The Oil and Gas Industry

TheOil, often called “black gold,” is the backbone of the global energy system. Since the 19th century, it has driven industrialization and shaped global geopolitics. Investing in oil andrequires understanding a complex market that spans from crude extraction to the sale of fuels at a gas industrystation. is a cyclical sector highly dependent on macroeconomic factors such as global supply and demand, geopolitical conditions, and energy market stability. Understanding its structure and business models is key to assessing its long-term viability and profitability.

In this document,progressive guide (from basic to advanced level), we will analyzelearn all the mainfundamental concepts,concepts typesneeded ofto reservoirs, industry segments, key metrics, and valuation methods used in investinginvest in oil and gasoil companies.

1.a Cyclical Natureglobal and Influencingeducational Factorsapproach.

1. Introduction to the Oil Market

1.1 History and Evolution of Oil as a Commodity:

The use of oil dates back to antiquity (it was known as "rock oil" in Babylon), but its modern exploitation began in 1859 with the first commercial oil well drilled by Edwin Drake in Pennsylvania. In the early 20th century, oil replaced coal as the primary energy source, fueling the automotive industry (e.g., Ford's Model T in 1908) and gaseconomic sectorexpansion. Throughout the 20th century, crude oil prices remained relatively stable until the major oil crises of the 1970s, when OPEC embargoes caused prices to quadruple and revealed oil’s enormous geopolitical influence. Since then, the market has experienced boom-and-bust cycles: all-time highs in 2008 (Brent ~$147/barrel) followed by crashes, a historic plunge into negative territory in 2020 during the pandemic (WTI -$37/barrel), and subsequent recoveries. Today, oil remains the world’s primary fuel, although it faces competition from alternative energies.

