🌛 Overnight Drift

The Overnight Drift:

🔎Debunking Myths 🌪️

There is a common "myth" that significantly more money can be made in the stock market by buying at the daily close and selling at the following day's opening. This concept—that true value generation occurs not during the hustle and bustle of the trading day, but while the market sleeps—is known as overnight return or overnight drift. it suggests that the majority of long-term gains in major indices occur between the close of one session and the opening of the next.

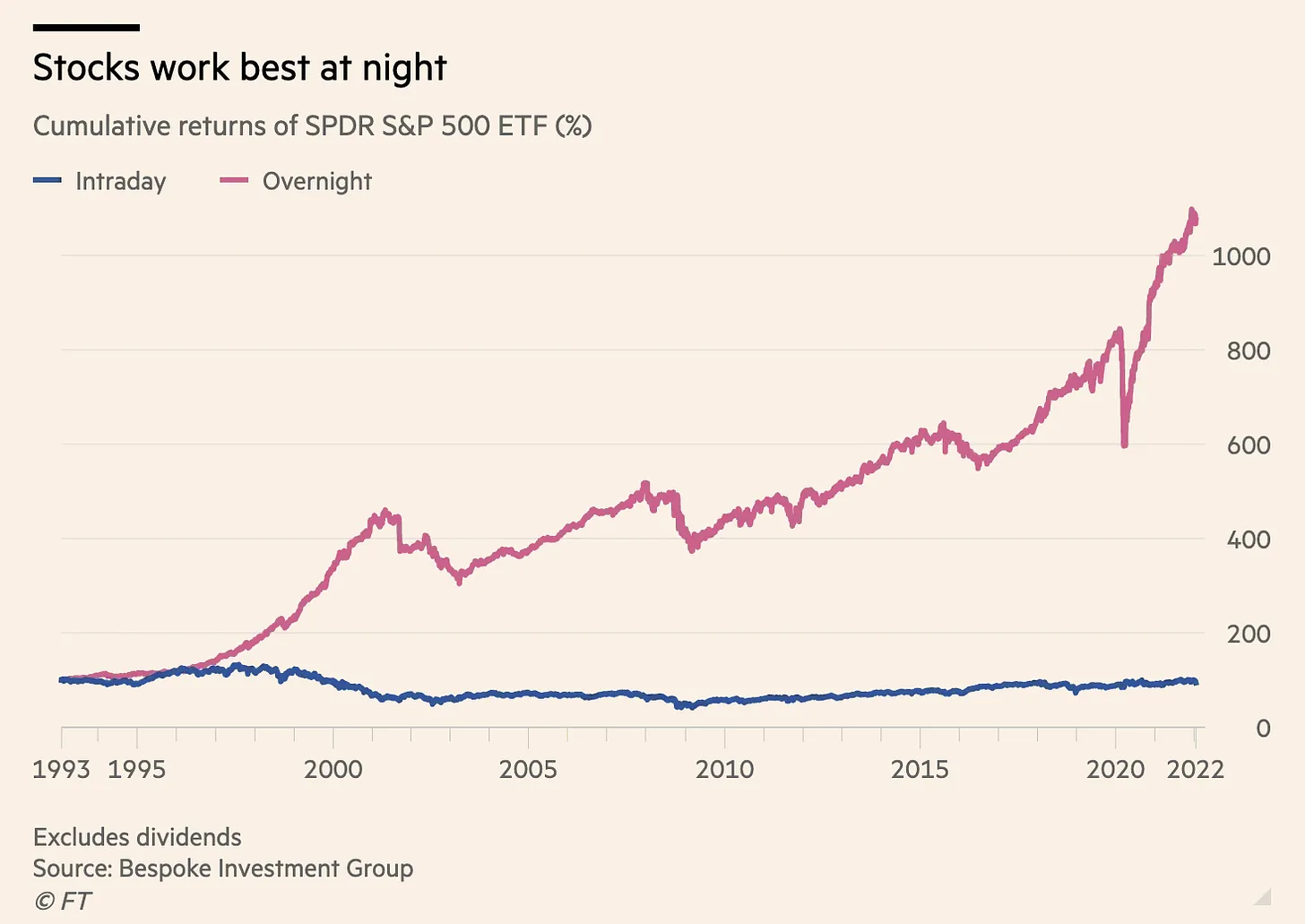

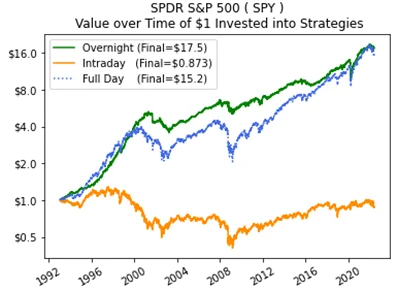

Contrary to the popular belief that constant intraday price movement reflects economic growth, evidence from the last three decades shows that the active trading period is often an environment of flat or negative returns, filled with noise and volatility. As shown in the image below:

🏛️ The Three Pillars of the Theory

The extraordinary performance of "night" over "day" is supported by three structural factors that keep this operational gap alive:

-

Genesis of Return: Since 1993, nearly all S&P 500 gains have been earned outside of market hours. The annualized advantage of the overnight period versus intraday is approximately 7.2%.

-

The "Tug of War": There is a dichotomy between participants: institutions trade during the day to take advantage of liquidity, while retail investors often react to news overnight, executing orders at the open. This imbalance creates a pattern where overnight optimism is absorbed by institutional supply during the day.

-

Information Schedule: Most earnings announcements and macroeconomic data releases occur while the market is closed. The opening price already incorporates this information, leaving little room for additional gains during the continuous session.

📊 Empirical Evidence in the US: Full Session vs. Overnight

To understand the magnitude of this disparity, let's look at the growth of an investment under different holding strategies (2020-2025):

| Asset / Index | Full Session ($) | Intraday Period ($) | Overnight Period ($) |

| S&P 500 ETF (SPY) | 2.07 | 1.25 | 1.66 |

| Nasdaq 100 (QQQ) | +83.8% (cum.) | 30.3% (cum.) | 53.5% (cum.) |

🚀 Evidence in Europe

In the EURO STOXX 50 (SX5E), evidence also favors the overnight period. An analysis of the 2016-2025 period shows that the total annual return was approximately 8%. However, when broken down by trading periods, the disparity is striking:

-

