Trading

Trading is a financial activity that involves buying and selling assets in the markets with the goal of making a profit. While it may seem complex, it can be understood and practiced with basic knowledge and a clear strategy. Below, we’ll explore the main indicators, and key concepts that every beginner should know.

1. Types of Trading Strategies

1.1 Escalping

This is a short-term strategy where the trader performs numerous trades per day, aiming for small profits per trade. This approach requires deep market knowledge and advanced tools.

1.2 Day trading

This strategy involves opening and closing trades within the same day. Day traders aim to take advantage of small price fluctuations within a single trading day. It requires high concentration and quick decision-making.

1.3 Swing Trading

This strategy involves holding positions for several days or weeks, taking advantage of short- to medium-term trends. It’s a suitable option for those who cannot constantly monitor the market.

1.4 Position Trading

This involves holding investments for months or years, focusing on long-term trends. It is less stressful than other styles but requires patience.

1.5 Timeframes

Traders choose timeframes (minutes, hours, days, weeks) based on their strategy. For example, scalpers prefer 1- to 5-minute periods, while swing traders opt for daily or weekly charts.

2. Key Indicators in Trading

Indicators help traders analyze the market and make informed decisions. Here are some of the most popular ones:

2.1 Japanese Candlesticks

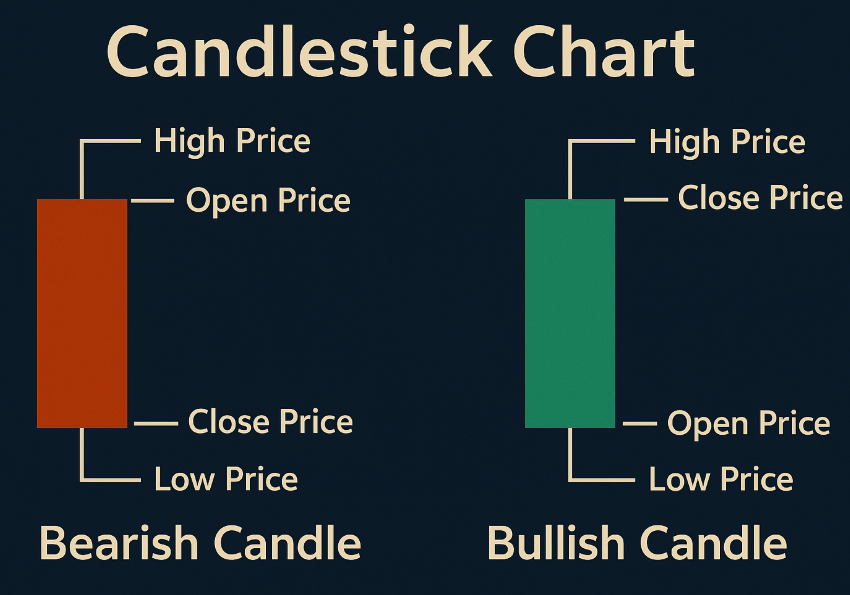

Japanese candlesticks are a method of representing the price of an asset over a specific period. Each candlestick displays:

-

Open: The price at the beginning of the period.

-

Close: The price at the end of the period.

-

High: The highest price reached during the period.

-

Low: The lowest price reached during the period.

2.1.1 Types of Candlesticks

Doji:

- Very small or non-existent body.

- Indicates indecision in the market.

- Variants include: Standard Doji, Dragonfly Doji, Long-Legged Doji.

Hammer:

- Small body at the top with a long lower wick.

- Sign of a potential bullish reversal.

Hanging Man:

- Similar to the hammer, but appears at the end of an uptrend.

- Sign of a bearish reversal.

Inverted Hammer:

- Small body at the bottom with a long upper wick.

- Sign of a bullish reversal.

Shooting Star:

- Similar to the inverted hammer but in an uptrend.

- Sign of a bearish reversal.

Engulfing Candles:

- A large candle that completely engulfs the previous one.

- Bullish Engulfing: Indicates a potential upward movement.

- Bearish Engulfing: Indicates a potential downward movement.

Harami:

- Small candle within the range of a larger preceding candle.

- Bullish Harami or Bearish Harami, depending on the trend.

