Pharmaceutical Industry

1. Introduction - Pharmaceutical Sector 🧬

The pharmaceutical sector stands as a fundamental pillar of the global economy and public health, attracting investor interest due to its distinctive nature and long-term growth potential.

1.1. History and Evolution of the Pharmaceutical Industry 📜

The trajectory of the pharmaceutical industry is a highlystory specializedof transformation, from its origins in medicinal botany to sophisticated modern biotechnology. The 19th century marked a turning point with the isolation of active plant compounds, laying the groundwork for modern pharmacology. The 20th century witnessed the emergence of "miracle drugs" like antibiotics and diversevaccines, industry,which rangingrevolutionized frommedicine largeand multinationallife corporationsexpectancy. withThis extensiveperiod solidified research and development (R&D) capabilitiesas the core of the industry, a pillar that has continued to grow in complexity and scope. Globalization and increasing regulatory demands have further shaped the sector, transforming it into one of the most highly regulated and capital-intensive industries.

The evolution of the pharmaceutical industry reveals a fundamental shift in its business model. Historically, profitability was generated through the large-scale manufacturing of relatively simple chemical compounds. However, with scientific advancements and intensifying regulations, value has shifted towards invention and the rigorous protection of intellectual property. This transformation means that risk and reward are increasingly concentrated in the early phases of drug development. Consequently, R&D investment has become a high-risk, high-reward gamble, and company valuations largely depend on the quality of their product "pipeline" and their innovation capacity, beyond their mere production capabilities.

1.2. Economic and Social Importance of the Sector 🌍

The pharmaceutical sector plays a crucial role in public health, improving quality of life and extending human existence through the development of innovative treatments and cures. Its economic contribution is equally significant, providing a substantial portion of global Gross Domestic Product (GDP) and generating employment in highly specialized areas such as R&D, manufacturing, and distribution.

A distinctive characteristic of this industry is its resilience. The pharmaceutical sector is often less affected by economic downturns compared to other industries. This is due to the inelastic demand for medications; diseases persist, and the need for treatments, especially for chronic or life-threatening conditions, remains even during periods of economic contraction. This demand stability provides a more solid revenue base for pharmaceutical companies, which can act as a buffer against volatility in a global investment portfolio. However, it's important to recognize that this resilience does not exempt the sector from other inherent risks, such as regulatory challenges or patent expirations.

1.3. Key Characteristics That Make It Attractive for Investment ✨

The attractiveness of investing in the pharmaceutical sector is based on several fundamental characteristics:

-

Long-Term Growth Potential: The demand for medicines is constantly increasing, driven by the aging global population, the rise in chronic diseases, and continuous technological advancements in medicine.

-

High Profit Margins: Innovative, patent-protected drugs typically generate substantial profit margins, which reward R&D investment.

-

High Barriers to Entry: The complexity and cost of R&D, along with rigorous regulatory requirements and the need for deep scientific expertise, create significant barriers for new competitors.

-

Stable Cash Flows: Once a drug gains approval and is commercialized under patent protection, it can generate predictable and consistent cash flows during its exclusivity period.

1.4. Overview of Risks and Opportunities ⚠️

Despite its attractiveness, the pharmaceutical sector presents a unique set of risks and opportunities that investors must carefully weigh:

-

Opportunities: The discovery of transformative therapies, expansion into emerging

biotechnologymarketscompanieswith growing healthcare needs, and advancements in precision medicine offer significant avenues for growth and value creation. -

Risks: The challenges are considerable and include:

-

The high risk of failure in clinical trials.

-

The constant threat of patent expiration (known as the "patent cliff").

-

Intense competition from generic and biosimilar drugs.

-

Increasing regulatory pressure on drug prices; governments and healthcare payers are exerting increasing pressure to control drug prices, seeking to

revolutionizereducemedicine.healthcareEachspending.segment -

theAdditionally,

sector has its own dynamics, risks,long andopportunities,costlymakingdrugitdevelopmentessentialcyclestomeanunderstandthatitscompaniesfundamentalsmust sustain significant investments for years beforeinvestingseeinginait.return.1.2. Types of Pharmaceutical Companies 💊The pharmaceutical sector is not monolithic; it is composed of various types of companies, each with a distinct business model, risk profile, and investment opportunities.

2.1.