Overnight Return (Close to Open): 12.9% annualized.

-

Intraday Return (Open to Close): -4.3% annualized.

At first glance, the strategy of buying at the close and selling at the open seems ostensibly superior to a passive buy-and-hold strategy. However, sensitivity to transaction costs is the determining factor often omitted in theoretical models. By introducing a nominal cost of just 1 basis point (bps) per trade (adding up to 2 bps for each daily round-trip), the overnight strategy’s return drops drastically from 12.9% to 7.3%. At this net level, the strategy yields less than simply holding the ETF (8% annually), suggesting that for most non-professional investors, potential profits are devoured by commissions and bid-ask spreads.

💧 The Effect of Liquidity on Overnight Drift

There is an inverse correlation between market capitalization and the magnitude of the overnight anomaly. Small-cap stocks typically show much more pronounced night/day disparities than large-caps. This is because liquidity in small-caps is much more fragmented after hours, leading to more violent price jumps when new information is processed.

However, this higher theoretical profitability in small companies is illusory in practice, as the bid-ask spreads at the opening for these stocks can easily exceed 1% or 2%, wiping out any gains accumulated overnight.

🚩 Risks and Red Flags: Why is it not easy to replicate?

Although the model looks like a "money machine," there are insurmountable barriers for the private investor:

-

Cost Erosion: Daily turnover (buying at close, selling at open) involves about 250 trades per year. Commissions eat up profits quickly.

-

The "Two-Month Rule" (Spain): This is the ultimate red flag. The law prevents offsetting losses if the same asset is repurchased within less than two months. In a daily strategy, the investor would be taxed on 100% of the gains without being able to deduct losses, making the operation financially non-viable.

-

Execution Risk: Spreads in the opening auction are usually wider, which can cancel out the theoretical benefit before the order is even executed.

-

Towards a 24/5 Market: The trend of stock exchanges moving toward uninterrupted trading (such as plans by the NYSE) could permanently eliminate opening "gaps" and, with them, this anomaly.

The value of knowing the "night effect" is not to attempt daily trading, but to understand that patience and passive holding (buy and hold) are the best tools to capture the value the market generates while we sleep.