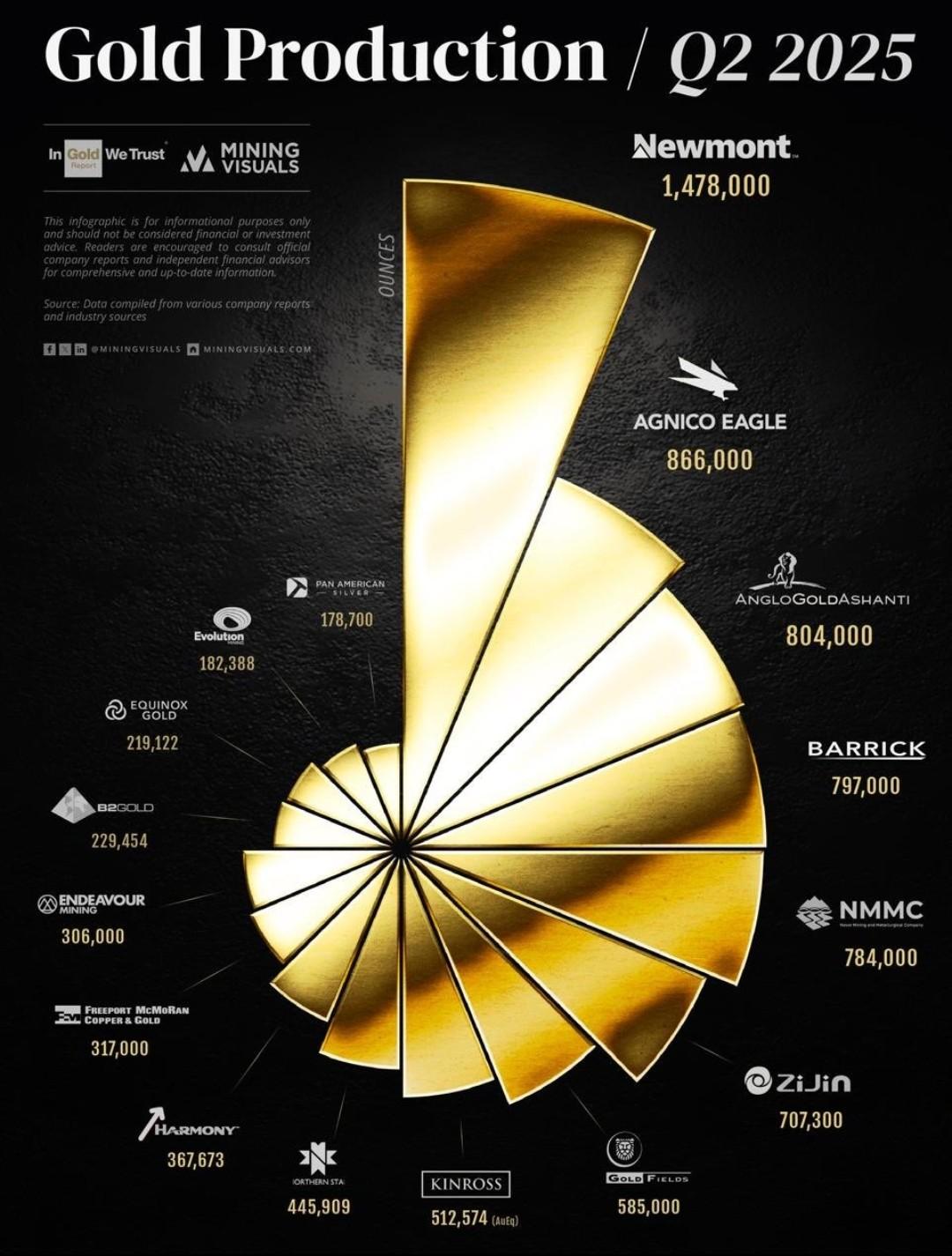

Below is an image showing the main GOLD producers.

4.2. Silver (Ag): The Industrial and Monetary Hybrid

Uses and Applications: Silver holds a unique position, halfway between gold and industrial metals. Like gold, it is a precious metal historically used as money and a store of value in the form of jewelry, coins, and bullion. However, unlike gold, more than half of silver's demand comes from industrial applications. It is the most electrically and thermally conductive metal, making it indispensable in electronics, solders, and, crucially, in green technology. Its antimicrobial properties also give it a role in medicine and water purification.

