What Moves Stock Prices?

Stock prices do not move randomly; they are influenced by various factors that determine their behavior in the short and medium term. Investors, analysts, and traders constantly monitor these factors to anticipate trends and make informed decisions.

1. News and Macro/Microeconomic Events

News has an immediate impact on stock prices, as it affects investors' perception of a company, sector, or the overall economy. These news events can be of several types:

📌 Macroeconomic news: Large-scale events that affect global markets, such as:

· Central bank decisions on interest rates.

· Inflation and unemployment data.

· GDP growth and consumer confidence.

📌 Corporate news: Relevant information about a specific company, such as:

· Announcements of mergers and acquisitions.

· Changes in executive leadership (CEO, CFO).

· Launch of new products or services.

📌 Political and regulatory news: External factors that can alter a company’s or sector’s operations, such as:

· Government regulations.

· Trade restrictions and tariffs.

· Geopolitical conflicts and economic crises.

Real example: When the U.S. Federal Reserve (FED) announces an interest rate hike, technology stocks tend to decline as financing costs rise, affecting future profitability.

2. Financial Results and Their Influence on Stock Prices

2.1 What Are Financial Results and Why Do They Matter?

Every quarter, public companies release their earnings reports, reflecting their financial performance in terms of:

- Revenue.

- Net profit and profit margins.

- EPS (Earnings Per Share).

- Guidance: Future growth projections.

Investors and analysts compare these results with market expectations. If a company exceeds expectations, its stock price can rise significantly. If it falls short, the stock is likely to drop.

2.2 Expectations vs. Reality

The market moves based on future expectations, not just current results. Strong performance may not be enough if a company issues a pessimistic outlook for the coming quarters.

Real example: In 2022, Meta (Facebook) reported strong revenue, but a weak growth projection. Result: its stock fell more than 20% in a single day.

3. Capital Flows and Their Effect on Supply and Demand

3.1 What Are Capital Flows?

Capital flows refer to the movement of money into and out of stock markets. Several factors influence these flows:

3.2 Institutional vs. Retail Investment

· Institutional investors: Investment funds, banks, and insurers have a significant impact on stock prices by moving large amounts of money.

· Retail investors: Small investors can influence more volatile stocks, but their impact is smaller in large companies.

Real example: When investment funds increase their exposure to a stock, its price may rise simply due to increased demand.

3.3 Stock Buybacks

Companies can repurchase their own shares to reduce the number of outstanding shares, creating scarcity and driving up the price.

Real example: In 2023, Apple announced a $90 billion stock buyback program, boosting its stock price.

4. Profit Margins and Their Impact on Profitability

Profit margins measure how efficiently a company converts revenue into profit. There are three main types:

· Gross margin: (Revenue - Cost of goods sold) / Revenue.

· Operating margin: Operating profit / Revenue.

· Net margin: Net profit / Revenue.

An expanding profit margin indicates improved efficiency and higher profitability, which is generally well received by investors.

Real example: If a company reduces costs without affecting sales, its net margin increases, and its stock may appreciate.

5. Revenue and Business Growth

5.1 Why Is Revenue Key?

Revenue reflects a company’s ability to generate sales. Sustained revenue growth indicates:

· Higher demand for its products or services.

· Expansion into new markets.

· Increased market share.

However, if revenue grows but the company spends more than it earns, profitability will suffer.

