Financial Options

Financial options are a versatile tool for investing and managing risk. While they may seem complex at first, understanding their fundamentals can open up a world of possibilities. This article will explain the basics of financial options, their types, and common strategies.

🔹 1. What Are Financial Options?

Options are financial contracts that grant the holder the right (but not the obligation) to buy or sell an asset at a predetermined price within a specific period. The two main types of options are call options and put options.

Call and Put Options

- Call Options: Grant the right to buy an asset at a specific price (strike price) before the contract expires.

- Put Options: Grant the right to sell an asset at a specific price before the contract expires.

Contract Sizes

Options are traded in standard contract sizes. For example, in the stock market, one option contract typically represents 100 shares of the underlying asset.

Types of Contracts: European and American

- European Options: Can only be exercised on the expiration date.

- American Options: Can be exercised at any time before the expiration date.

The flexibility of American options makes them more popular in certain markets, while European options are commonly used for index options.

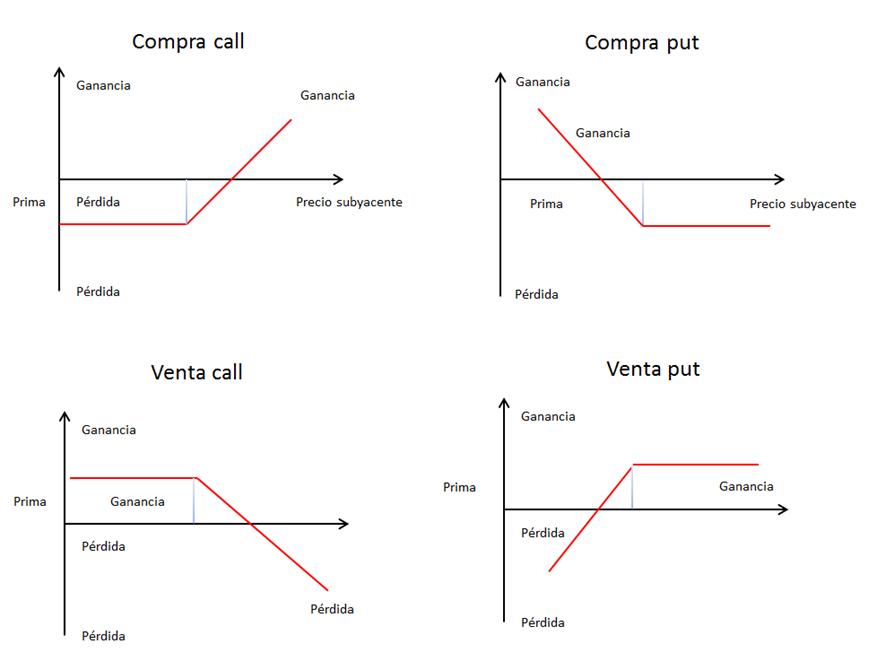

🔹 2. Buying and Selling Options

- Buying Calls: You expect the price of the underlying asset to rise. If the price exceeds the strike price, you can buy the asset at a lower price.

- Buying Puts: You expect the price of the underlying asset to drop. If the price falls below the strike price, you can sell the asset at a higher price.

- Covered Call Selling: You own the underlying asset and sell call options on it, earning the premium while limiting profit potential.

- Uncovered (Naked) Call Selling: You sell call options without owning the underlying asset. This strategy is risky, as losses can be unlimited if the price rises sharply.

- Put Selling: You sell put options, betting that the price will not fall below the strike price. If it does, you may have to buy the asset at the strike price.

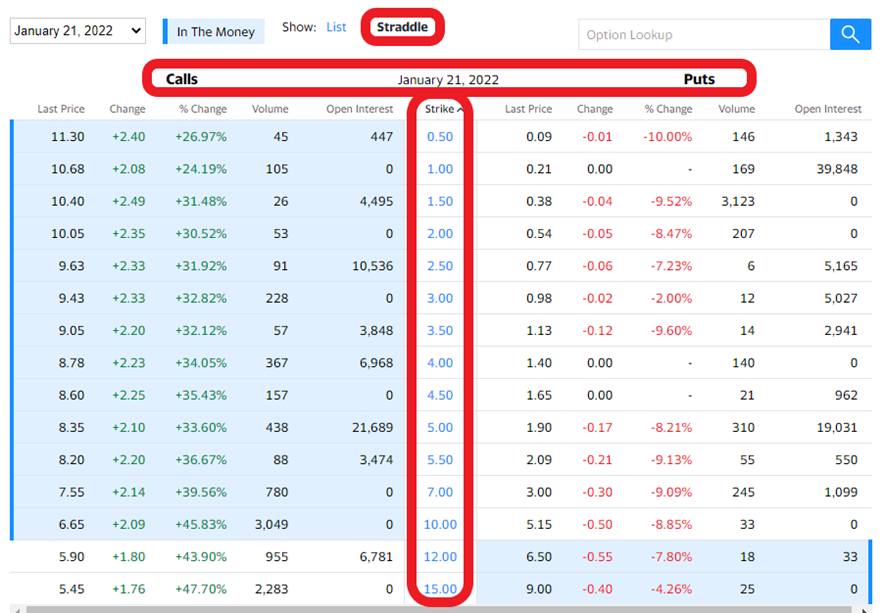

🔹 3. Financial Options Chain

The options chain is a visual tool that systematically displays all relevant information about available options for an underlying asset at a given time. It is a table or list detailing the strike prices and data for call and put options associated with each price.

What Information Does the Options Chain Contain?

Each row in the chain corresponds to a strike price, while the columns include key data about call and put options. Here’s what you typically find:

- Strike Price: The price at which the option buyer has the right to buy (call) or sell (put) the underlying asset.