Supply and Demand Dynamics: The narrative for silver is increasingly tied to its industrial role. The energy transition is a key catalyst: electric vehicles use a significant amount of silver, and it is an essential component in the manufacture of solar panels (silver paste in photovoltaic cells). Demand from this sector is projected to grow exponentially. This is in addition to its use in the expansion of 5G networks and consumer electronics. On the supply side, mining production, often a byproduct of mining other metals like lead, zinc, and copper, has struggled to keep pace with this growing industrial demand. Investment demand, although volatile, adds an additional layer of pressure on the market.

Investment Perspectives: The investment thesis for silver is twofold. On one hand, it benefits from the same macroeconomic factors as gold (a hedge against inflation, a weak dollar). On the other, it presents the growth potential of an industrial metal at the heart of the technological and green revolution. This dual character makes it a leveraged investment in both monetary uncertainty and global industrial growth. The main risk is its volatility, as its price can be affected by both speculative investment flows and industrial demand cycles.

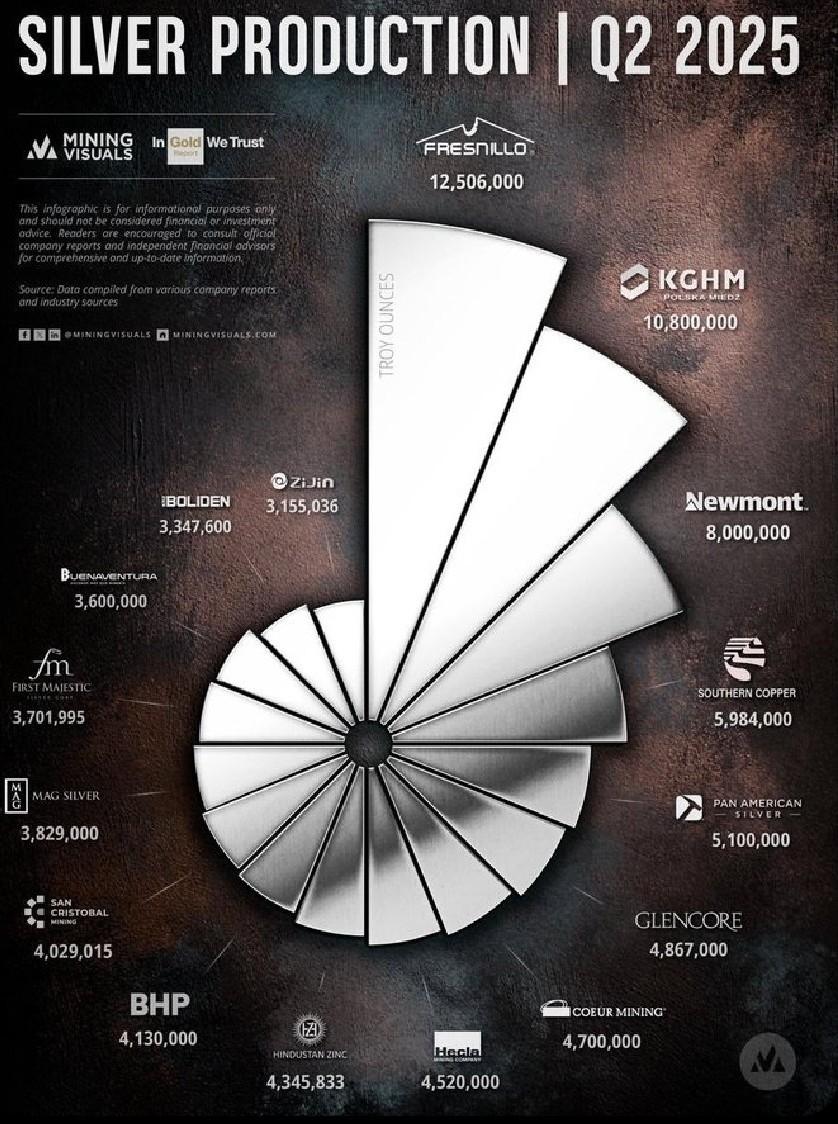

Below is an image showing the main SILVER producers.

4.3. Copper (Cu): The Backbone of the Energy Transition

Uses and Applications: Often called "Dr. Copper" for its ability to diagnose the health of the world economy, this metal is the cornerstone of all electrical infrastructure. It is used in wiring, construction, communications, electronics, and transportation.

