Cryptocurrencies

Cryptocurrencies are digital currencies that use blockchain technology to ensure secure, transparent, and decentralized transactions. Unlike traditional currencies, such as the dollar or euro, cryptocurrencies do not rely on central banks or governments for issuance or regulation.

Blockchain Technology

Definition: Blockchain, or chain of blocks, is a distributed digital database that securely and transparently stores information. Each block contains transaction data, a timestamp, and a link to the previous block.

How does it work?

- Transactions: Users send data (e.g., cryptocurrencies) that are grouped into blocks.

- Validation: A network of computers (nodes) verifies transactions using advanced cryptographic algorithms to ensure authenticity and prevent tampering. This process is detailed in the famous "Bitcoin White Paper," a foundational document that explains the structure and philosophy behind blockchain technology.

- Record: Once validated, the block is added to the chain immutably.

Uses: Finance, supply chain management, smart contracts, electronic voting, among others.

Advantages:

- Transparency: Blockchain allows all transactions to be visible to anyone on the network, reducing the risk of tampering or fraud.

- Security: By using advanced cryptography, transactions and data on the blockchain are protected against unauthorized access and alterations.

- Decentralization: Since it does not depend on a central authority, blockchain distributes its operation across thousands of nodes, eliminating risks of censorship or single points of failure.

Disadvantages:

- Technical complexity.

- High energy consumption: Cryptocurrency mining is more common in countries with low energy costs, such as China (before restrictions), Kazakhstan, and Russia. In contrast, countries with high electricity costs, like Japan and Germany, have less mining activity due to economic uncompetitiveness.

- Limited speed on some networks: For example, Bitcoin processes approximately 7 transactions per second (TPS), while Ethereum reaches around 30 TPS. These limitations make some blockchains less efficient for large volumes of real-time transactions.

Types of Cryptocurrencies

Bitcoin

Bitcoin is the first and most well-known cryptocurrency, created in 2009 by Satoshi Nakamoto. Its issuance is limited to 21 million bitcoins, over 90% of which have already been mined (approximately 19 million by 2023). This means that, in the future, the number of new bitcoins entering the market will decrease due to the halving process, reaching the maximum limit around the year 2140.

How does it work? Bitcoin operates on a blockchain network that allows peer-to-peer transactions without intermediaries.

Uses: Payment for goods and services, investment, and value storage.

Altcoins

These are cryptocurrencies alternative to Bitcoin. Some of the most notable include:

- Ethereum (ETH): Famous for its smart contracts and decentralized applications (dApps).

- Cardano (ADA): Focused on sustainability and scalability.

- Monero (XMR): Designed for private transactions.

- Tron (TRX): Popular in the digital entertainment industry.

- XRP: Used for fast cross-border payments.

- BNB (Binance Coin): Utilized within the Binance ecosystem.

- Dogecoin (DOGE): Initially a meme, now widely used for everyday transactions. It is especially known for the backing of public figures like Elon Musk, who has significantly influenced its popularity and price through statements on social media.

Tokens-NFT

Non-fungible tokens (NFTs) are unique assets that represent digital ownership of art, music, or virtual goods. Examples of notable NFTs include artworks like "Everydays: The First 5000 Days" by Beeple, sold for $69 million, and collections like "Bored Ape Yacht Club." Companies such as OpenSea, Rarible, and Foundation are heavily involved in the buying, selling, and auctioning of these digital assets.

Stablecoins

Cryptocurrencies pegged to stable assets such as the dollar to reduce volatility. Their primary function is to enable cryptocurrency sales while maintaining a balance in cash. Instead of converting sales to fiat currency like USD or EUR, users switch to USDT, which reduces transaction costs for users and makes transactions cheaper.

Examples:

- USD Coin (USDC).

- Tether (USDT).

- DAI.

- Terra (Luna) (now inactive after its collapse).

Wallets

Digital wallets for storing cryptocurrencies. They can be:

- Hot Wallets: Connected to the internet, such as MetaMask.