1

consolidatedLarge"BigpharmaceuticalPharma"companies dominate the industry with massive R&D budgets, representing uprefers to20%multinationalofcorporations characterized by theirsales. These companies typically haveextensive product portfolios,includingglobalboth brandedpresence, andgenericadrugs.1.2historyBiotech (Biotechnology)Highly innovative companies developing advanced therapies based on genetic engineering, cell therapies, and biological molecules. Many of them are not profitable and depend onin thesuccess of their research.1.3Specialty PharmaSmaller companies that market specialized drugs, over-the-counter (OTC) medications, or generics. The market assigns them lower valuation multiples, around 7-8 times EV/EBITDA.1.4GenericsManufacturers that produce equivalent versions of drugs whose patents have expired.industry. Their business model is based onlowverticalproductionintegration,costscovering everything from research andeconomiesdevelopment (R&D) to the commercialization and distribution ofscale.medicines. They focus on developing "blockbusters," drugs with multi-billion dollar sales, and diversify their efforts across multiple therapeutic areas.These companies invest heavily in R&D, with budgets ranging from 14% to 50% of their revenues. For example, Merck & Co. allocated $30.5 billion to R&D in 2023, representing 50.8% of its revenues, with over half of this investment dedicated to strategic partnerships and acquisitions. AstraZeneca and Novartis also show high R&D-to-revenue ratios, with 23.9% and 30.1% respectively in 2023. Their product portfolios are extensive, including branded drugs, some generics, biologics, and advanced therapies.

The high proportion of R&D investment in Big Pharma, which often includes acquisitions of smaller companies with promising pipelines, represents both a defensive and offensive strategy. Defensively, it seeks to counteract revenue loss due to the "patent cliff," while offensively, it aims to maintain market growth and relevance.

1.52.2. BiotechPlasma(BiotechnologyCompaniesCompanies) 🧪CompaniesBiotechnologythatcompaniesproducearebloodgenerallyplasmasmallerderivativesand younger than Big Pharma, and their primary focus lies in innovation and the development of biological and advanced therapies. They are pioneers in cutting-edge areas such as genetic engineering, cell therapies, gene therapies, and nucleotide-based drugs. Their goal is totreataddressrarepreviously untreatable diseases, such asGrifols.cancer and organ failure.2.Drug Development ProcessThe

developmentvalue of these companies rests almost entirely on their research pipeline. The success of a single drugiscan radically transform their market position. However, they face significant challenges in terms of funding and profitability. They have experienced along"funding crisis" in bear markets, which has pressured them to reduce costs andcostlyextendprocess,theirtaking"runway"10-12oryears and costing billionsperiod ofdollars.operationOnlywithaboutavailable2.5%capital.Furthermore, nearly 90% of