Spinning Top:

- Small body with long wicks.

- Indicates indecision or a possible trend change.

Marubozu:

- No wicks, with a large body.

- Bullish Marubozu: Strong buying pressure.

- Bearish Marubozu: Strong selling pressure.

Three Black Crows / Three White Soldiers:

- Three Black Crows: Three consecutive bearish candles, signaling a strong downtrend.

- Three White Soldiers: Three consecutive bullish candles, signaling a strong uptrend.

ü Time Frames

Traders choose time frames (minutes, hours, days, weeks) according to their strategy. For instance, scalpers prefer 1 to 5-minute periods, while swing traders opt for daily or weekly charts.

ü Moving Averages

Moving averages are lines that smooth price movements and show trends:

· Simple Moving Average (SMA): Average of closing prices over a period.

· Exponential Moving Average (EMA): Gives more weight to recent data.

· Moving Average Crossover: When a faster-moving average crosses a slower one, it may indicate a trend change.

ü Volume

Volume shows the number of transactions made in a period. High volume often confirms significant price movements.

ü Elliot Wave Oscillator

Based on the Elliott Wave Theory, this indicator helps identify market patterns and potential entry or exit points.

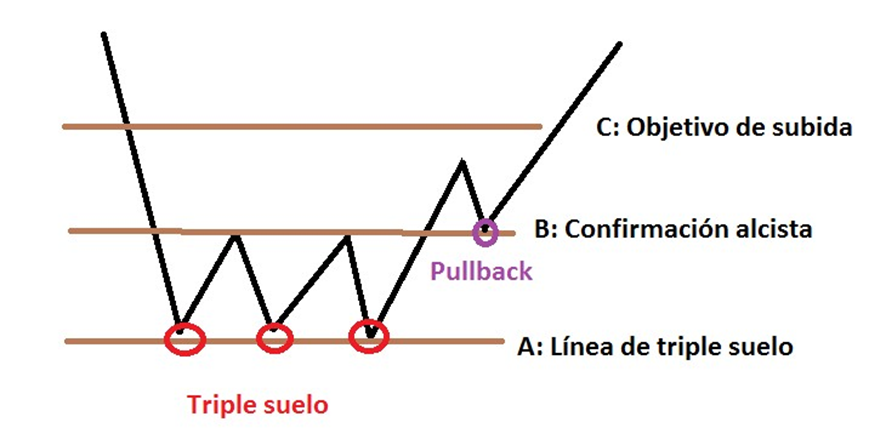

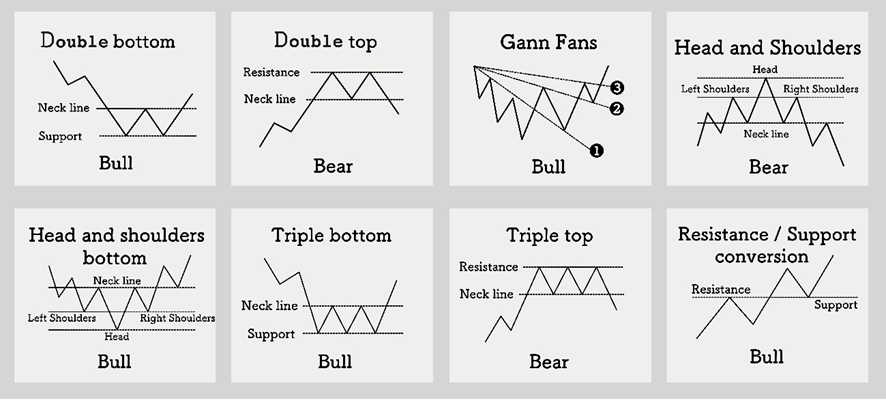

ü Support and Double Bottoms

Support is a level where the price finds stability and stops falling. A double bottom indicates a potential bullish reversal.