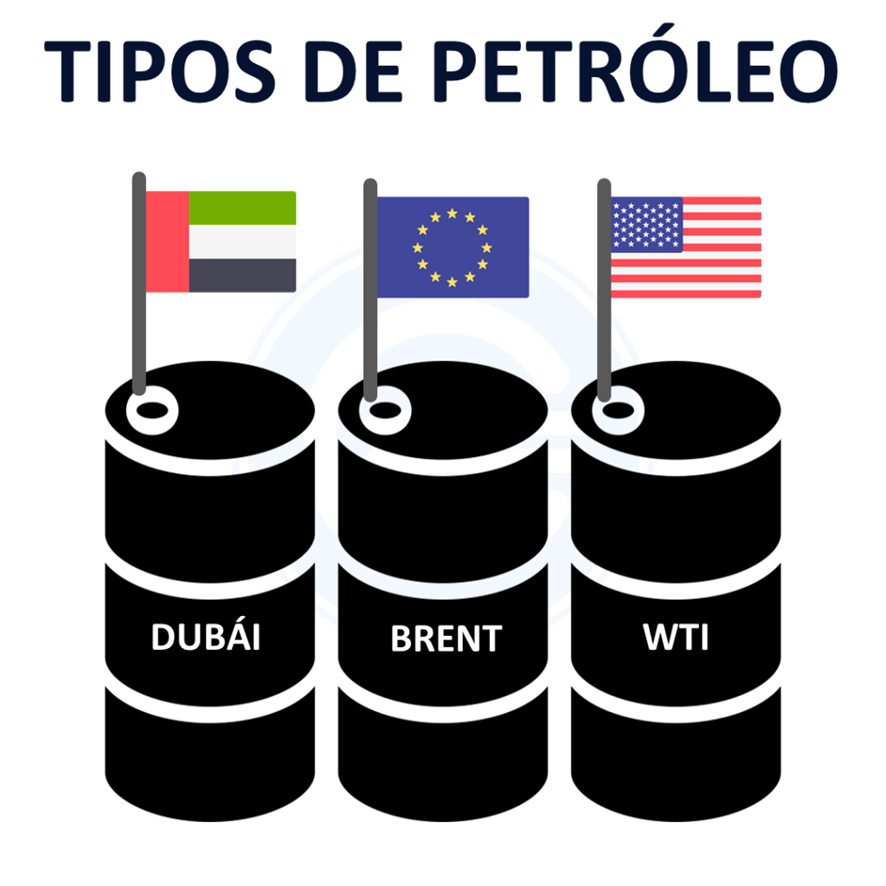

1.2 Types of Crude Oil and Their Characteristics:

Not all crude oil is characterizedthe same; it is classified by highits volatilitydensity (light vs. heavy) and sulfur content (sweet vs. sour). Markets use benchmark crude types to set international prices:

-

Brent: Sourced from the North Sea (Europe), Brent is light and sweet (low density and low sulfur). It serves as the benchmark for European and global pricing, typically trading at a slight discount compared to WTI. Brent sets the price basis for over two-thirds of the world's crude oil.

-

WTI (West Texas Intermediate): A crude oil from Texas (USA), WTI is very light and sweet, even of higher quality than Brent. It is the benchmark in North America and is ideal for refining into gasoline. It usually trades close to Brent (historically sometimes a bit higher due to its dependence on:quality).

Global supply and demand: Affected by economic growth and energy policies.

Geopolitical conditions: Conflicts in producing countries can significantly impact prices.

Climatic factors: Hurricanes or harsh winters can affect production and distribution.

Technological advancements: New extraction techniques such as fracking can change market dynamics.

1.1 The price of crude oil is determined in two main markets:

West Texas Intermediate (WTI): Represents oil produced in the U.S.

-

Dubai/Oman: These Middle Eastern crudes are medium-grade and sour (higher sulfur content). They are used as benchmarks for pricing in Asia. Due to their relatively lower quality, they usually trade at a discount compared to Brent Crude:and

A global benchmark based on oil from the North Atlantic.WTI.

Brent: Sourced from the North Sea (Europe), Brent is light and sweet (low density and low sulfur). It serves as the benchmark for European and global pricing, typically trading at a slight discount compared to WTI. Brent sets the price basis for over two-thirds of the world's crude oil.

WTI (West Texas Intermediate): A crude oil from Texas (USA), WTI is very light and sweet, even of higher quality than Brent. It is the benchmark in North America and is ideal for refining into gasoline. It usually trades close to Brent (historically sometimes a bit higher due to its dependence on:quality).

Global supply and demand:Affected by economic growth and energy policies.Geopolitical conditions:Conflicts in producing countries can significantly impact prices.Climatic factors:Hurricanes or harsh winters can affect production and distribution.Technological advancements:New extraction techniques such as fracking can change market dynamics.

1.1 The price of crude oil is determined in two main markets:

West Texas Intermediate (WTI):Represents oil produced in the U.S.-

Dubai/Oman: These Middle Eastern crudes are medium-grade and sour (higher sulfur content). They are used as benchmarks for pricing in Asia. Due to their relatively lower quality, they usually trade at a discount compared to Brent

Crude:and

Additionally, there are many other regional blends (such as 2.Urals Typesfrom Russia, Maya from Mexico, etc.). In general, light and sweet crude oils are more valued because they yield more high-quality gasoline and diesel with less processing, whereas heavy or sour crudes generate more residuals (like fuel oil and asphalt) and require more complex refining. This is reflected in pricing: light/sweet crudes sell at a premium, while heavy/sour crudes trade at a discount.

1.3 Main Petroleum Derivatives:

Crude oil is processed through refining to obtain multiple derivatives, which are the backbone of modern industry. The main petroleum products include:

-

Gasoline (naphtha): Fuel for cars and light vehicles. It’s a light derivative in high demand for road transport and light aviation.

-

Diesel (gas oil): Fuel for diesel engines in trucks, buses, heavy machinery, and also heating. It has a higher energy density than gasoline.