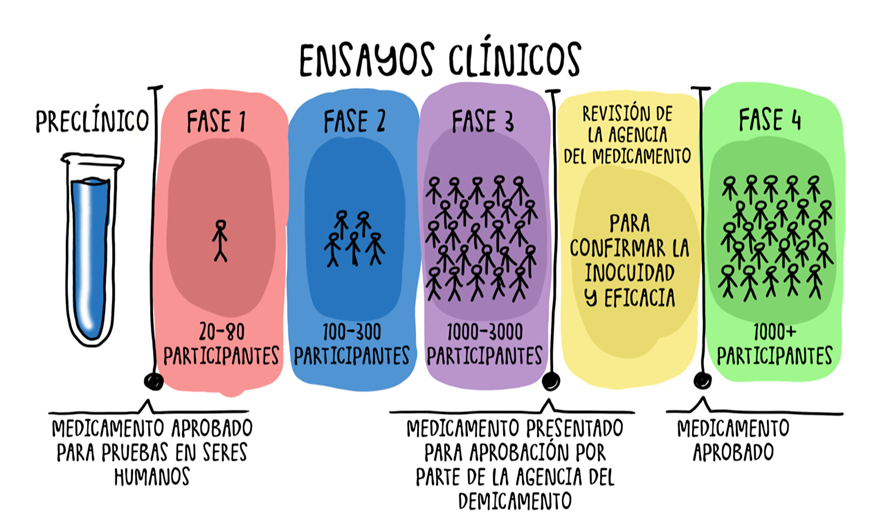

studiedU.S.moleculesbiotechreachcompaniescommercialization.2.1DiscoveryUnmet medical needs are identified, and candidate molecules are sought.2.2Preclinical PhaseLaboratory and animal testing to assess the toxicity and viability of the compound.2.3Clinical PhasesPhase I:Testedrely on20-100 healthy subjectsimports for6atmonths to 1 year.Only 20% progress to the next phase.Phase II:Evaluated in 100-300 patients to determine the appropriate dosage (up to 26 months).Only 50% advance.Phase III:Studied in more than 1,000 patients for 3-6 years to assess efficacy and safety.Onlyleast half of their product components, exposing them to supply chain risks. The complexity and high costs of clinical trials also represent significant barriers. Most early-stage biotech companies do not generate revenue, and their success depends entirely on thedrugsapprovalreachofregulatorytheirapproval.drugs.

2.

43. SpecialtyRegulatoryPharmaEvaluation(Specialty Pharmaceutical Companies) 🎯RegulatorsSpecialtyanalyzepharmaceuticalclinicalcompaniesdatadistinguishandthemselvesapprovebyor reject the drug.In some cases, they may request additional studies.2.5Commercialization and Phase IVOnce approved, the drug is marketed with high margins until the patent expires.Its safety continues to be monitored in Phase IV.3.Key Investment Factors3.1PipelineThe pipeline refers to a company's set of drugs in development. Investors shouldtheir focus onthosethein Phase IIdevelopment andIII, as they have a higher probability of success.3.2Target Market ValueSome diseases have larger markets and intense competition, while rare diseases allow for higher margins due to their exclusivity.3.3Regulatory ImpactEach country has its own regulatory authority (FDA in the U.S., EMA in Europe), which can affect a drug’s approval in different markets.3.4Mergers and AcquisitionsThe pharmaceutical sector is prone to mergers and acquisitions due to the high R&D costs.Large pharmaceutical companies often acquire promising biotech firms.4.Pharmaceutical Company Valuation4.1Valuation MethodsP/E Ratio (Price-to-Earnings):Used for established pharmaceutical companies, compared to historical averages.DCF (Discounted Cash Flow):Used to value biotech firms with growth potential.Typically assumes a WACC of 8.5% and a 2% growth rate.SOP (Sum of Parts):Values each business unit separately and sums them.

4.2Key Valuation FactorsPipeline and product diversification.Active patents and expirations.Cost structure and profit margins.Debt levels and interest rate sensitivity.

5.Glossary of Key TermsANDA (Abbreviated New Drug Application):Application to approve a generic drug without repeating efficacy studies.Accelerated Development:Fast-track approval for critical drugs.Biological Drugs:Biotech-based medications that are more complex to manufacture.Drug Lag & Drug Loss:Delays and losses in drug approval.Ethical Drugs:Prescription medications.IND (Investigational New Drug):Application to start human trials.NCE (New Chemical Entities):New molecules under investigation.NDA (New Drug Application):Request for approval of a new drug.Complete Response Letter:Regulator’s document explaining a rejection with the possibility of reevaluation.Drug Label & Black Boxes:Warnings on approved drugs about adverse effects.Orphan Drug Act:Regulation incentivizing the developmentcommercialization of drugs for specific market niches, often related to rarediseases.diseases OTCor conditions requiring complex treatments. Their product portfolio may include branded drugs, specialized generics, or over-the-counter (Over-the-Counter):OTC)Non-prescriptionproducts.medications.PDUFAcompanies typically operate with smaller, highly targeted sales and marketing teams, allowing them to benefit from less competition in their market segments. They concentrate on high-cost drugs that, by their nature, require specialized administration or monitoring.In terms of valuation, specialty pharma companies have demonstrated superior performance compared to the general market. Valuation multiples for biopharmaceutical service companies (

Prescriptionwhich often overlap or serve this segment) have shown an increase.The projected explosive growth in specialty pharmacy spending indicates an investment opportunity in a segment that combines innovation with a more focused business model and, potentially, less exposure to mass generic competition. As R&D becomes more sophisticated, treatments for rare or very specific diseases are discovered. These drugs, while often expensive, frequently have fewer therapeutic alternatives and therefore less competitive pressure than "blockbusters" aimed at mass markets. The projected growth of the specialty pharmacy market indicates increasing demand and a willingness of healthcare systems to pay for unmet medical needs.