- Cold Wallets: Disconnected, like Ledger. These cold wallets are physical devices, similar to USB drives, that store private keys offline, offering greater protection against cyberattacks. For example, when using a Ledger Nano S, the user connects the device to a computer only to sign transactions, keeping private keys secure at all times. This mechanism prevents malware or hackers' risks by not being constantly connected to the internet.

Advantages:

- High security by keeping private keys offline.

- Compatibility with hundreds of cryptocurrencies.

- Ease of use with dedicated applications.

Risks:

- Loss of the physical device, which can result in the inability to access funds if a backup of the seed phrase is not available.

- Higher initial cost compared to hot wallets.

Ledger, for example, is one of the most popular brands, offering models like Ledger Nano S and Ledger Nano X, which also include advanced features such as Bluetooth connectivity and extended storage for applications.

Keys:

- Public: Address for receiving cryptocurrencies.

- Private: Password for accessing funds. It should never be shared.

Mining and Mining Companies

Mining is the process of validating transactions and creating new blocks on the blockchain. Miners are computers that perform this work by solving complex mathematical problems called "proof of work" (PoW). This system rewards miners with new cryptocurrencies as an incentive for their work. For example, on the Bitcoin network, miners receive bitcoins as a reward for successfully adding a block.

Over time, the reward system is adjusted through a mechanism called halving, which occurs approximately every four years. This event reduces the reward per block by half, decreasing Bitcoin's inflation and increasing its scarcity. For instance, in 2020, the reward dropped from 12.5 to 6.25 bitcoins per block.

Mining Companies: Many organizations, such as Riot Blockchain and Marathon Digital Holdings, engage in large-scale mining operations.

Exchange

These platforms function as digital markets where users can buy, sell, and trade cryptocurrencies directly with each other. Exchanges enable direct ownership of digital assets and offer trading tools, such as price charts and buy/sell orders. Notable examples include Coinbase and Binance.

Advantages:

- Direct ownership of acquired cryptocurrencies.

- Wide variety of available cryptocurrencies.

- Competitive transaction fees in most cases.

Disadvantages:

- Users are responsible for the security of their funds if they use external wallets.

- Some exchanges can be complex for beginners.

Broker

Instead of directly acquiring cryptocurrencies, brokers allow users to trade cryptocurrencies as underlying assets through financial instruments like contracts for difference (CFDs). Users do not own the actual cryptocurrencies but can speculate on their price. Example: eToro -> https://etoro.tw/3JD8SrR

Advantages:

- Easy access for beginners.

- Leverage trading options.

- Additional tools, such as demo accounts and market analysis.

Disadvantages:

- Does not allow direct cryptocurrency ownership.

- Higher fees compared to exchanges.

- Exposure to additional risks from leverage.

In summary, while exchanges are ideal for those who want to acquire and store cryptocurrencies directly, brokers are suitable for those looking to speculate on market movements without managing digital assets directly. For many, brokers might be a better choice for simplicity and cash conversion.

Myths and Truths of Bitcoin (written for eToro in 2021)

MYTH: Bitcoin is controlled by no one; only the entry or exit of investors (speculators) moves the price.

Reality: Bitcoin is controlled by so-called whales (early miners), who hoard 98% of Bitcoins, leaving only 2% for individuals to purchase (see the footnote photo). In the following image I show you its distribution.

MYTH: Bitcoin will replace FIAT currencies.

Reality: Governments are the only entities that can set rules and decide how to limit the purchasing power of their citizens. We are governed by supranational entities, and if they feel threatened, they will act accordingly to ban it (as seen in China or India). Some speculators claim, “You can’t put gates on the sea,” but perhaps they are not considering that people build dams, just as rules are created—though both processes take time.

MYTH: Future transactions will be made with Bitcoin.