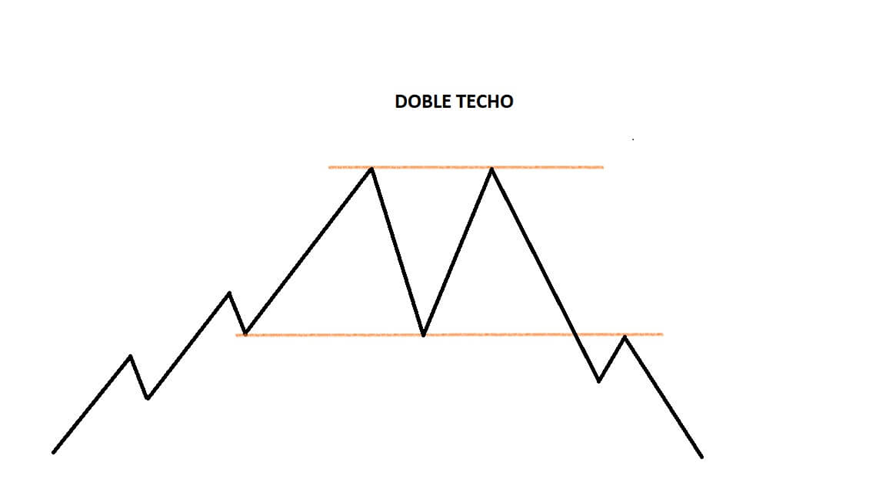

Resistance and Double Tops

A resistance is a level where the price struggles to rise further. A double top may signal a bearish reversal.

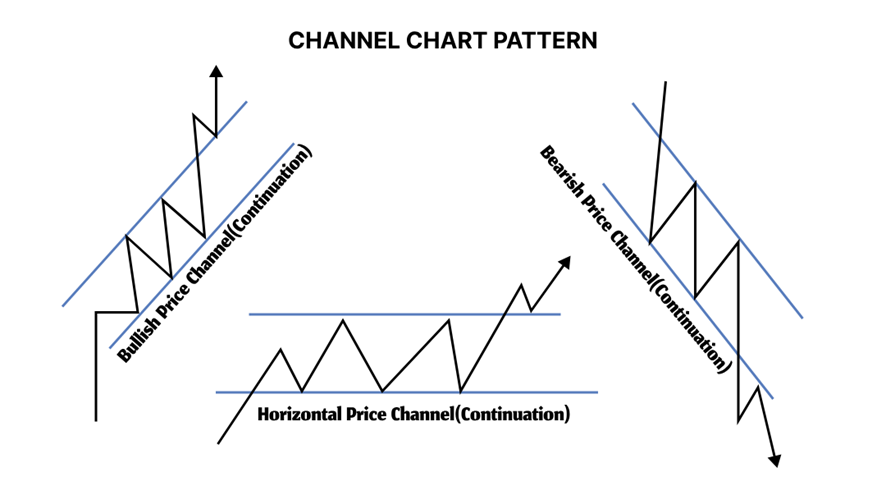

ü Channels

A channel is a range where the price moves parallelly between support and resistance lines.

Resistance and Support Levels

- Resistance: A level where the price struggles to rise further.

- Support: A level where the price struggles to fall further.

- Breakouts: When the price breaks through a support or resistance level, it may indicate a strong move in that direction.

Common Expressions

- Falling Knife: Price dropping rapidly.

- Free Rise: Price with no nearby resistance levels.

- ATH (All-Time High): Highest price ever reached.

- 52-Week Low: Lowest price in the past year.

Success and Failure Stories

Success

A trader who studied patterns, managed risk well, and applied disciplined strategies, like Jesse Livermore in his early years, achieved consistent returns by anticipating market trends and avoiding impulsive decisions.

Failure

Many novice traders lose money by trading without a plan, over-leveraging, or being driven by emotions. For example, a beginner might invest all their capital in a rapidly rising stock without analyzing the fundamentals, only to find the price drops drastically due to a market correction, resulting in significant losses.

Is Trading a Reliable Method?

Trading can be profitable, but it is not foolproof. Indicators help analyze the past but do not guarantee future movements. Discipline, risk management, and continuous education are essential to improving the chances of success.

This section only includes what I find most relevant and reliable. There are other terms like Fibonacci Levels, Bollinger Bands, or patterns like the head-and-shoulders that I don’t rely on as much. If you need more information, there is plenty of material available online.

The shorter the time frame, the less predictable trends become. I would recommend using at least daily scale charts, no less, which is why I rule out all trading styles below Swing Trading.