2.4. Generics (Generic Drug

UserManufacturers)Fee🔄Act):10-month deadline forGeneric drug

approvalmanufacturers produce bioequivalent versions of branded drugs once their original patents expire. Their business model is based on manufacturing efficiency, rigorous supply chain optimization, and leveraging economies of scale. Unlike innovative companies, they do not incur the high costs associated with R&D and marketing of branded drugs.Competition in the

U.S.generics MarketmarketExclusivity:isMarketintense,protectiondrivingwithoutprices down. Generic drugs are, on average, 80% to 85% cheaper than their branded counterparts. This affordability significantly improves access to essential medicines for a broad segment of the population.The generics industry directly benefits from the "patent cliff" of branded drugs faced by Big Pharma. When a branded drug loses its patent, generic manufacturers can enter the market with low-cost versions, causing a drastic drop in sales and prices of the original drug. For investors, this means that while patent expiration is a threat to large pharmaceutical companies, it is a growth opportunity for

approximatelygeneric7companies.years.A Compositiongeneric company's ability to quickly identify and launch off-patent drug versions and achieve economies ofMatter:Patent covering a drug’s chemical structure.Method of Use:Patent covering the drug’s mechanism of action.

These

6.ConclusionThe pharmaceutical sector presents significant investment opportunities but also carries high risks due to regulatory uncertainty and development costs. Itscale is crucial toanalyzeits success.2.5. Plasma Companies (Plasma-Derived Therapies) 🩸

Plasma companies specialize in the

pipeline,collectiontargetofmarket,human plasma andfinancialthestabilitymanufacturebeforeofinvestingplasma-derived therapies, which contain invaluable therapeutic proteins. Their business model is often vertically integrated, covering the entire process from plasma collection through extensive networks of donation centers to the production and commercialization of the final medicines. Grifols, for example, is a global leader in this field with over 390 donation centers worldwide.These companies focus on treating chronic, rare, and sometimes life-threatening conditions, such as immunodeficiencies and hemophilia. The plasma value chain is a complex and rigorous process that ensures the highest quality and safety standards, from initial donation to final drug delivery to the patient.

Plasma companies, by concentrating on therapies for rare diseases that require a complex production process and a highly controlled supply chain, operate in a

companymarket niche with significant barriers to entry and less exposure to competition from generics or biosimilars. This situation can translate into stable margins and high profitability. Unlike small molecule drugs, plasma-derived therapies are complex biological products that require specialized infrastructure for raw material (plasma) collection and an intricate manufacturing process. This creates high barriers to entry for new competitors, limiting generic or biosimilar competition. Additionally, their focus on rare diseases often means higher prices and inelastic demand, contributing to the stability and predictability of profit margins. This makes these companies attractive to investors seeking stability and growth inthisprotectedsector.market segments.Moreover,2.6. Contract Manufacturing (CMO/CDMO) 🏭

The pharmaceutical industry, characterized by its complexity and high costs, has seen the emergence of a crucial business model: contract manufacturing, known as Contract Manufacturing Organizations (CMOs) or, more broadly, Contract Development and Manufacturing Organizations (CDMOs). These companies specialize in offering development and manufacturing services to other pharmaceutical and biotechnology companies, allowing them to partially or fully outsource their production processes.

The business model of a CMO/CDMO is based on providing a wide range of services, from early research and development phases to large-scale commercial manufacturing. This includes process development, active pharmaceutical ingredient (API) production, drug formulation, packaging, quality control, and, in many cases, the regulatory services required for product approval. By outsourcing these functions, pharmaceutical companies can focus on their core competencies, such as research and marketing, reduce their capital expenditures, optimize their operational costs, and accelerate their products' time to market.

One of the main advantages for companies that contract with a CMO/CDMO is flexibility. Smaller companies, especially developing biotech firms, often lack the necessary infrastructure and expertise for manufacturing. Using a CMO allows them to scale their production as needed, without the need for massive investments in plants and facilities. For Big Pharma, outsourcing can be a strategy to manage demand peaks, diversify their supply chain, or access specialized manufacturing technologies they do not possess internally.

The value proposition of a CMO/CDMO lies in its technical expertise, production capacity, and strict regulatory compliance. They operate under rigorous Good Manufacturing Practices (GMP), ensuring that manufactured products meet the highest quality and safety standards required by regulatory agencies worldwide. Their efficiency derives from optimizing their processes and achieving economies of scale by serving multiple clients.