-

Kerosene/Jet Fuel: Fuel for aircraft turbines and special stoves. It’s an intermediate fraction between gasoline and diesel.

-

Fuel oil: A heavy residue used as fuel in ships, power generation, and industrial boilers. There are both light and heavy grades depending on their density.

-

Lubricants and oils: Heavier derivatives refined to reduce friction in engines and machinery.

-

Asphalt and bitumen: Very heavy products used in paving and roofing.

-

Petrochemical feedstocks (ethane, propane, naphtha): Used to produce plastics, fertilizers, detergents, synthetic rubbers, etc. In other words, oil not only powers vehicles but is also indirectly present in countless everyday products.

Oil also yields petrochemical raw materials (ethane, propane, naphtha) that are essential in manufacturing plastics, fertilizers, detergents, synthetic rubbers, and more. So, oil doesn't just fuel transportation; it is embedded in numerous modern products.

2. Oil Reservoirs

In the oil market, reservoirs are underground geological formations where hydrocarbons (mainly oil and natural gas) accumulate. These reservoirs are classified based on various criteria: geological formation, location, depth, and the type of crude they contain. Below are the main types:

2.1 By OilGeographic SandsEnvironment:

Extraction

🔹 Onshore reservoirs

-

- Located on land.

- Easier and cheaper to develop than offshore fields.

- Examples: Permian Basin (USA), Orinoco Belt (Venezuela)

🔹 Offshore reservoirs

-

- Located beneath the seabed.

- Require offshore drilling platforms.

- They are divided into:

-

Shallow water offshore: less than 200 meters deep.

-

Deepwater offshore: between 200 and 1,500 meters.

-

Ultra-deepwater: more than 1,500 meters.

-

-

Examples: Pre-salt fields in Brazil, Gulf of

veryMexico.

2.2 By Geological Trap Type:

🔹 Structural traps

-

- Formed by deformations in rock layers (anticlines, faults, salt domes).

- The most common and productive.

🔹 Stratigraphic traps

-

- Result from changes in rock porosity or permeability.

- Harder to detect using seismic methods.

🔹 Combination traps

-

- Include features of both structural and stratigraphic types.

2.3 By Type of Crude Oil Contained:

🔹 Conventional oil

-

- Flows easily.

- Extracted using traditional techniques.

- High profitability.

🔹 Unconventional oil

-

- Heavier, more viscous, or trapped in challenging formations.

- Requires advanced extraction techniques:

-

Oil sands (bituminous sands): Very heavy oil embedded in

sandsand,and its processingprocessed intorefinablesyntheticcrude.crude (e.g., Alberta, Canada).2.2 -

DeepwaterShalereservoirsoil:locatedOil in low-porosity rock (e.g., Bakken, Permian), extracted via fracking. -

Heavy / extra heavy oil: e.g., Orinoco Belt.

-

Tight oil: From low-permeability rocks.

-

Pre-salt deepwater: Fields beneath thick salt layers

ofinsalt,deep waters, making extractionmore challenging.difficult.2.3 -

Shale

gas:GasGas trapped in low-porosity

rock formations,rocks, extractedthroughvia hydraulic fracturing (fracking).2.4 -

Shale

oil:OilOilAlsoencapsulatedtrapped inlow-porosity rockshale formations,alsoextractedthroughusing fracking.

Pre-Salt Deepwater -

- Heavier, more viscous, or trapped in challenging formations.

2.4 By Physical State of the Hydrocarbon:

🔹 Oil reservoirs

-

- Contain mainly liquid crude, sometimes with dissolved gas.

🔹 Gas reservoirs

-

- Contain mainly natural gas, with or without liquid condensates.

🔹 Condensate gas reservoirs

-

- The gas contains hydrocarbons that condense at the surface.

3. Extraction Methods

Depending on the type of reservoir, geological location, and crude oil characteristics.

3.1 Primary Extraction (Natural Method)

Description: Relies on the reservoir’s natural pressure (from gas, water, or rock) to push the oil to the surface.

