Mergers and Acquisitions

🎓(M&A): Analyzing the Premium and the Risk

The Mergers and Acquisitions (M&A) ecosystem is a dual source of value creation and value destruction. Historically, statistics show that between 50% and 70% of acquisitions fail to generate the expected return for the acquiring company. This class explores the fundamental tension between the need to pay a significant premium and the high probability that such a payment will not translate into success.

1. The Justification for the Premium Price: Why Pay More Than the Quote?

1.1. Control Value and Operational Synergies

1.2. Strategic Imperatives and Intangible Assets

-

Strategic Value and Positioning: The main objective may be to obtain a unique strategic benefit, such as immediate entry into a new geographical market, access to a disruptive new technology (capability acquisition), or the acquisition of key talent (acqui-hire acquisitions).

-

Brand, Reputation, or Customer Base: Intangible assets can justify a price superior to book value. A strong brand, a loyal customer base, or an impeccable reputation are difficult to build and can be acquired instantaneously.

-

Intellectual Property and Patents (IP): Owning proprietary technology or high-value patents grants a significant and legally protected competitive advantage, for which the buyer is obliged to pay an extra amount to secure its temporary monopoly.

-

Growth Potential (Future Opportunities): The buyer may have a superior view of the target company's future growth prospects that the market has not yet discounted. Paying a premium is a bet on the rapid capture of that potential before competitors do.

1.3. Financial and Defensive Factors

-

Undervaluation by the Market: The buyer may firmly believe that the company is undervalued by the public market, and is willing to pay closer to its "real" intrinsic value calculated by the acquirer.

-

Tax Benefits: The acquisition can grant tax advantages, such as the ability to utilize accumulated tax losses that offset the acquirer's future profits.

-

Prevention of Rival Acquisition (Defensive M&A): Paying a high price may be necessary to prevent a strategic competitor from acquiring the company, which would grant them a decisive competitive advantage.

2. The Risk of Value Destruction

2.1. The Asymmetric Power of the Seller

-

The Seller Controls the Timing: In most cases, the sale is voluntary. Owners and shareholders wait for the peak of market conditions (bull cycles), when their valuation multiples are maximum. The buyer, eager to grow or deploy capital, has few options other than accepting an inflated premium price, often at the worst point in the cycle.

-

Information Asymmetry (The Hidden Information Problem): No matter how exhaustive the Due Diligence is, the selling company's management team will always have a deeper and more detailed knowledge of the operational weaknesses, legal risks, contingent liabilities, and cultural problems of the company. The buyer pays, in part, for information that is not complete.

-

The Premium Requirement: The acquirer not only competes with other potential buyers but must convince the shareholders to sell. This implies that the price offered must be significantly higher than the current market value to overcome inertia and the preference to hold the stock, ensuring that the cost of the acquisition is high from the start.

2.2. Common Execution Errors

Many acquisitions fail because execution is poor, nullifying any potential synergy.

-

Excessive Overpayment (Winner's Curse): This is the most common error. It arises in competitive auctions where the acquiring company overestimates synergies or underestimates integration costs. When the premium paid is too high, the return expectations are impossible to meet, even if the integration is perfect.

-

Lack of Integration and Operational Disruption: The Post-Merger Integration (PMI) phase is the battlefield where value is won or lost. If the acquirer fails to properly merge IT systems, processes, supply chains, or sales teams, massive operational problems can arise that paralyze both companies for months or years.

-

Underestimating Risks and Financial Liabilities: Superficial financial due diligence can lead to buying a company with a fragile capital structure or with hidden liabilities not disclosed during negotiation, resulting in a sudden increase in debt or restructuring costs for the buyer.

-

Failure to Evaluate Organizational Culture (The Culture Clash): Cultural incompatibility is one of the main causes of failure. If the acquirer's culture (e.g., bureaucratic and slow) clashes with that of the acquired company (e.g., innovative and agile), key talent and leadership teams may abandon the company, taking with them the very basis of value (the "talent" or the "technology") for which the premium was paid.

3. The Key to Success: Strategy, Discipline, Execution

Acquisitions are an engine of growth for companies. The answer to "Why do they continue to pursue acquisitions?" lies in the potential for success when they are executed strategically and disciplinedly, creating significant shareholder value that no other (organic) strategy can achieve.