Supply and Demand Dynamics: Copper is at the epicenter of a perfect demand storm. The energy transition is the main catalyst. An electric vehicle (EV) uses up to four times more copper than an internal combustion engine car. Renewable energy sources like solar and wind are orders of magnitude more copper-intensive per megawatt of capacity than fossil fuel plants. Furthermore, the expansion and modernization of electrical grids to support this massive electrification will require astronomical amounts of copper. Added to this is a new wave of demand from the construction of data centers to power artificial intelligence. Projections indicate that in the next 30 years, 115% more copper will need to be extracted than has been extracted in the entire history of humanity. Meanwhile, supply faces enormous challenges. New discoveries of high-quality deposits are becoming rarer, existing mines face declining ore grades (which increases costs), and the time required to obtain permits and build a new mine exceeds a decade. A structural supply deficit is projected starting in 2025.

Investment Perspectives: The copper market presents one of the most compelling long-term bullish theses among all commodities. The demand story is clear and powerful, while the industry's ability to meet it is highly uncertain. This creates a fundamental imbalance that should drive prices higher in the coming years. The main risks are not in demand but in supply: political instability in major producing regions (Chile, Peru, Democratic Republic of Congo), growing ESG (Environmental, Social, and Governance) hurdles, and the technical and financial difficulty of launching new projects.

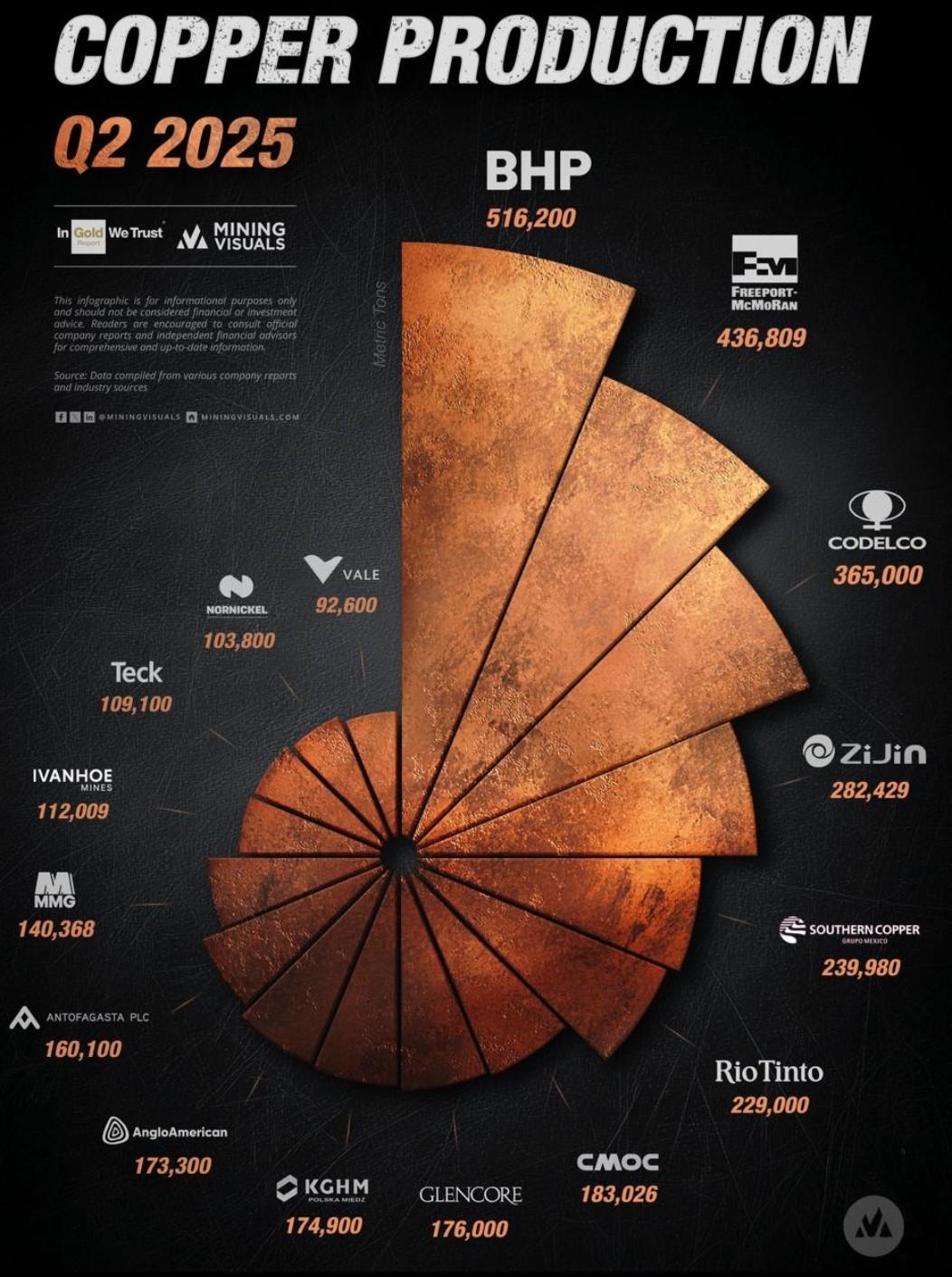

Below is an image showing the main copper producers.