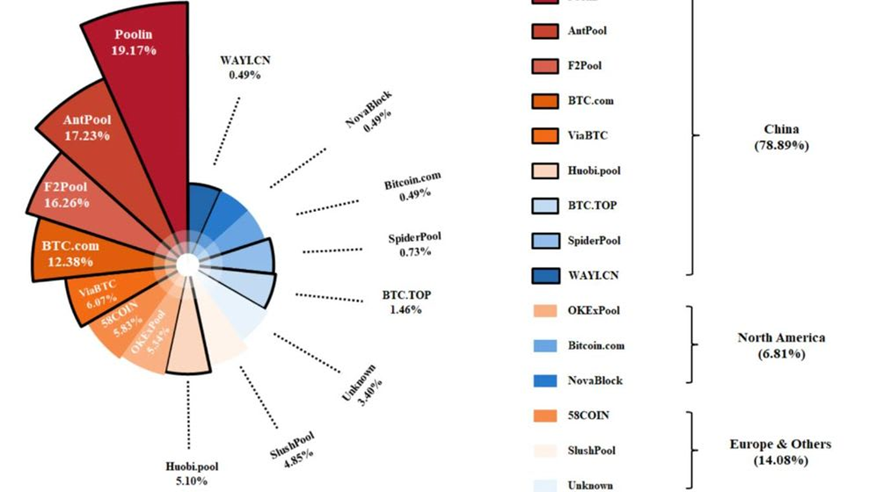

Reality: The energy consumption per BTC transaction is very high, making it unfeasible. This is why most miners are based in China or countries where electricity is very cheap.

MYTH: Many companies have adopted Bitcoin.

Reality: Such companies can be counted on one hand: TSLA, SQ, MSTR.

MYTH: Elon Musk endorses Bitcoin’s security.

Reality: Elon Musk is a social media influencer and takes advantage of his position. If Musk had done the same with stocks, it would have had legal consequences.

MYTH: Bitcoin will keep increasing in value.

Reality: The famous Lookintobitcoin chart, which shows the estimated value of Bitcoin, is the work of the creator of Tether, who issues USDT to manipulate Bitcoin’s price at will.

MYTH: Tether is a safe cryptocurrency backed by the dollar.

Reality: The company reported that it holds only slightly more than $2 billion in cash for over 60 billion Tethers. Tether issues new Tethers indiscriminately, which are then used to buy more cryptocurrencies, artificially increasing their value. Let’s face it—if exchanging BTC for Tether is cheaper than exchanging BTC for dollars, where does Tether profit? By scamming you.

MYTH: Cryptocurrencies are safer in cold wallets.

Reality: If a major exchange is attacked, crypto values will drop so much that it won’t matter whether they are in cold or hot wallets.

MYTH: BTC is currently worth $100,000.

Reality: If it drops 80% tomorrow, you will rush to sell so fast your hands will shake. You won’t buy more, thinking it will be worth $100,000 or $1M in four years, because this narrative is what everyone tells themselves to justify their position—until the price changes, and suddenly the laser-eyed enthusiasm vanishes from $TWTR.

MYTH: Bitcoin is helping humanity by preserving the purchasing power of ordinary people.

Reality: When you buy BTC, you are buying it from someone who already had it, slightly increasing its price. And who are you giving your money to? Drug traffickers, under-the-table businesses, and cybercriminals—those who truly use this “currency.”

MYTH: The dollar is used for wrongdoing more than BTC.

Reality: Bitcoin cannot be seized from an account with a court order as easily as conventional currencies. For this reason, no self-respecting criminal today would keep their money in a bank.

MYTH: If a criminal uses BTC, their criminal footprint is traceable on the network.

Reality: Try tracing all the pseudonyms a criminal uses for their transactions, linking them to a specific individual or company, and proving these transactions are tied to criminal activity in court—it’s practically impossible.

MYTH: I can close my Bitcoin position anytime and walk away.

Reality: No one is responsible or guarantees you’ll get your money back if exchanges go bankrupt or scam you. In fact, eToro makes this clear in its insurance conditions. For instance, in August 2021, when people started mass withdrawals from exchanges, there were already liquidity issues, and platforms restricted withdrawals. Why? You should ask yourself that.

Material of Interest

*Bitcoin Creation Manifesto: https://bitcoin.org/bitcoin.pdf

*Free Bitcoin Book in Spanish, "The Little Bitcoin Book":

https://artigapartners.com/wp-content/uploads/2021/06/Pequeno_Libro_de_Bitcoin.pdf

*Bitcoin Flow Diagram: https://www.bitcoinmagazinepro.com/es/charts/stock-to-flow-model