For an M&A to pay its premium and generate value, it must follow a rigorous process:

-

Strategic Clarity: The acquisition must be aligned with a clear and proven strategic thesis, and not just an opportunistic chance to spend cash.

-

Rigorous Due Diligence (DD): It must go beyond the numbers, including operational, technological, and cultural DD. The goal is to identify "value destroyers" before closing the transaction.

-

Price Discipline: The buyer must set a maximum price (reserve value) based on realistic synergy projections and stand firm to avoid the Winner's Curse, even if it means withdrawing from the auction.

-

Detailed Post-Merger Integration (PMI) Plan:

-

Leadership and Structure: Quickly appoint a dedicated integration leader.

-

Talent Retention: Implement aggressive retention plans for key talent.

-

Communication: Be transparent with employees and the market to reduce uncertainty and friction.

-

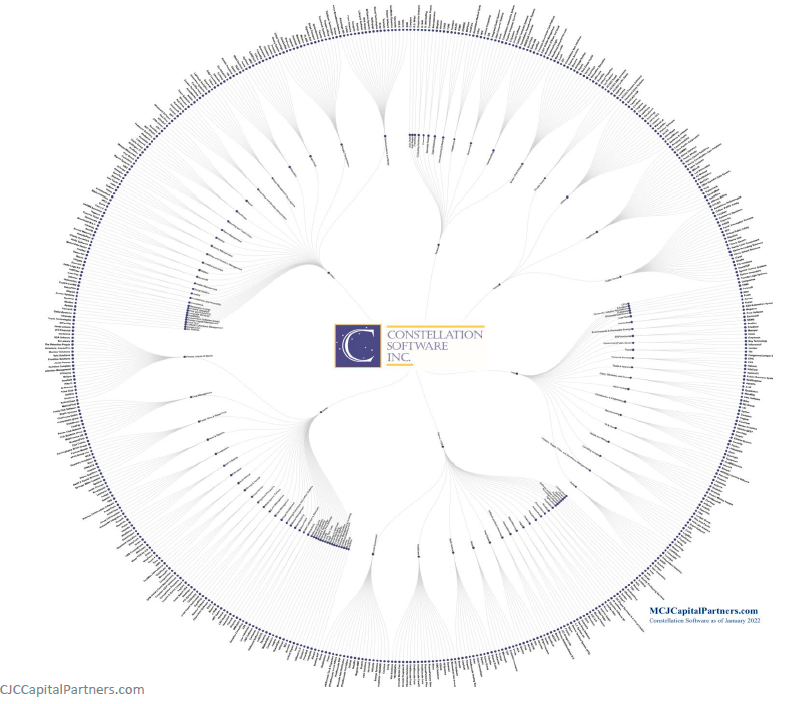

4. Example of success: Constellation Software

Constellation Software Inc. (CSU) is a Canadian company founded in 1995 by Mark Leonard. Its business model revolves around acquiring niche software companies and allowing them to operate independently.

Acquisition Strategy

CSU has achieved extraordinary growth through its acquisition strategy, which focuses on:

- Acquiring specialized software companies in sectors with high recurring revenue.

- Targeting already profitable companies rather than startups.

- Avoiding drastic changes in management or corporate culture.

- Maintaining a decentralized management style, allowing acquired companies to operate autonomously.

Results

Thanks to this strategy, CSI has:

- Acquired more than 500 companies across various sectors.

- Increased its stock market value more than 100 times since its inception.

- Generated high returns for shareholders through a disciplined investment approach.

Acquisitions can be a highly effective strategy for expanding a business and enhancing competitiveness, but they require detailed analysis and strategic execution.

The case of Constellation Software demonstrates that a successful acquisition strategy is based on:

- Discipline in purchasing, ensuring reasonable prices are paid.

- Careful selection of acquisition targets.

- Minimal integration, allowing acquired companies to operate independently.

For investors, analyzing a company’s acquisition strategy is crucial before investing. If a company pursues acquisitions in a disorganized manner or without a clear plan, the risk of losing value is high.

Here's a link to the Compounders or Roll-ups section, so you can dig deeper into this topic::

https://en.stockinvestingroom.com/books/sector-valuation-and-kpis/page/compounders-roll-up