✅Confirmation Bias

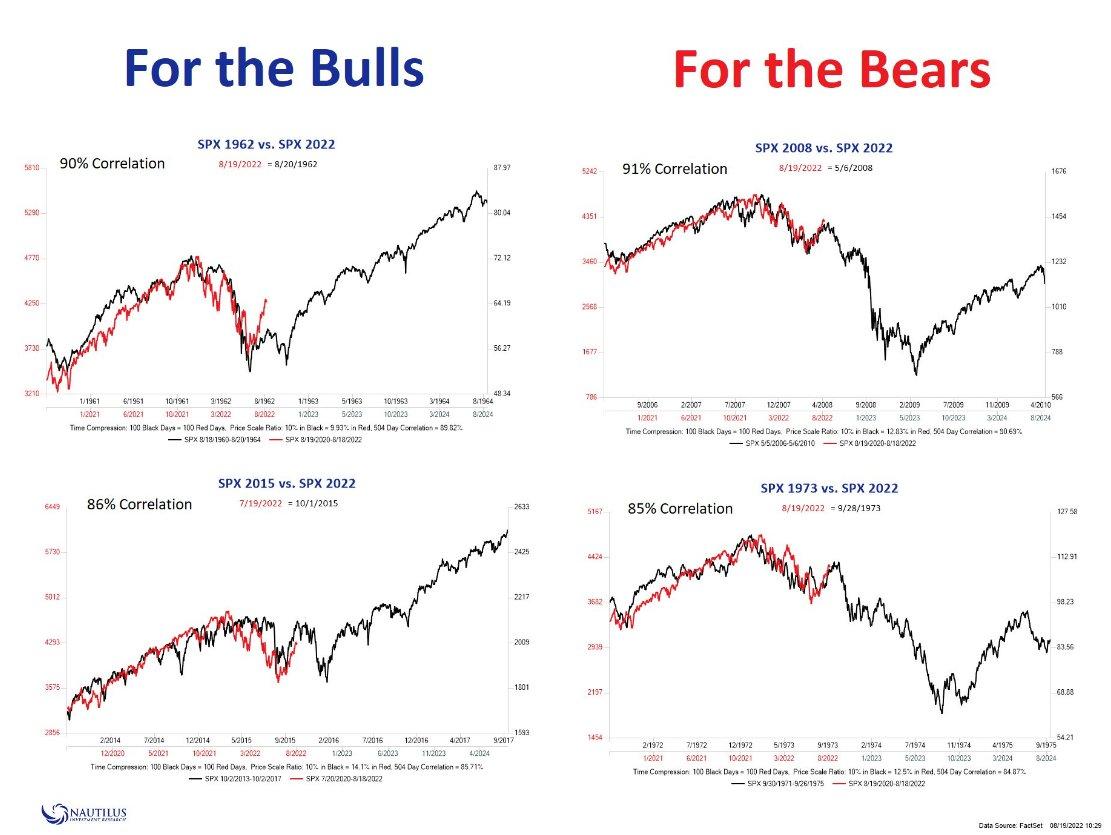

✅ Confirmation Bias: Are you investing with logic or just looking for someone to agree with you? 🤔

Have you ever bought a stock and suddenly started seeing only positive news about it? Or do you ignore that analyst who says your favorite company is about to tank? 📉

Be careful: it’s not that you have "faith"; it’s that your brain is playing tricks on you. This is called Confirmation Bias.

🧠 What exactly is it?

It is our mind's natural tendency to search for, interpret, and remember only the information that fits what we already believe. At the same time, we dismiss (or label as "FUD") any data that contradicts us. 🛡️

Basically, we filter reality to avoid the feeling that we’ve made a mistake.

🏠 The "Echo Chamber" Effect in your portfolio.

Imagine you’ve decided to go heavy on Tesla ($TSLA) or Bitcoin ($BTC). What do you do next?

-

Selective Searching: You go on Twitter or YouTube and only follow accounts that are "bullish" (optimistic). 📈

-

Tailored Interpretation: If bad news breaks, you think: "It doesn't matter, the market doesn't understand" or "It's just manipulation."

-

Selective Memory: You forget the times you were wrong and only remember the arguments that support your current thesis.

📉 Why is this dangerous for your money?

Confirmation bias gives us a false sense of security. We lock ourselves in a bubble where everything seems perfect... until the market delivers a reality check. 👊

When we ignore the warning signs ("red flags"), we stop managing risk. You are no longer an investor; you are a believer. And markets have no mercy for beliefs.

🛠️ How to break the spell (The Devil's Advocate Trick)

To survive in the markets, you need to be your own harshest critic. The next time you are convinced about a trade:

-

Look for the "No": Read someone who thinks the exact opposite of you. Try to understand their reasons without getting angry. 🧐

-

Ask yourself: "What would have to happen for my thesis to be proven wrong?" If you don't have an answer, you are under the bias.

-

Accept mistakes: Changing your mind when the data changes isn't a sign of weakness; it’s being a smart investor. 🧠✅

"Your goal isn't to be right; it's to make money. And sometimes, to make money, you have to admit you were wrong."