4.4. Platinum Group Metals (PGMs): The Catalysts of the Automotive and Energy Future

Uses and Applications: The platinum group metals (PGMs), which include platinum, palladium, rhodium, ruthenium, iridium, and osmium, are vital for a wide range of industries due to their exceptional catalytic, conductive, and durability properties. Their primary use is in catalytic converters for combustion vehicles, where they help reduce harmful emissions—a use that accounts for approximately 60% of global demand. They are also crucial in electronics (in high-precision components and hard drives), the chemical industry, and medicine. As the world seeks to transition to clean energy, their role in hydrogen fuel cells is gaining importance.

Supply and Demand Dynamics: The PGM market dynamics are complex. Demand remains strongly tied to the automotive industry, but the transition to battery electric vehicles (BEVs) is changing the landscape. However, the increasing popularity of hybrid vehicles, which still require catalytic converters, maintains robust demand. On the supply side, the market faces significant challenges. Primary production comes mainly from South Africa, which accounts for 70% to 80% of world production. Mining production has been in decline for over a decade due to aging mines and a lack of investment, creating a supply deficit in recent years. The recycling of old metals, especially from automotive catalytic converters, supplements the supply but is not enough to cover the growing demand.

Investment Perspectives: The investment thesis for PGMs is fascinating but volatile. On one hand, they face the long-term challenge of the full electrification of the vehicle fleet. On the other, they have a solid demand base in hybrid vehicles and significant growth potential in hydrogen technologies. Supply constraints in major producing countries suggest that prices could remain elevated to incentivize new investments. The main risk is market volatility, driven by fluctuations in industrial demand and changes in investor sentiment.

4.5. Lithium (Li): The Fuel of Electric Vehicles (EVs)

Uses and Applications: Lithium has become synonymous with the modern energy era. Its primary use, which drives its market, is in the manufacturing of lithium-ion batteries, the dominant technology for electric vehicles and large-scale energy storage systems. It also has secondary uses in the manufacturing of ceramics, glass, and lubricating greases.

Supply and Demand Dynamics: The demand for lithium is experiencing exponential growth, driven almost entirely by the massive adoption of EVs. Projections indicate that demand could multiply more than tenfold by 2050. Supply has responded with a rapid increase in production, mainly from two sources: hard rock mines (spodumene) in Australia and the extraction from brines in the salt flats of Latin America (the "Lithium Triangle": Argentina, Chile, Bolivia). A key geopolitical factor is that China overwhelmingly dominates the midstream of the supply chain: the refining of lithium into battery chemicals (lithium carbonate and hydroxide).

Investment Perspectives: Lithium is the archetype of an "explosive growth" commodity, and its market is characterized by extreme volatility. The price experienced a parabolic rise followed by a crash of more than 75% in 2023. This volatility is the main challenge for investors, as it can slow down the necessary investment to meet long-term demand. The investment thesis centers on the clear growth trajectory of demand but requires careful project selection and a high tolerance for risk.

4.6. Iron Ore (Fe): The Foundation of Global Infrastructure

Uses and Applications: More than 98% of all iron ore extracted worldwide is used to make steel. Steel, in turn, is the fundamental material for construction, infrastructure, manufacturing of machinery, automobiles, and appliances. It is, quite literally, the framework of the modern world.

Supply and Demand Dynamics: The demand for iron ore is directly linked to global industrial production and urbanization. China is the dominant player, consuming more than 60% of the world's supply to fuel its vast construction and manufacturing sector. Therefore, the health of the Chinese economy, particularly its real estate sector, is the main driver of the market. India is emerging as the next major engine of demand growth. Supply is highly concentrated in a handful of large producers (Vale, Rio Tinto, BHP, Fortescue Metals Group) that operate gigantic mines in Australia and Brazil.

Investment Perspectives: Although often considered a "traditional" and cyclical commodity, iron ore has interesting investment narratives. The first is its role as a direct proxy for the Chinese economy. Investing in iron ore producers is a leveraged way to bet on the growth (or contraction) of Chinese infrastructure and industry. The second, more long-term narrative, is the transition to "green steel," which seeks to replace coal with hydrogen in the manufacturing process. This change could create preferential demand for higher-quality, purer iron ores.