Techniques:

-

Simple vertical well

-

Directional/horizontal well (in more complex cases)

Recovery: Extracts between 5% and 15% of the oil in the reservoir.

Cost: Low — it is the most economical method.

Application: Used in conventional reservoirs and during the early years of a well's life.

3.2 Secondary Extraction (Fluid Injection)

Description: Water or gas is injected to maintain or increase reservoir pressure.

Techniques:

-

Water injection

-

Injection of natural gas, nitrogen, or CO₂

Recovery: Boosts total recovery to 30–50%.

Application: When natural pressure drops.

3.3 Tertiary or Enhanced Oil Recovery (EOR)

Description: Advanced methods used to mobilize the remaining oil that cannot be recovered through primary or secondary methods.

Techniques:

-

Polymer injection: increases water viscosity.

-

Steam flooding: especially effective for heavy oils.

-

High-pressure CO₂ injection: dissolves oil to improve its flow.

-

Chemical and thermal methods.

Recovery: Raises total recovery to 60% or more.

Cost: High — but profitable when oil prices are high.

Application: In heavy oils, mature fields, or unconventional reservoirs.

3.4 Hydraulic Fracturing (Fracking)

Description: High-pressure injection of water, sand, and chemicals to fracture rock and release trapped oil/gas.

Application: For shale oil and gas.

Reservoir Type: Unconventional.

Leading Countries: USA, Argentina.

🔧 How Fracking Works:

-

-

-

Vertical and then horizontal drilling:

A vertical well is drilled to reach the shale formation, then extended horizontally for several kilometers within the hydrocarbon-bearing rock layer. -

High-pressure fluid injection:

A mixture of water (90%), sand (9%), and chemicals (1%) is injected at extremely high pressure. -

Fracture creation:

This creates microscopic fractures in the rock. -

Oil/gas release:

The fractures allow trapped oil/gas to flow into the well.

The sand keeps the fractures open, enabling continuous hydrocarbon flow.

-

-

3.5 Oil Sands Mining

Description: Extraction of oil from sands rich in bitumen.

Methods:

-

Open-pit mining: used when deposits are close to the surface.

-

Steam-Assisted Gravity Drainage (SAGD): used for deeper sands.

Application: Extra-heavy oil.

Example: Alberta, Canada.

3.6 Offshore (Marine) Production

Description: Extraction from seabed reservoirs using platforms.

Types:

-

Shallow water (< 200 m)

-

Deepwater (up to 1,500 m)

-

Ultra-deepwater (> 1,500 m)

Cost: Very high, but also highly productive.

Examples: Gulf of Mexico, North Sea, Pre-salt Brazil.

📌 Quick Summary Table:

| Method | Reservoir Type | Estimated Recovery | Cost | Technology |

|---|---|---|---|---|

| Primary | Conventional | 5–15% | Low | Basic |

| Secondary | Conventional | 30–50% | Moderate | Injection |

| Tertiary (EOR) | Mature / Heavy | 50–60%+ | High | Advanced |

| Fracking | Unconventional (shale) | Variable | High | Highly advanced |

| Oil Sands | Extra heavy | 10–20% | Very high | Mining / Steam |

| Offshore | Marine | Similar to onshore | Very high | Specialized |

4. Industry Segments

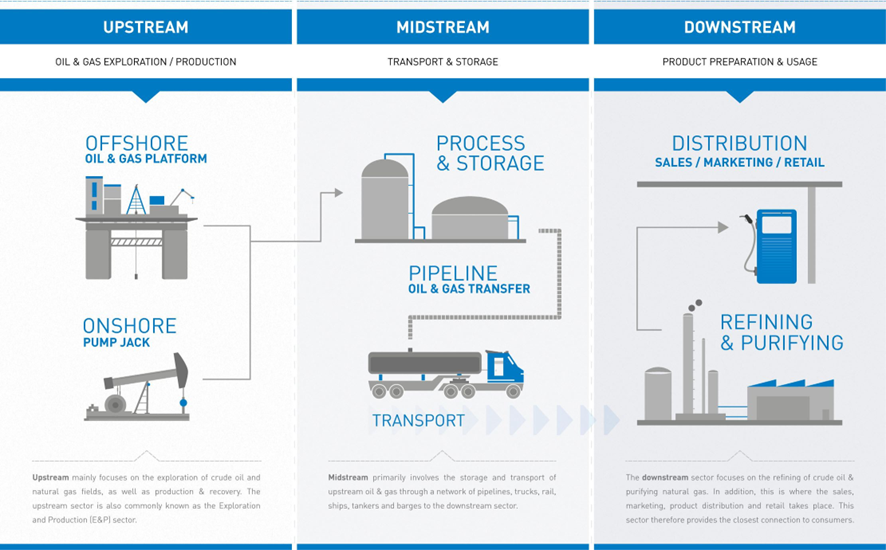

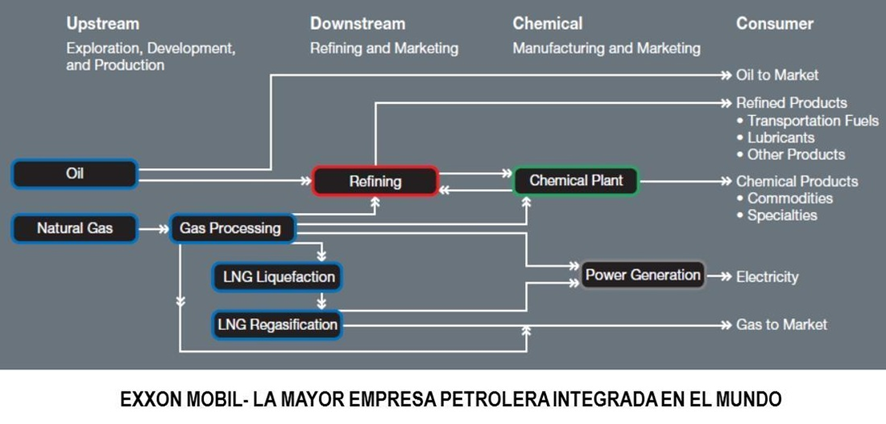

3.4.1 Upstream (Exploration and Production)

ThisUpstream isrefers to the most capital-intensive and high-risk phase. It involves:

Exploration of new reservoirs.Extractionexploration and production of hydrocarbons. It is the initial phase involving the search for oil and gas reservoirs (via seismic and geological exploration), drilling of wells, and extraction of crudeoil.oil

CompaniesExamples: Occidental Petroleum (an independent E&P company) and state-owned firms like Pemex Exploración y Producción.

Upstream activity is high-risk (due to geological uncertainty and sunk capital investments) but offers potentially high rewards if commercially viable reserves are found. It also includes operations in this segment must balance capital costs with theirdeepwater, Returnshale, on Invested Capital (ROIC) to ensure profitability.etc.

3.4.2 Midstream (Transportation and Storage)

ThisMidstream segment involvesrepresents the distributionintermediate link that connects production with consumption. It includes the transportation of crude oil fromand wellsgas (via pipelines, oil tankers, gas pipelines, and tanker trucks), storage in tanks, and sometimes initial processing (e.g., gas plants to refineriesliquefy through:or separate liquids).

Pipelinescompanies typically use fee-based business models — they charge tolls for moving or storing barrels, generating relatively stable, contractual revenues.Examples: Kinder Morgan, Enbridge, port terminal operators, etc.

These firms are less sensitive to crude oil prices andgasmorepipelines.dependent Maritimeonandtransportlandvolumestransportation.(although

Midstream

Many U.S. midstream firms are structured as MLPs (Master Limited Partnerships) — a common corporate structure in U.S. energy sectors, known for high dividend payouts (distributions) to investors. MLPs are exempt from corporate income tax if 90% of their income comes from qualified energy activities.

