Investment Funds and ETFs

The world of investments can seem complicated at first, but one of the most accessible ways to invest is through mutual funds and ETFs (exchange-traded funds). In this article, we will explain what these instruments are, their types, and the differences between active and passive management. Additionally, we will explore the advantages and disadvantages of each type of management.

Mutual Funds

Mutual funds are financial vehicles that pool money from many investors to invest in different assets, such as stocks, bonds, or a mix of both. These funds are managed by professionals who decide where and how to invest the money depending on the type of fund.

Mutual funds are mainly divided into:

Equity Funds (Active Management)

These funds primarily invest in company stocks. "Active management" means that a manager or team of managers carefully selects stocks in an attempt to achieve returns superior to the overall market. An iconic success story is the Magellan Fund, managed by Peter Lynch from 1977 to 1990, achieving an average annual return of over 29%.

Fixed Income Funds (Active Management)

Fixed income funds invest in bonds and other debt instruments. Managers aim to maximize returns while minimizing risk, selecting securities they deem promising.

Balanced Funds (Active Management)

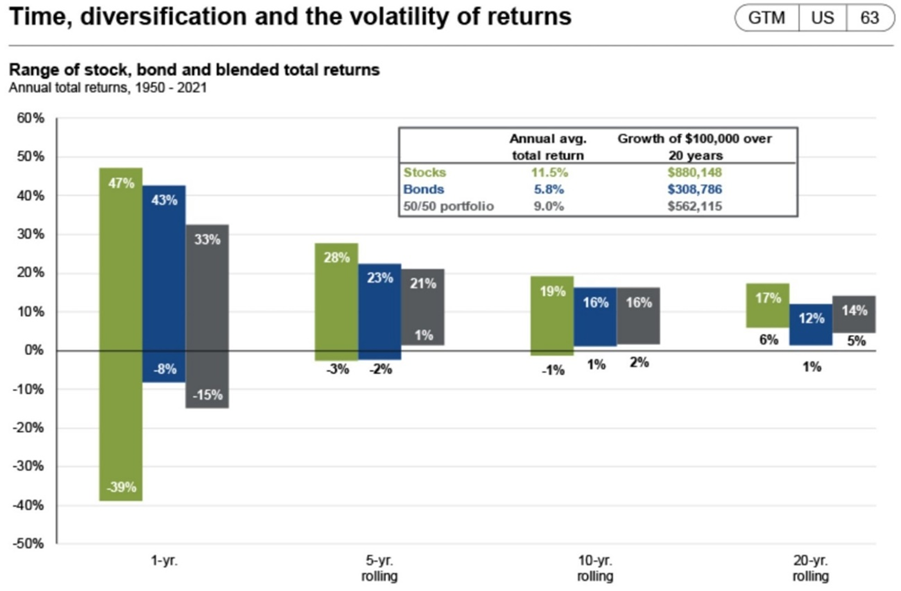

Balanced funds combine fixed income and equity assets. Their goal is to balance risk and return. For example, they may invest 60% in stocks and 40% in bonds (a 60/40 strategy), or vice versa, depending on the manager's strategy.

In this image you can see the returns of the different types of assets and how they vary according to volatility.

Accumulation and Distribution Funds

- Accumulation Funds: The profits generated (such as dividends or interest) are automatically reinvested in the fund, increasing its value over time.

- Distribution Funds: The profits are distributed among investors in the form of periodic payments, which can be attractive if you seek regular income.

** Website for Fund Search: https://www.morningstar.es/es/funds/default.aspx (in the search bar, you need to enter the name or ISIN of the fund. You will be able to see: The fund's performance, Fees and Top 10 holdings.

What Are ETFs?

ETFs (Exchange-Traded Funds) are funds that trade on the stock market like individual stocks. This means you can buy and sell them easily during market hours. Most ETFs follow passive management strategies.

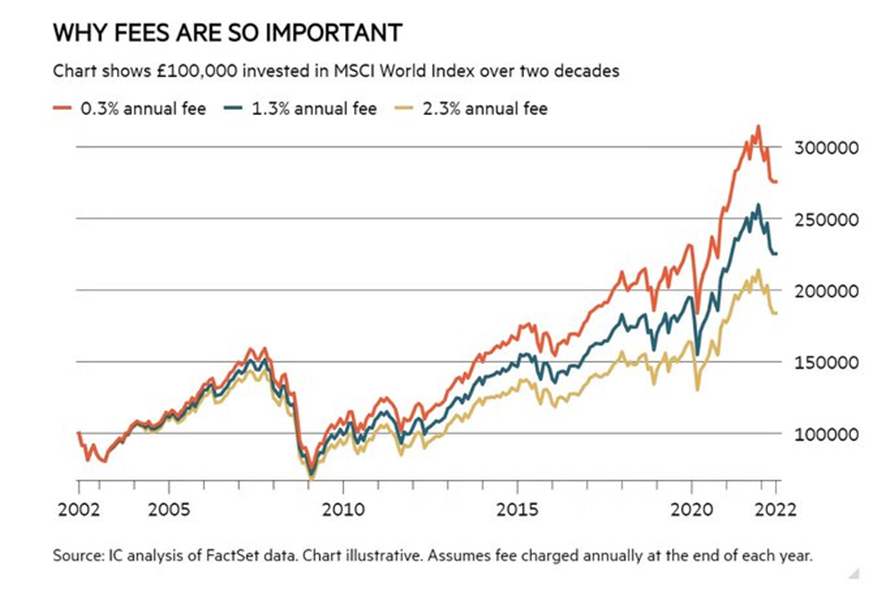

ETFs typically replicate an index, such as the S&P 500 (SPY), following its composition and performance. There are also thematic ETFs, such as those focused on oil, renewable energy, semiconductors, defense, or healthcare. They are less expensive than actively managed funds, with fees typically ranging from 0.1% to 0.9%, and at most around 1.5%, compared to 3% to 15% in active management (including maintenance, exit, and success fees).

- Manual Option: You buy and sell ETFs yourself according to your goals.

- Automated Option (Robo Advisor): A robo advisor is an automated service that manages your investments for you, based on your preferences and risk profile.

**Websites for ETF Search: (In the search bar, you need to enter the name or ISIN of the ETF) You will be able to see: The ETF's performance, Fees and Top 10 holdings.

Active Management

Advantages:

- Potential to achieve higher returns than the market.

- Flexibility to adapt to market changes.

Disadvantages:

- Higher fees due to the involvement of managers.

- No guarantee of outperforming the market.

Passive Management

Advantages:

- Lower costs, as there is less human intervention.

- Simplicity and transparency: replicates the performance of an index.

Disadvantages:

- Does not aim to outperform the market, only to match it.

- Less ability to adapt to specific market situations.