Financial Options

Financial options are a versatile tool for investing and managing risks. While they may seem complex at first, understanding their fundamentals can open up a world of possibilities. This article will explain the basics of financial options, their types, and common strategies.

What Are Financial Options?

Options are financial contracts that give the holder the right (but not the obligation) to buy or sell an asset at a predetermined price within a specific period. The two main types of options are call options and put options.

Call and Put Options

- Call Options: Grant the right to buy an asset at a specific price (strike price) before the contract expires.

- Put Options: Grant the right to sell an asset at a specific price before the contract expires.

Contract Sizes

Options are traded in standard contract sizes. For example, in the stock market, an options contract typically represents 100 shares of the underlying asset.

Types of Contracts: European and American

- European Options: Can only be exercised on the expiration date.

- American Options: Can be exercised at any time before the expiration date.

The flexibility of American options makes them more popular in certain markets, although European options are common for index options.

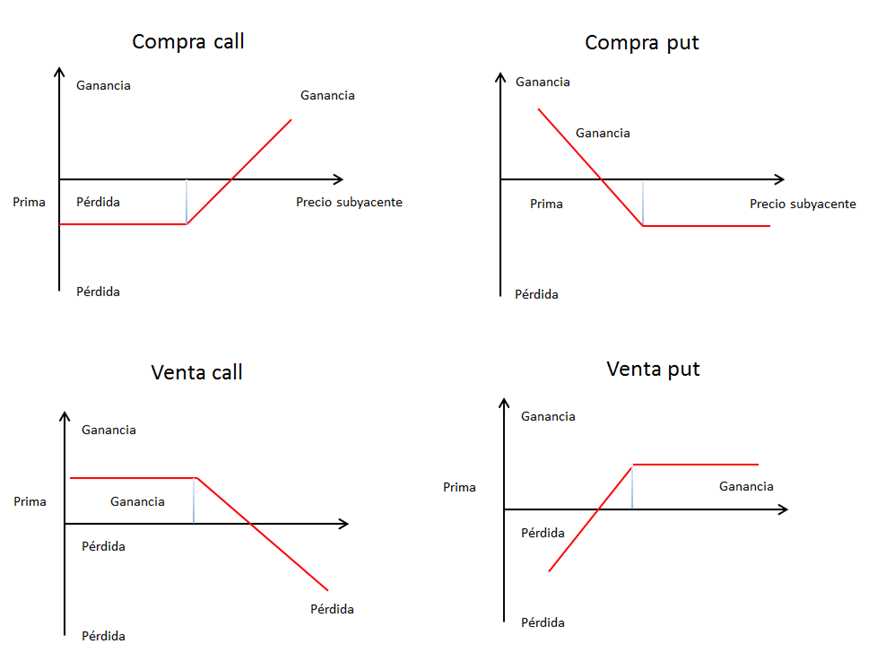

Buying and Selling Options

- Buying Calls: You expect the price of the underlying asset to rise. If the price exceeds the strike price, you can buy the asset at a lower price.

- Buying Puts: You expect the price of the underlying asset to fall. If the price drops below the strike price, you can sell the asset at a higher price.

- Selling Covered Calls: You own the underlying asset and sell call options on it, earning the premium while limiting upside potential.

- Selling Naked Calls: You sell call options without owning the underlying asset. This strategy is risky, as losses can be unlimited if the price rises sharply.

- Selling Puts: You sell put options, betting the price will not fall below the strike price. If it does, you may need to purchase the asset at the strike price.