A relevant example of this model in Spain is Rovi. Although Rovi is known for its own portfolio of pharmaceutical products, it has also established itself as an important CDMO, especially in the field of injectable manufacturing. Its expertise in the development and manufacture of complex drugs, combined with its modern facilities, has positioned it as a strategic partner for other pharmaceutical companies seeking to outsource the production of their injectable therapies. During the COVID-19 pandemic, for example, Rovi played a crucial role in manufacturing vaccines for third parties, demonstrating the strategic importance of CDMOs in the global drug supply chain.

Investing in contract manufacturing companies can be attractive for several reasons. They offer exposure to the pharmaceutical industry with a different risk profile. Unlike biotech companies that depend on the success of a

pharmaceuticallimited number of drugs in development, or Big Pharma with its patent cycles, CDMOs benefit from the overall R&D and manufacturing activity of the entire industry. Their growth is driven by the increasing trend towards outsourcing and the need for specialized manufacturing capabilities. Additionally, by serving multiple clients and products, their business model tends to be more diversified and less dependent on the success of a single drug. However, they also face challenges, such as intense competition, the need for continuous investment in technology, and reliance on contracts with their clients.2.7. Life Sciences Specialized REITs 🔬🏢

Within the vast universe of real estate investment, Real Estate Investment Trusts (REITs) have evolved to specialize in very specific market niches. A particularly interesting and increasingly important segment is that of REITs that focus on providing highly specialized office and laboratory spaces, primarily to companies in the life sciences, agritech, and technology sectors. Alexandria Real Estate Equities, Inc. (NYSE: ARE) is a clear example of this model.

A REIT, by definition, is a company

dependsthat owns, operates, or finances income-producing real estate. Life sciences specialized REITs, like Alexandria, are distinguished by their focus on providing critical infrastructure for research, development, and production in high-tech and growth sectors. Their properties are notonlyconventional offices; they are facilities built or specifically adapted to house state-of-the-art laboratories, clean rooms, R&D centers, vivariums, and other specialized infrastructure that biotech, pharmaceutical, and technology companies require for their operations.Alexandria's business model is based on the acquisition, development, and management of these laboratory and office complexes in key geographic clusters, which are typically hubs of biotech and technological innovation. These clusters, such as Boston/Cambridge, San Francisco Bay Area, San Diego, Seattle, New York, and Maryland, are characterized by a high concentration of academic research institutions, hospitals, life sciences companies (both startups and large corporations), and a highly skilled workforce. Proximity to these innovation ecosystems is a critical factor in their success.

Alexandria's value proposition for its

currenttenantssalesgoesbutbeyondalsosimply leasing space. They offer a collaborative and high-tech work environment, laboratory infrastructure services that may include specialized ventilation, security, and waste management systems, and a deep understanding of the specific needs of scientific research. By doing so, they allow their tenants to focus onitstheirabilityscience and discoveries, outsourcing the complexity of managing highly specialized facilities.For investors, a REIT like Alexandria offers a unique way to

innovategainand develop new drugsexposure toensurethefuturegrowthgrowth.of the life sciences industry without directly investing in the risk of clinical trials or drug development. Instead, they benefit from the rental of the infrastructure necessary for these industries to thrive.Table: Types of Pharmaceutical Companies 📊

Type of Company

Primary Business Model

R&D Focus

Risk/Reward Profile

Examples of Companies

Big Pharma

Vertical integration (R&D to commercialization), "blockbusters"

Massive, diversified, includes M&A

Moderate-High risk, stable growth with patent challenges

Merck, AstraZeneca, Pfizer, Johnson & Johnson

Biotech

Innovation, development of biological/advanced therapies

Highly specialized, innovation driver

Very High risk, Very High reward (pipeline-dependent)

Early-stage clinical companies (e.g., many startups)

Specialty Pharma

Niche markets, rare/complex diseases

Targeted at specific medical needs

High risk, High reward (less niche competition)

Companies focused on oncology, immunology, etc.

Generics

Low-cost production, economies of scale

Minimal R&D (bioequivalence), focus on efficiency

Low-Moderate risk, growth from patent expiration

Sandoz, Teva, Sun Pharma, Viatris

Plasma Companies

Plasma collection, derived therapies

Research in plasma proteins, rare diseases

Moderate risk, stable growth (high barriers to entry)

Grifols

of -