4.7. Metallurgical Coal (Coking Coal): The Irreplaceable Ingredient of Steel

Uses and Applications: It is essential to distinguish metallurgical coal (or coking coal) from thermal coal used to generate electricity. The function of metallurgical coal is not energetic but chemical and structural. After a process of heating at high temperatures in the absence of air (coking), it becomes coke, a hard and porous material. Coke is the essential ingredient in a blast furnace, where it serves two irreplaceable functions: it acts as a reducing agent, removing oxygen from iron ore to produce liquid iron, and it provides the structural support and permeability necessary for the furnace to function. In short, without coke, there is no steel in large-scale primary production.

Supply and Demand Dynamics: The demand for metallurgical coal is inseparably linked to steel production, which in turn depends on global construction and industrial activity. As with iron ore, China is the main consumer, but India is becoming an increasingly important demand driver. Supply is highly geographically concentrated, with Australia as the main global exporter of high-quality coking coal. Supply can be affected by climatic events (cyclones in Australia) and logistical challenges. The development of new mines is a long and costly process that faces growing opposition on environmental grounds (ESG).

Investment Perspectives: Investing in metallurgical coal is a bet on the persistence of traditional steelmaking. While the "green steel" narrative (using hydrogen instead of coal) is powerful in the long term, the technological transition is enormously complex, expensive, and will take decades to materialize on a scale that displaces coal. In the short and medium term, the demand for steel for global infrastructure, including the energy transition (wind towers, electrical grids), will continue to depend on coking coal. The thesis is based on the market underestimating the longevity of this demand, creating a profitable investment "bridge" until alternative technologies are viable on a large scale. The main risk is regulatory and perceptual (ESG), which can limit the valuation multiple of these companies.

4.8. Thermal Coal: The Fuel for Electricity Generation

Uses and Applications: It is crucial to differentiate thermal coal from metallurgical coal, which is used to make steel. Thermal coal, also known as steam coal, is burned to generate heat, which is primarily used in electricity production and various industrial processes, such as cement manufacturing. Historically, it has been the main source of energy for electricity generation worldwide.

Supply and Demand Dynamics: The dynamics of thermal coal demand are marked by a clear geographical division. While demand is declining notably in advanced economies (such as the European Union and the United States) due to the shift toward cleaner energies, it continues to grow in the emerging economies of Asia (China, India, and Southeast Asia). China is the main global consumer and producer, accounting for a large part of the global demand. Supply is affected by geopolitical factors and prices, which can fluctuate enormously. In the first half of 2025, oversupply in China and weak global demand caused prices to fall to their lowest levels since 2021.

Investment Perspectives: Investing in thermal coal is a high-risk bet, but with considerable potential for return. The investment thesis is based on the idea that the global energy transition is slower than expected, and that coal will continue to be an essential energy source, especially in developing countries. Investors who bet on thermal coal are seeking to benefit from an asset that could be a source of income for decades, despite environmental and regulatory pressure. However, the main risk of this type of investment is the massive divestment by financial institutions and governments, which consider coal a "stranded" asset due to global climate goals.

4.9. Uranium (U): The Resurgence of Nuclear Energy

Uses and Applications: The use of uranium is almost exclusive: it serves as fuel for nuclear power reactors. The fission of uranium atoms generates an immense amount of heat, which is used to produce steam and generate electricity without emitting carbon dioxide. It has minor applications in medicine (isotopes) and industry.

Supply and Demand Dynamics: The uranium market is emerging from a decade of stagnation after the Fukushima accident in 2011. Now, it is facing a revival. Given the urgency of the climate crisis and the need for energy security (evidenced by the gas crisis in Europe), governments around the world are once again betting on nuclear energy as a reliable, baseload, and carbon-free source of power. Dozens of new reactors are under construction or in advanced planning stages, especially in China, India, and Russia, and many Western countries are extending the useful life of their existing fleets. This new demand is facing a restricted supply. Years of low prices led to a drastic lack of investment in exploration and development of new mines. A significant portion of current global production is not profitable at historical prices, indicating that much higher prices are needed to incentivize the new supply required to avoid a deficit in the future.

Investment Perspectives: Uranium is in the early stages of what appears to be a long-term structural bull market. This market is driven by a fundamental paradigm shift in global energy policy, where the narrative has changed from "nuclear energy is dangerous" to "nuclear energy is essential for decarbonization." This change has created a supply-demand imbalance that could take many years to resolve, given the very long lead time needed to discover, permit, and build new uranium mines.