3.4.3 Downstream (Refining and Distribution)

TheDownstream transformationinvolves ofrefining crude oil into finished products suchand asthe distribution and marketing of fuels. In refining, crude oil is processed in refineries to produce gasoline, diesel, kerosene, lubricants, petrochemicals, and plastics.more. KeyDistribution characteristicsincludes include:storing refined products, transportation (via pipelines or tanker trucks), and retail sale at gas stations or bulk sales to industrial customers.

Downstream companies typically operate refineries and retail or wholesale networks.

Examples:

LowerreturnsValero

on(largeinvestment.independent refiner)HighdependencePhillips

and marketing operations)on66 (refiningmargins.-

In Latin America: Ecopetrol, Repsol (refining and fuel sales assets)

Downstream profits depend on 3.4refining margins, Oilfieldwhich Servicesare the difference between crude oil prices

Companiesand specializingproduct inprices providing(e.g., supportmargin from turning crude into gasoline/diesel). Ironically, refiners may benefit from low crude prices (lower raw material costs) and suffer when oil prices rise — the opposite of upstream.

Retail gas stations tend to have stable margins, as they often pass costs directly to the industry,end suchconsumer.

4.4 Oilfield Services

This segment includes companies that do not produce oil or gas directly, but provide essential technical, operational, and logistical services that enable upstream (exploration & production) companies to operate. These are considered the "operational arm" of the oil industry.

4.4.1 Main Services Provided:

-

Drilling rig

rentals.rental and operation: Onshore and offshore platforms (including high-tech), maintenance, installation, and removal. Geologicalmapping.Seismic and geophysical services: Subsurface studies and 2D/3D/4D seismic analysis to identify hydrocarbon-bearing structures.

-

Well engineering and design: Geological modeling, drilling planning, and reservoir simulation.

-

Hydraulic fracturing and well completion: Key techniques for maximizing oil/gas recovery, especially in unconventional (shale) reservoirs.

-

Cementing, casing, and well stimulation services

-

Specialized

transportation.logistics and transport: Moving heavy equipment, hazardous materials, crude oil, or intermediate products. -

Subsea services: Installation and maintenance of pipelines and equipment in offshore fields (e.g., deepwater operations).

4.4.2 Types of Service Companies:

-

Large global integrators: e.g., Schlumberger, Halliburton, Baker Hughes, Weatherford — provide full-scale services worldwide.

-

Mid-size and niche firms: Focused on specific areas like seismic, cementing, or subsea services.

-

National companies: In some countries, local or state-owned service providers operate alongside multinationals.

4.4.3 Business Characteristics:

-

Highly dependent on the oil cycle: Oilfield service activity volume directly tracks E&P spending. In high oil price periods, demand soars; during downturns, it’s the first segment to suffer cuts.

-

Technology- and capital-intensive: Services often require sophisticated equipment, advanced software, and highly specialized labor.

-

Contract-based relationships: Contracts are usually medium-term, with fixed or performance-based pricing.

📉 Example of vulnerability:

During oil price crises (like 2014–2016 or 2020), many oilfield service companies went bankrupt or had to restructure due to a sharp decline in drilling investments.

4. Key Factors in Evaluating Oil Companies

4.1 Production Costs

- Cash Cost of Production: The cash expense to produce an additional barrel.

- Marginal Cost of Production: The extraction cost for new projects.

If the crude oil price falls below the cash cost, the company may operate at significant losses.

4.2 Reserve Replacement Ratio

Measures the company's ability to replenish extracted reserves. A ratio above 100% indicates reserve growth.

4.3 Reserves and Useful Life

Reserves are classified as:

- 1P (Proven Reserves): Extraction probability above 90%.

- 2P (Proven + Probable Reserves): 50% probability.

