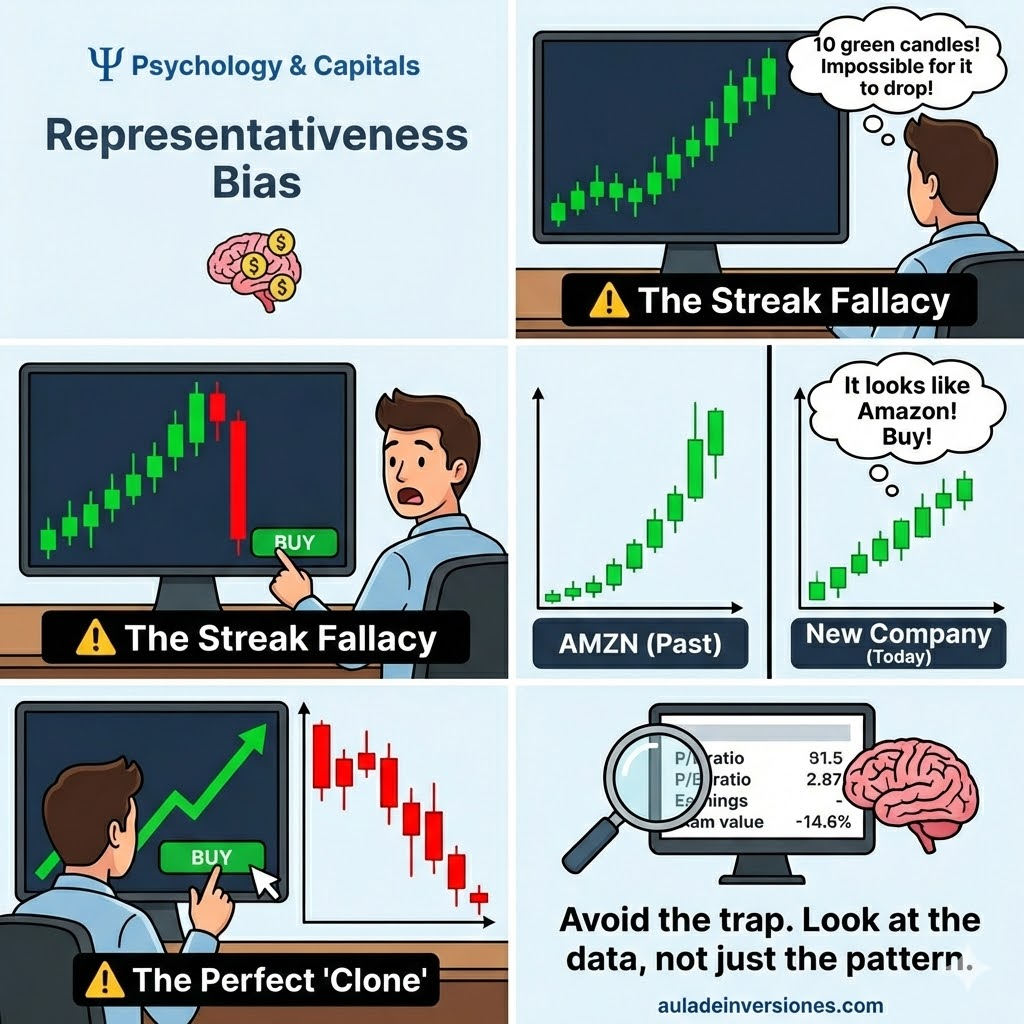

🎢 Representativeness Bias

What is Representativeness Bias?

It’s the mental tendency to judge the probability of an event based on how much it resembles past experiences or stereotypes we hold in our minds.

In trading, this translates to:

- The "Hot Hand" Fallacy: If a stock has been rallying for five days, we assume the sixth will be no different. "It’s worked so far, so it’ll keep working."

- The Perfect "Clone": Investing in an unknown company simply because its chart or sector reminds you of a giant that already made it big (e.g., "It’s the next $NVDA").

⚠️ The Danger of Ignoring Fundamentals

The catch is that the market has no memory of "what’s supposed to happen" based on your visual patterns. When we get carried away by this bias:

- We ignore current data: We stop checking if the company is overvalued or if interest rates have shifted; we only see the line going "up and to the right."

- Entering late (FOMO): We buy at the top of the mountain because "it always goes up," right before the cycle flips.

- Underestimating Mean Reversion: We forget that, sooner or later, prices tend to snap back to their true value.

🛠️ How to Break the Spell

To be a savvy investor on eToro, you need to pull apart "resemblance" from "reality":

- Check the Sample: Is this rally backed by actual earnings, or is it just market noise?

- Don't Look for Twins: Just because a company looks like Apple doesn't mean it will mirror its success. Every context is unique.

- Embrace Randomness: A winning streak doesn't guarantee the next trade. Every time you hit that button, the risk starts from scratch.

"The past is a mirror that often distorts the future. Don't trade based on what you think you recognize; trade based on what the data confirms today."