4.10. Rare Earths (REE): The Magnets of the Technological Era

Uses and Applications: "Rare earths" are not a single mineral but a group of 17 chemical elements with exceptional magnetic and electronic properties. Although they have a wide range of uses, their most critical application, and the one that drives the market, is in the manufacturing of high-performance permanent magnets. Elements like neodymium (Nd), praseodymium (Pr), dysprosium (Dy), and terbium (Tb) are crucial for creating the powerful, lightweight magnets needed for electric vehicle motors and wind turbine generators. They are also vital for consumer electronics (hard drives, speakers) and advanced military applications (guidance systems, lasers, sonars).

Supply and Demand Dynamics: The demand for key rare earths is experiencing explosive growth, directly correlated with the production of electric vehicles and wind turbines. The efficiency and power density offered by these magnets are, for now, irreplaceable. The market is characterized by extreme geopolitical concentration. China exerts almost total dominance over the entire value chain, controlling not only a majority of the mining but, more importantly, more than 90% of the world's capacity for processing and separating these elements into the high-purity oxides required by industry. This dominance gives it a formidable strategic leverage.

Investment Perspectives: Investing in rare earths is a high-risk, high-reward bet on geopolitics and technology. The thesis is based on the critical and irreplaceable nature of these metals for the energy transition and defense. The efforts of Western countries to develop "mine-to-magnet" supply chains outside of China are a long-term driver but face enormous technical, financial, and environmental challenges. The main risk is extreme price volatility, which China can manipulate through production and export quotas, and the technical difficulty of investing in viable projects outside the Chinese ecosystem.

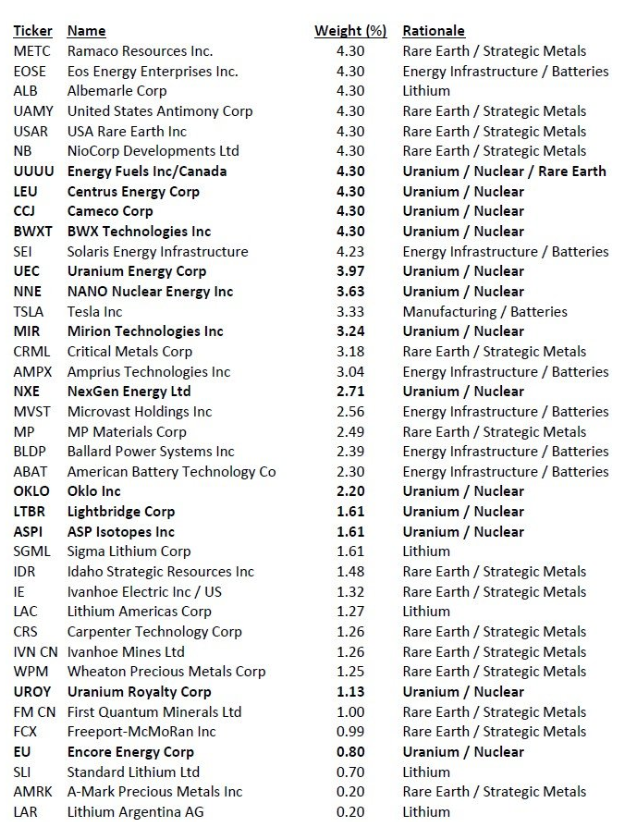

Below is an image showing the main producers of URANIUM AND RARE EARTHS.

5. Financial Analysis and Valuation of Mining Companies 📊

The valuation of mining companies is a specialized discipline that requires going beyond standard financial metrics. Due to the cyclical nature of the sector, its capital intensity, and the fact that its main asset is a finite resource that depletes over time, analysts have developed specific tools to assess its financial health and intrinsic value.

5.1. The Definitive Cost Metric: All-In Sustaining Cost (AISC)

For an investor, perhaps the most important operational metric to understand a mine's profitability is the All-In Sustaining Cost (AISC).

-

Definition and Purpose: Introduced by the World Gold Council in 2013, AISC was designed to offer a much more transparent and complete view of the true costs of mining, surpassing the old and misleading "cash cost" metric that omitted many essential expenses. AISC represents the total cost to maintain (sustain) the current production levels of a mine.

The AISC formula groups all recurring expenses necessary for the mine to continue operating:

$$ \frac{\text{(Cash Costs + Sustaining Capital Expenditures + Sustaining Exploration Costs + General & Administrative Expenses)}}{\text{(Ounces (or pounds/tonnes) of metal produced)}}$$Where:

-

Cash Costs: Include direct mining and processing expenses, such as labor, fuel, energy, and reagents.

-

Sustaining Capex: Investments necessary to maintain production, such as equipment replacement or the continuous development of an underground mine. Capital for major expansions ("growth capex") is excluded.

-

Sustaining Exploration Costs: Expenses to find new reserves to replace those being extracted near the current mine.

