Broker Security

Are They Safer or Less Safe Than a Traditional Bank?

🛡️ The Security of Your Investments

In the exciting world of finance and investment, the security of our assets is a primary concern. When we deposit our money with a broker, we trust that our investments are protected, even in adverse scenarios like the firm's bankruptcy. This module will break down the existing layers of protection that safeguard your funds and securities, ensuring a deep understanding of how your capital remains safe.

🔑 Fundamental Principles of Investor Protection

Before delving into specific protection mechanisms, it's crucial to understand the guiding principle: asset segregation. Imagine leaving your car in a parking lot. That car is still yours, even though it's in the custody of the parking company. If that company went bankrupt, its creditors couldn't claim your car to settle their debts. Your car would be returned to you. The same principle applies to your investments with a broker.

🧱 The Asset Segregation Rule

In jurisdictions like the United States, there's a fundamental regulation that acts as the first line of defense for investors. This rule requires brokers to keep client funds and securities completely separate from the firm's own assets.

This means that the money and titles you own aren't mixed with the broker's operating capital. Think of it this way: what belongs to the broker, belongs to the broker; what belongs to you, belongs to you. This strict segregation is vital protection. If the broker faces financial problems and goes bankrupt, your investments can't be used to satisfy the company's debts. Instead, they should be returned to you, intact.

This rule is a crucial barrier against fraud and mismanagement. It prevents the broker from misusing client funds or failing to keep proper records of the positions they hold on behalf of their clients. It's the foundation upon which other protections are built.

🤝 SIPC Coverage: The Additional Shield

Despite the strict segregation rule, what happens if a broker doesn't comply with it, commits fraud, or simply can't return clients' securities? This is where an additional and robust protection comes into play: coverage from an investor protection corporation.

In the United States, this protection is provided by the Securities Investor Protection Corporation (SIPC). The SIPC is a non-profit organization, created by the U.S. Congress, that protects clients of SIPC member securities firms in case of broker bankruptcy.

SIPC Member Broker Search: https://www.sipc.org/list-of-members/

💰 Limits and Scope of Coverage

SIPC coverage is significant, and it's important to understand its details:

- Limit per Client: The SIPC protects up to $500,000 per client. It's crucial to understand that this limit is "per client," not per account. This means if an investor has multiple accounts at the same broker under their name, these are combined for the purpose of the coverage limit.

- Cash Limit: Within the total $500,000 limit, there's a sub-limit of $250,000 for cash (money held in cash) that the client may have in their account. It's important to note that money market funds, which are investments themselves, are considered "securities" and not "cash" for this purpose.

- Independence of Residence and Nationality: SIPC coverage doesn't discriminate. It doesn't matter where the client resides or what their nationality is; if their broker is a SIPC member, they are covered.

- Broker Membership: For coverage to apply, the broker must be a SIPC member. Most legitimate brokers are, and they usually advertise their membership on their websites and promotional materials. Investors can verify a broker's membership directly on the SIPC website.

- What It DOES NOT Cover: It's vital to understand what SIPC doesn't cover. This protection doesn't shield you from losses due to normal market fluctuations. If the value of your stocks decreases because the company performed poorly, the SIPC won't compensate you for that loss. Its function is to protect you if the broker goes bankrupt and can't return your securities to you, not if the value of your investments decreases.

📈 Covered Assets

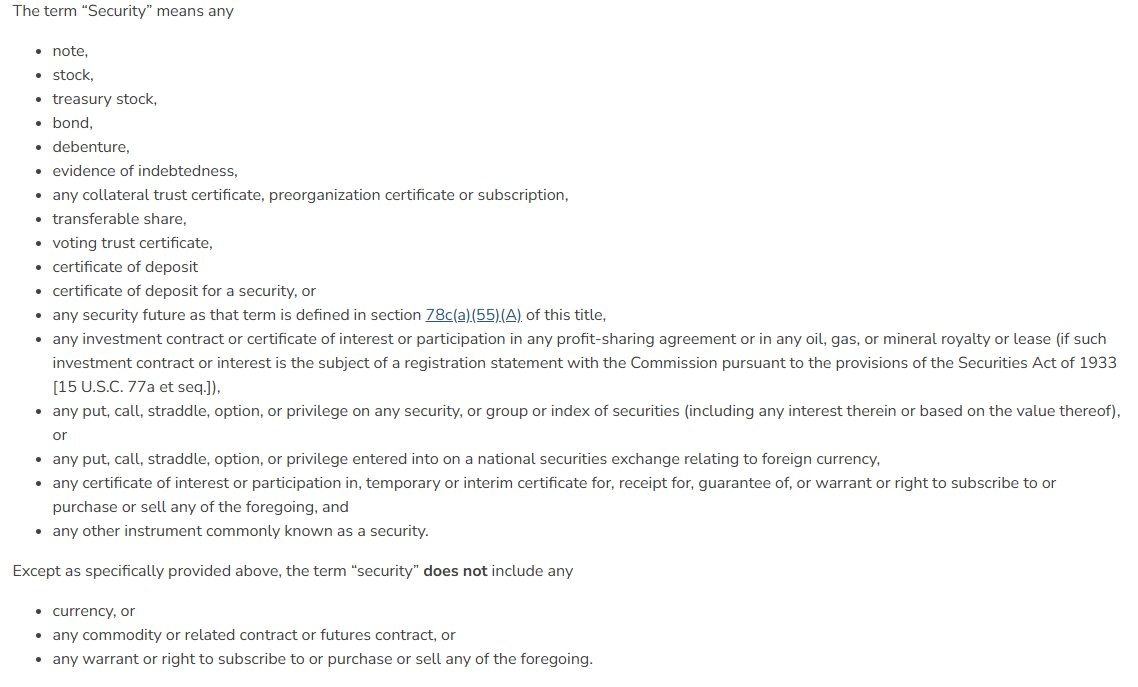

The SIPC covers a wide range of assets considered "securities" under U.S. law. This includes:

- Stocks

- Bonds

- Options

- Certificates of deposit

- Money market funds

- ETFs (exchange-traded funds)

However, there's an important caveat: certain "investment contracts" not registered with the SEC (U.S. Securities and Exchange Commission), such as many UCITS-type funds or ETFs (a European regulatory framework), and cryptocurrencies might not be covered. It's essential to verify the nature of your investments and their eligibility for coverage.

🎯 Coverage Per Client, Not Per Account

The distinction between "per client" and "per account" is crucial for understanding the extent of SIPC coverage.

- Multiple Accounts in Your Name: If you have two individual accounts in your name at the same broker, you'll be considered a single client, and the two accounts will be combined for the $500,000 limit.

- Joint and Separate Accounts: The "capacity" of the account determines whether they are considered separate clients. For example:

- If you have a personal account and another joint account with someone else, these are considered two different "capacities" and, therefore, two separate accounts for coverage purposes.

- If you have two accounts with the same holders (e.g., account A and B, and another account A and B), everything is considered a single "capacity" and a single combined account for coverage.

- If you have an account with holders A and B, and another account with holders A and C, these are considered different "capacities" and, therefore, separate accounts, which means each could have its own coverage up to the limit.

To illustrate with an example: if holders A and B have two accounts totaling $1,000,000, only $500,000 will be covered by the SIPC. However, if the A and B account has $500,000 and a separate A and C account has another $500,000, both accounts, being of different "capacities," would be individually covered for $500,000 each.

🛡️ Additional Broker Insurance

Beyond the protection provided by the SIPC, many brokers, especially large ones like eToro or Interactive Brokers, choose to take out additional insurance policies, such as those from Lloyd's, to offer even greater coverage to their clients. These policies are a testament to brokers' commitment to the security of their clients' funds and can provide additional peace of mind.

These insurances are usually contracted with reputable insurers and can significantly extend the coverage limits per account, as well as establish aggregate limits (the maximum total the insurer will pay in case of broker bankruptcy).

For example, some leading brokers offer additional coverage that can amount to tens or even hundreds of millions of dollars per account, with also expanded cash limits, subject to very substantial aggregate limits. It's advisable to review each broker's insurance policies, as these vary considerably.

⚠️ Warning: When Protection Does NOT Apply

While protections are robust, there are certain operations and situations where assets might not be segregated and, consequently, not accessible to the client in case of broker insolvency. A notable example is rehypothecation, a practice where the broker uses client securities as collateral for their own operations or loans. While this is a regulated practice, in certain contexts or in case of massive default, it could compromise the accessibility of assets. It's fundamental for investors to understand the nature of their accounts and their broker's policies regarding these practices.

🏛️ A Historical Precedent: Lehman Brothers

History provides us with real-world examples of how these protections work in practice. One of the best-known and most complex cases is the bankruptcy of Lehman Brothers Holdings Inc. (LHBI) in September 2008. LHBI was one of the largest investment banks in the world, with a vast network of global subsidiaries. Its collapse was chaotic and unprecedented in its scale.

However, what interests us here is the resolution of the bankruptcy of its broker subsidiary, Lehman Brothers Inc. (LBI). Unlike the parent company, which filed for general bankruptcy, LBI was liquidated under a specific law designed to protect broker clients, the law that created the SIPC.

The result was remarkable: LBI clients recovered 100% of their claims, totaling $190 billion. Half of these claims, mainly from retail clients with simpler operations, were resolved quickly, in a matter of days or weeks. Their assets were transferred to other brokers. The other half, mostly composed of institutional clients with more complex operations (such as derivatives and margin trading), took years to resolve, ending in 2013.

This historical case underscores the effectiveness of existing protection mechanisms. Despite the magnitude and complexity of one of the largest bankruptcies in financial history, investors, for the most part, managed to recover their assets, thanks to fund segregation and SIPC intervention.

🌐 Conclusion: Invest with Confidence and Knowledge

The security of your investments isn't a matter of luck, but the result of a robust regulatory framework and well-established protection mechanisms. Understanding asset segregation, SIPC coverage, and the additional protections offered by brokers allows you to invest with greater confidence.

While no investment is free from market risk, the current protection structure is designed to safeguard your funds from risks associated with broker insolvency. As an informed investor, your task is to choose regulated brokers, understand how these protections work, and be aware of the particularities of your own investments. With this knowledge, you can navigate the market with greater peace of mind and focus on your financial goals. 🚀

This article was created thanks to the idea, guiding thread, and basis from Guza, on Twitter-X: https://x.com/GuzaInversiones