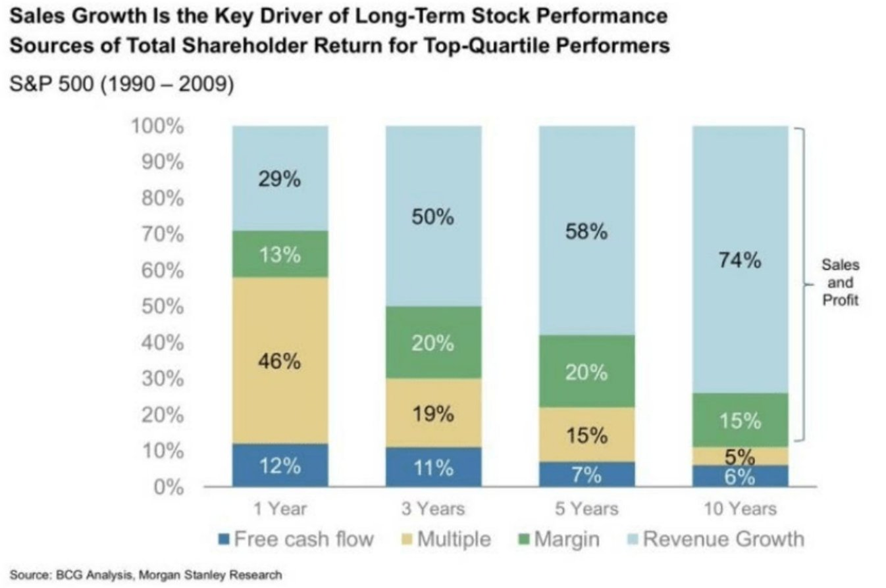

5.2 Importance of Revenue Growth

Investors prefer companies that increase their revenue year over year. Tech and high-growth companies are evaluated based on future revenue rather than current profits.

Real example: In 2021, Tesla reported 50% annual revenue growth, helping its stock surge.

6. Conclusion

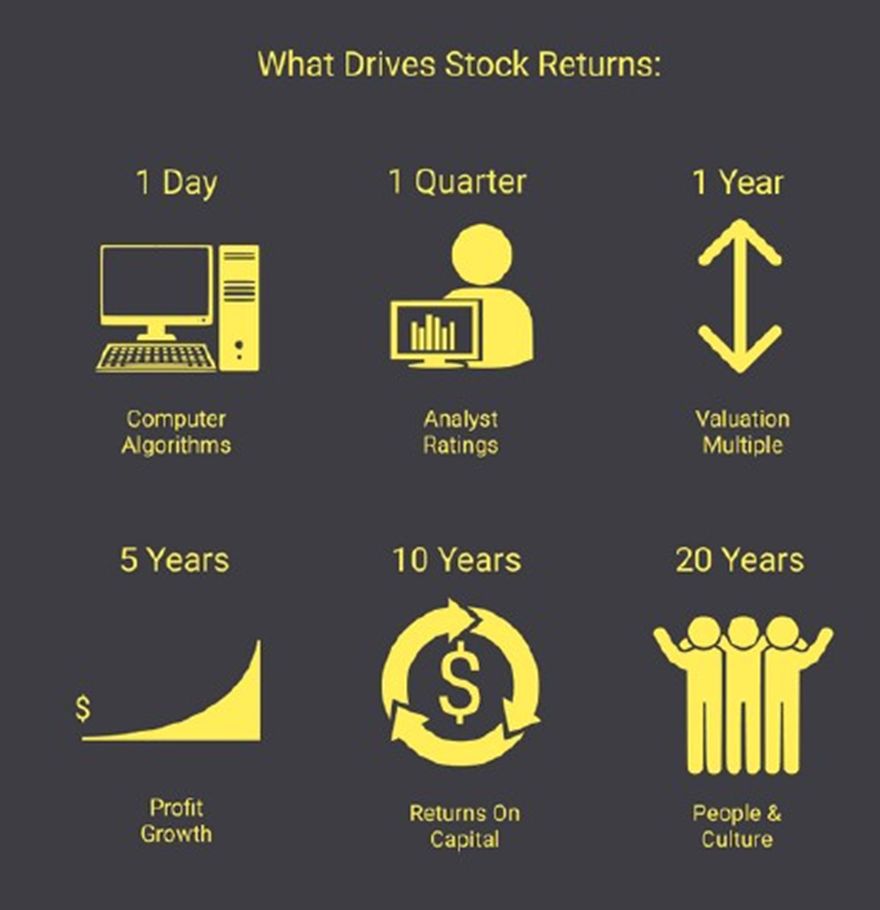

Stock prices do not move randomly. They are influenced by economic, corporate, and psychological factors that affect market supply and demand.

📌 In the short term, news and capital flows can create volatility.

📌 In the medium term, financial results, margins, and revenue determine a stock’s true performance.

Source: @BrianFeroldi (X), https://brianferoldi.kit.com/99