-

General and Administrative Expenses (G&A): Corporate costs such as management salaries, office rent, etc.

-

-

Importance for Investors: AISC is the "great equalizer." It allows investors to compare the operational efficiency of different mines and companies on an "apples-to-apples" basis. A company with a low AISC is more profitable and resilient to price drops. The difference between the metal's selling price and the AISC is the mine's profit margin per ounce, a direct indicator of its profitability.

5.2. Valuing the Ground: Net Asset Value (NAV) and Reserve Analysis

Given that a mining company's profits are highly volatile, valuation based on earnings multiples (like P/E) is often unreliable. The primary and most accepted valuation method in the industry is the Net Asset Value (NAV).

5.3. Key Ratios and Multiples for Comparative Analysis

In addition to AISC and NAV, investors use other ratios for quick and comparative analysis:

-

Reserve Life: Calculated by dividing the total proven and probable reserves by the annual production. It indicates how many years a mine can continue to operate with its current resources. A long and stable reserve life is a sign of sustainability.

-

Net Debt / EBITDA: Measures the level of financial leverage. In such a cyclical industry, a low level of debt is a sign of strength and resilience.

-

Enterprise Value / Reserves (EV/Reserves): Calculated by dividing the Enterprise Value (market capitalization + net debt) by the total ounces (or tonnes) of reserves. It is a quick multiple to compare how the market values the "in-the-ground" resources of different companies.

5.4. Gold Equivalent Ounces

Gold Equivalent Ounces (GEOs) are a measure used in the mining and investment industry to convert the production of different precious metals into a common unit of gold. This conversion allows companies and investors to easily compare the production of different assets without needing to evaluate each metal separately.

To calculate GEOs, the production of other metals (like silver, copper, or platinum) is converted into gold terms using the market price ratio.

Example of GEO Calculation

Suppose a mine produces:

-

10,000 ounces of silver

-

The price of silver is $25 USD per ounce

-

The price of gold is $2,000 USD per ounce

Then, the production in gold equivalent ounces would be:

This means those 10,000 ounces of silver have a value equivalent to 125 ounces of gold.

Why are GEOs Important?

-

Standardizes mining production: Allows for comparison of operations that produce different precious metals.

-

Facilitates project valuation: Investors can better understand a mine's profitability without analyzing each metal individually.

-

Aids in strategic planning: Mining companies can better optimize their resources and calculate their revenues.

6. External Factors: Risks and Opportunities 🌍

The success of a mining investment does not depend solely on the quality of its geology or the efficiency of its financial management. The sector is profoundly influenced by a series of external factors that can create both significant risks and unexpected opportunities. Investors must carefully evaluate this landscape to make informed decisions.

6.1. The ESG Mandate: From Risk Mitigation to Value Creation

Environmental, Social, and Governance (ESG) criteria have moved from a secondary consideration to become the number one risk and opportunity for the mining industry, surpassing traditionally dominant factors like price volatility or operating costs.

-

Environmental (E): This pillar covers the management of mining's impact on the natural environment. Key concerns include water management, an increasingly scarce resource and a critical point of conflict with local communities; climate change mitigation through the decarbonization of operations (e.g., electrifying truck fleets); protection of biodiversity; and the responsible planning and execution of mine closure to leave a positive environmental legacy.

-

Social (S): The concept of a "Social License to Operate" is now paramount. This is not a legal permit, but the ongoing acceptance and support of local communities and society at large for a mining project. This requires transparent and respectful community relations, the creation of shared value (local employment, supplier development), and ensuring the mine leaves a lasting positive social impact. A project with world-class geology can be unviable if it lacks community support.

-

Governance (G): This pillar refers to how a company is managed. It includes transparency in reporting (especially on ESG metrics), robust anti-corruption policies, a corporate governance structure that protects the interests of all shareholders, and an ethical commitment in all its operations.

The integration of ESG principles is no longer an option but a strategic imperative. Companies with poor ESG performance face increased scrutiny from regulators, opposition from communities, and, crucially, difficulties in accessing capital. Large institutional investors and banks are increasingly incorporating ESG criteria into their investment and financing decisions, divesting from companies with poor performance. Conversely, a company that demonstrates ESG leadership can gain a significant competitive advantage: easier access to permits, better community relations, a greater ability to attract and retain talent, and a lower cost of capital.

6.2. Geopolitical Chess: Resource Nationalism and Supply Chain Security

Geopolitics has escalated to become the second most important risk for the mining industry. The fixed location of mineral deposits means that mining is intrinsically linked to the politics of the host country.

