Gold as an Investment

Gold has been considered a store of value for centuries. Its luster and scarcity have made it a desirable asset, not only for jewelry but also as an investment tool. In this article, we will explore the different ways to invest in gold, the aspects we need to consider when doing so, and its main advantages and disadvantages.

Physical Gold (Coins and Bars)

Investing in physical gold involves acquiring coins or bars. It is one of the most traditional ways to own this precious metal.

- Coins: Some of the most popular gold coins include the South African Krugerrand, the American Eagle, and the Canadian Maple Leaf. These have high liquidity.

- Bars: Available in different sizes and weights, they are often preferred by those looking to invest larger amounts.

Custodian Companies (Allocated/Unallocated Gold)

This involves buying gold stored by a specialized company. There are two main options:

- Allocated Gold: The investor owns specific bars stored in their name.

- Unallocated Gold: The gold is pooled among several investors without specifying particular bars.

Gold ETFs (ETCs)

Exchange-Traded Funds (ETFs) offer a simple way to invest in gold without owning it physically. They replicate the price of gold and allow investors to access the market without the inconvenience of storing the metal. Popular examples of ETFs include SPDR Gold Shares (GLD) and iShares Gold Trust (IAU), both widely used by investors seeking gold exposure.

Additionally, investments can also be made through trusts like the Sprott Physical Gold Trust, which enables investment in stored physical gold, combining security with simplicity. These options offer flexibility and transparency for those who do not wish to handle tangible gold.

Another option is to invest in shares of mining companies dedicated to the extraction and commercialization of gold. These companies often benefit directly from rising gold prices but are also subject to operational risks such as extraction costs, government regulations, and production fluctuations.

Another alternative in this segment is investing in royalty and streaming companies. These companies do not directly extract gold but finance mining operations in exchange for a portion of future production or revenues. Royalty companies tend to be more stable as they diversify their income across multiple mining projects and do not face the same operational risks as miners.

Financial Derivatives

These include futures and options on the price of gold. Such tools are more speculative and are typically used by advanced investors looking to capitalize on market volatility.

Key Considerations - Physical Gold

- Certified Supplier: If you buy physical gold, ensure you do so through a certified supplier, such as a distributor of refineries meeting the Good Delivery standards of the LBMA (London Bullion Market Association). Avoid second-hand stores or unreliable websites.

- VAT Exemption: Investment gold, such as bars and coins with a minimum purity of 99.5%, is VAT-exempt in many countries. Verify this aspect before buying.

- Liquidity: Coins are often easier to sell than bars due to their smaller size and widespread acceptance.

Advantages of Investing in Gold

- Inflation Protection: Gold has shown to maintain its value over time, even during periods of high inflation.

- Independence from Central Banks: Unlike fiat currencies, gold is not affected by central bank money-printing policies.

- Tangible Asset: Being physical, you can store it wherever you wish and have full control over it.

Disadvantages of Investing in Gold

- Market Confidence: Gold’s value depends on the confidence of investors that it will continue to be a store of value.

- No Passive Income: Unlike other assets like stocks or bonds, gold does not pay dividends or interest. Its return comes solely from selling it at a higher price.

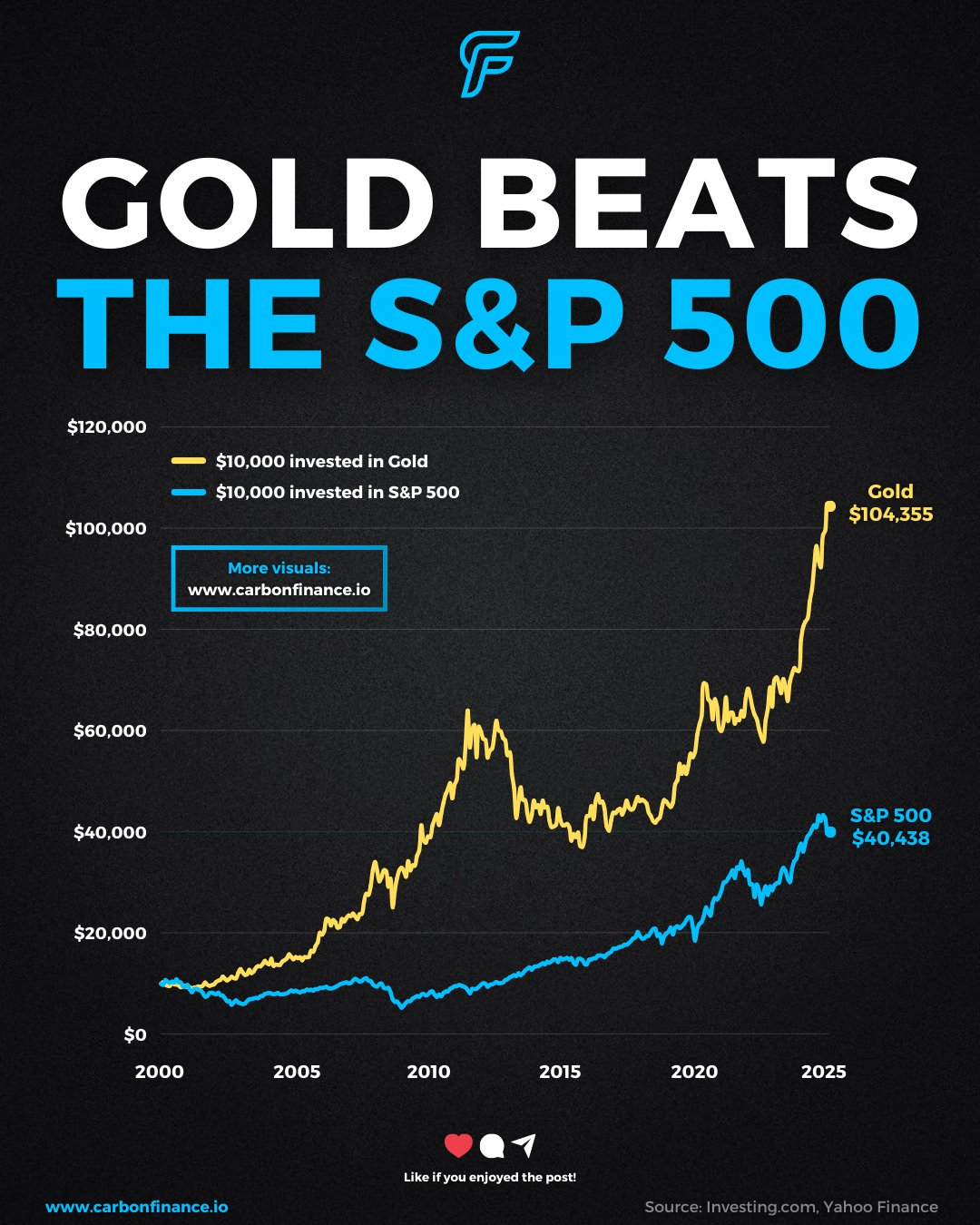

Source: https://x.com/carbonfinancex