- 3P (Proven + Probable + Possible Reserves): 10% probability.

5. Valuation Methods

5.1 EV/BOE

Compares Enterprise Value (EV) with barrels of oil equivalent produced daily (BOE/day).

- 1 barrel (bbl) = 42 U.S. gallons.

- Prefixes used: Mbbl (1,000 barrels), MMbbl (1 million barrels).

5.2 NAV (Net Asset Value)

Values the company based on its reserves and net assets. Typically, a 50% discount is applied to NAV.

5.3 RLI (Reserve Life Index)

Measures the estimated duration of current reserves at the current production rate.

5.4 Key Multiples

- EV/Adjusted Cash Flow from Debt.

- Adjusted PER.

- EV/EBITDA (Maximum recommended: 6x in a normalized cycle).

- FCF (Maximum recommended: 10x).

For pure exploration companies, valuation should be based on the Net Present Value (NPV) of reserves.

6. Risks and Final Considerations

6.1 External Factors

- Increasingly strict environmental regulations.

- Energy transition and development of renewable sources.

- Impact of geopolitical crises and OPEC agreements.

6.2 Dependence on Crude Oil Prices

Oil companies are highly correlated with commodity prices, which can drastically affect profitability.

6.3 Company Selection

It is essential to choose low-cost producers with a strong management team and clear strategies to mitigate market volatility.

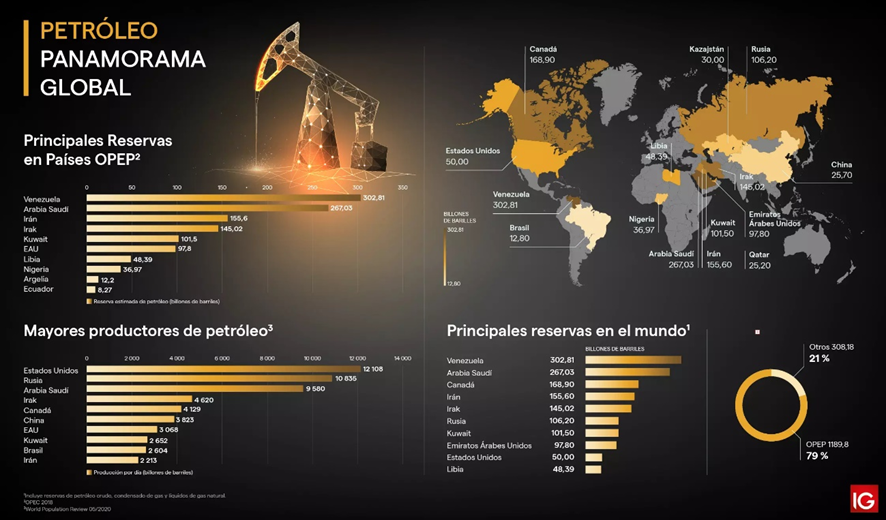

OPEC and Its Influence

The Organization of the Petroleum Exporting Countries (OPEC) is a cartel formed by some of the world's largest oil producers. Its main objective is to coordinate and unify the oil policies of its members to ensure stable and profitable prices for producers.

History and Members

Founded in 1960, OPEC currently consists of 13 countries, including Saudi Arabia, Iran, Iraq, and Venezuela. There is also a group known as OPEC+, which includes other producers such as Russia.

Impact on Crude Oil Prices

OPEC influences oil prices by regulating production. When demand is low, the organization can cut supply to maintain higher prices, and vice versa. However, its decisions can be affected by the production levels of non-member countries, such as the United States.

7. Conclusion

The oil and gas industry, is complex and requires in-depth analysis, to properly evaluate investment opportunities. Due to its cyclical nature, investors must consider factors such as production costs, reserves, reservoir lifespan, and the macroeconomic environment.

Success in investing in this sector lies in selecting companies with low operating costs, good capital management, and well-defined strategies to mitigate the effects of crude oil price volatility.