-

Resource Nationalism: In times of high commodity prices, it is common for governments of resource-rich countries to seek a larger share of the profits. This can manifest through tax and royalty increases, the renegotiation of contracts, or, in extreme cases, the expropriation of assets. Changes in government in key mining jurisdictions like Chile and Peru have brought this risk to the forefront of investors' attention.

-

Supply Chain Security: The energy transition has elevated certain minerals, such as lithium, cobalt, and rare earths, to "strategic" status. The concentration of the production or processing of these minerals in a small number of countries (e.g., China's dominance in lithium and rare earth refining) creates vulnerabilities in the global supply chain. This has led countries like the United States and those in the European Union to actively promote policies to secure the supply of these critical minerals, either through domestic mining or alliances with friendly countries ("friend-shoring").

For the investor, this means that jurisdictional risk analysis is as important as geological analysis. A low-cost deposit in a politically unstable country can be a much riskier investment than a higher-cost deposit in a stable jurisdiction with a history of respecting contracts and private property.

6.3. The Regulatory Landscape: A Constant Variable

The mining industry is one of the most regulated in the world, and the regulatory environment is a constant source of risk and uncertainty.

-

Permits and Licenses: The process to obtain the necessary permits to explore, build, and operate a mine is long, complex, and increasingly rigorous. Permitting timelines have lengthened in many jurisdictions, becoming a major bottleneck that delays new supply from reaching the market to meet growing demand. In Chile, for example, the government has committed to trying to reduce wait times for permits by 30% to encourage investment.

-

Tax and Royalty Regimes: Governments constantly review and modify the tax frameworks applicable to mining. Uncertainty about future tax increases or changes in royalty structures can deter long-term investment, as it directly affects a project's projected profitability.

The complex regulatory landscape acts as a significant barrier to entry, which can protect established producers from new competition. However, it also stifles the investment needed to develop the projects the world needs for the energy transition. For investors, this implies that companies that already own long-life assets, with all permits in order and located in stable jurisdictions, deserve a significant valuation premium. The ability of a management team to successfully navigate these regulatory labyrinths is a crucial skill and a key factor for long-term success.

7. Conclusion

The mining sector presents itself as a fascinating and complex investment field, fundamental for economic and technological progress but fraught with unique risks. Its intrinsically cyclical nature, high capital intensity, and prolonged development timelines have forged an industry with specialized business models and valuation metrics that an investor must master.

The analysis reveals that there is no single way to "invest in mining." The spectrum ranges from the Majors, diversified giants offering stability and dividends, to the Juniors, high-risk exploration vehicles with explosive return potential. In an intermediate position, and with a particularly attractive risk-reward profile, are the Royalty and Streaming companies. Their business model, which allows them to gain direct exposure to the upside of metal prices without taking on the operating costs and risks of the mines, has proven to be structurally superior, especially in inflationary environments.

8. Terms and Concepts

8.1 Tailings

In the mining industry, tailings are the residual material left over after the valuable minerals have been extracted from the mined ore. This residue is typically a mixture of:

-

Ground rock fragments

-

Water (used during the separation process)

-

Chemicals (used in the beneficiation process, such as cyanide, flotation reagents, etc.)

Key characteristics of tailings:

-

They have no direct economic value but may contain traces of metals.

-

They are stored in special impoundments called tailings dams or tailings storage facilities.

-

They can pose an environmental risk if not managed properly, due to potential leakage of contaminants or structural failures.

8.2 Declining Ore Grade

Declining ore grade refers to a downward trend in the concentration of valuable minerals (such as gold, copper, silver, etc.) contained in the ore extracted from a mine over time.

-

Ore Grade: This is the amount of metal contained per tonne of ore extracted, usually expressed in grams per tonne (g/t) for precious metals or as a percentage (%) for base metals.

-

Grade Decline: Occurs when, as the richest parts of the deposit are depleted, mining begins on material with a lower concentration of useful mineral.

Economic Implications:

-

Higher cost per unit of metal produced: More rock needs to be mined and processed to obtain the same amount of metal.

-

Lower profitability: If metal prices do not rise, the operating margin may be reduced.

-

Greater environmental impact: More consumption of water, energy, and generation of tailings for each unit of metal obtained.

8.3 High-Grade Ore

-

High grade: Means that for every tonne of rock processed, a larger amount of the valuable metal is obtained, which makes the process more profitable. It is a measure of the richness of the deposit.

Examples:

-

Gold: A mine with 5 g/t of gold is considered high-grade; one with 1 g/t might be marginal.

-

Copper: A deposit with 1% copper is high-grade; one with 0.3% could be considered low-grade.