The options chain

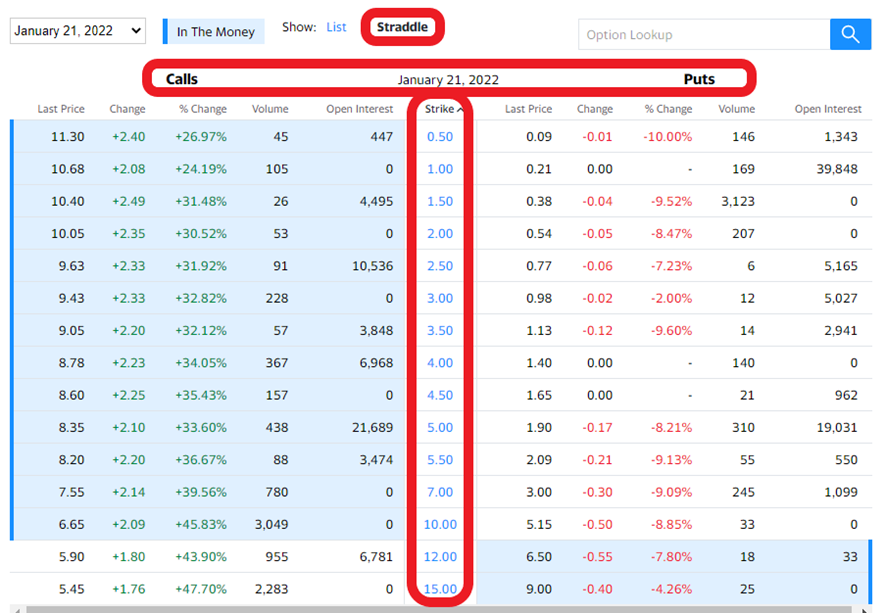

The options chain is a visual tool that organizes and displays all relevant information about the available options for an underlying asset at a given time. It is a table or list that details the strike prices and data for both call and put options associated with each price.

What Information Does the Options Chain Include?

Each row in the options chain corresponds to a strike price, while the columns contain key data about call and put options. Here’s what you’ll typically find:

- Strike Price: The price at which the buyer of the option has the right to buy (call) or sell (put) the underlying asset.

- Premium (Option Price): The current cost of buying the call or put option. This varies based on factors like volatility and time until expiration.

- Volume: The number of contracts traded during the current session.

- Open Interest: The total number of open contracts that have not yet been closed or settled.

- Expiration Date: The date when the option expires.

- Implied Volatility: An estimate of the underlying asset's future volatility based on the option’s price.

- Delta, Gamma, Theta, Vega, and Rho (Greeks): Indicators that show how the option’s price is expected to change in response to various factors, such as changes in the underlying asset’s price, time decay, or interest rates.

How Is the Options Chain Used?

The options chain is essential for investors and traders because it allows them to:

- Evaluate Strategies: Compare option prices to decide whether to buy or sell calls or puts and at which strike price.

- Identify Market Trends: Analyze volume and open interest to see which options are being actively traded.

- Calculate Profitability: Determine the cost and potential profit or loss of an options trade.

- Adjust Trades: Plan complex strategies, such as spreads or combinations of calls and puts, with different strike prices or expiration dates.

Simplified Example of an Options Chain

Suppose you’re looking at the options chain for a stock trading at $100. You might see something like this:

|

Strike Price |

Call Price |

Put Price |

Open Interest (Call) |

Open Interest (Put) |

|

$95 |

$6 |

$1 |

1,000 |

500 |

|

$100 |

$3 |

$3 |

2,500 |

1,800 |

|

$105 |

$1 |

$6 |

1,200 |

700 |

This example shows the premiums for buying call and put options at three different strike prices, along with the open interest.

Real example of an Options chain

The Greeks: Measuring Risks in Options

The "Greeks" are mathematical tools used to measure the risks associated with options. Each Greek represents a specific factor that affects an option’s price:

- Delta: Measures how much the price of the option will change for a $1 change in the price of the underlying asset. For example, if an option has a Delta of 0.5 and the underlying asset increases by $1, the option’s price will increase by $0.50.

- Gamma: Measures the rate of change of Delta for a $1 change in the price of the underlying asset. For example, if the Gamma is 0.1, a $1 increase in the asset’s price will raise the Delta from 0.5 to 0.6.

- Theta: Measures the rate at which the option loses value as expiration approaches (time decay). For example, if Theta is -0.02, the option loses $0.02 per day due to time passing, assuming other factors remain constant.

- Vega: Measures sensitivity to changes in market volatility. For example, if Vega is 0.1, a 1% increase in market volatility will increase the option’s price by $0.10.

- Rho: Measures sensitivity to changes in interest rates. For example, if Rho is 0.05, a 1% increase in interest rates will increase the option’s price by $0.05. The underlying asset, which can be a stock, index, or commodity, directly influences how this metric behaves under various market conditions.

Common Strategies with Options

Options offer a wide range of strategies, from simple to complex:

- Protective Put: Buying a put option to protect against a potential decline in the price of an asset you own.

- Covered Call: Selling a call option while owning the underlying asset to generate additional income.

- Straddle: Buying both a call and a put option with the same strike price and expiration to profit from significant price movements in either direction.

- Iron Condor: Combining multiple call and put options to profit in low-volatility markets.

- Butterfly Spread: Using multiple strike prices to limit risk and maximize potential profits within a specific price range.

Glossary of Terms

- Strike Price: The predetermined price at which the option can be exercised.

- Expiration Date: The date when the option contract expires.

- Underlying Asset: The asset that underpins the option, such as a stock, index, or commodity, which directly affects its performance under various market conditions.