- Premium (Option Price): The current cost of buying the call or put option. It varies based on factors such as volatility and time to expiration.

- Volume: The number of contracts traded during the current session.

- Open Interest: The total number of open contracts that have not yet been closed or settled.

- Expiration Date: The date the option expires.

- Implied Volatility: An estimate of the future volatility of the underlying asset based on the option price.

- Delta, Gamma, Theta, Vega, and Rho (The Greeks): Indicators that show how the option price is expected to change in response to various factors, such as changes in the underlying asset's price, time decay, or interest rates.

Simplified Example of an Options Chain

Suppose you are viewing the options chain for a stock trading at $100. You might see something like this:

| Strike Price | Call Price | Put Price | Open Interest (Call) | Open Interest (Put) |

|---|---|---|---|---|

| $95 | $6 | $1 | 1,000 | 500 |

| $100 | $3 | $3 | 2,500 | 1,800 |

| $105 | $1 | $6 | 1,200 | 700 |

This example shows the purchase prices (premiums) for call and put options at different strike prices, along with open interest.

🔹 4. What Is the Premium?

🔹 5. The Greeks: Measuring OptionRisks Risksin Options

The "Greeks" are mathematical tools used to measure the risks associated with options. Each Greek represents a specific factor affectingthat affects an option’option's price:

- Delta: Measures how much the

optionoption's price will change for a $1 change in the underlyingasset.asset's price. For example, if an option has a Delta of 0.5 and the underlying asset increases by $1, the option's price will rise by $0.50. - Gamma: Measures the rate of change of Delta for a $1 change in the underlying

asset.asset's price. For example, if Gamma is 0.1, a $1 increase in the asset's price will cause Delta to rise from 0.5 to 0.6. - Theta: Measures the rate at which

anthe option loses valueoverastimeexpiration approaches (time decay). For example, if Theta is -0.02, the option loses $0.02 per day due to time decay, assuming other factors remain constant. - Vega: Measures sensitivity to changes in market volatility. For example, if Vega is 0.1, a 1% increase in market volatility will increase the option's price by $0.10.

- Rho: Measures sensitivity to changes in interest rates. For example, if Rho is 0.05, a 1% increase in interest rates will raise the option's price by $0.05.

🔹 6. Common Options Strategies

Options offerprovide a wide range of strategies, from simple to complex:

- Protective Put: Buying a put option to protect against a potential

dropdecline in the price of an asset you own. - Covered Call: Selling a call option while holding the underlying asset to generate additional income.

- Straddle: Buying both a call and a put option with the same strike price and expiration to

takeprofitadvantage offrom significant price movements in either direction. - Iron Condor: Combining multiple call and put options to

profitgenerate profits in low-volatility markets. - Butterfly Spread: Using multiple strike prices to limit risk and maximize potential gains within a specific price range.

🔹 7. What Are LEAPS Options?

LEAPS (Long-Termterm Equity Anticipation Securities) options are call or put options with extended expirations, typically ranging from one to three years. These options allow investors to speculate on an asset’asset's future price or hedge against adverse portfolio movements with greater time flexibility.

Example:

An investor who believes AppleApple's (AAPL) stock price will rise significantly over the next two years could buy a LEAPS call option instead of purchasing the stock directly, gaining exposure to price movementsmovement with a lower initial investment.

📊 Differences Between Traditional Options and LEAPS Options

| Feature | Traditional Options | LEAPS Options |

|---|---|---|

| Duration | Less than 1 year | More than 1 year (up to 3 years) |

| Premium Cost | Lower | Higher |

| Volatility | Higher in the short term | Less affected by daily fluctuations |

| Primary Purpose | Short-term speculation | Long-term strategy/hedging |

🔹 7.1. Key Features of LEAPS Options

LongLonger Duration: Unlikestandardconventional options that expire in a few months, LEAPS options have longer expirationperiods.dates, - providing more time for the investment thesis to materialize.

📌 Lower Time

Decay:Decay Loss: Time decay (Theta decay), which erodes an option’s value as expiration nears, is slower for LEAPSexperiencecomparedless time decay thanto short-term options. 📌

MoreGreaterStableSensitivity to MarketSensitivity:Movements:LEAPSAs long-term options, their sensitivity to the underlying asset’s price (Delta) is higher, meaning they more accurately reflectpricevaluemovements more steadily over time.

📌

🔹 7.2. How Do LEAPS Options Work?

LEAPS operateoptions function similarly to standardtraditional options:

- Call LEAPS

CallOption: Grants the buyer the right (but not the obligation) tobuypurchase the underlying asset at a specific price beforeexpiration.the expiration date. - Put LEAPS

PutOption: Grants the buyer the right (but not the obligation) to sell the underlying asset at a specific price beforeexpiration.the expiration date.

📍 Practical Example: Buying a LEAPS Call Option

Suppose Tesla (TSLA) stock is currently trading at $200, and an investor believes it will exceed $300 in the next two years.

- The investor buys a LEAPS call option with a 2-year expiration and a $250 strike price.

- The option premium is $30 per share.

- If Tesla’s stock price rises to $350 before expiration, the option becomes highly valuable.

- The potential profit is $70 ($350 - $250 - $30 premium).

🔹 7.3. ProsAdvantages and ConsDisadvantages of LEAPS Options

✅ Advantages

✔ SlowerLower Time Decay → They depreciate more slowly.

✔ Ideal for Long-Term Investing → Useful for growth strategies.

✔ Less Immediate Volatility → Less sensitive to daily market fluctuations.

✔ Lower Risk of Total Loss → Compared to short-term options.

❌ Disadvantages

🔹 7.4. Investment Strategies with LEAPS Options

📌 Stock7.4.1. SubstitutionReplacing Stocks with LEAPS Calls

Instead of buying shares,shares of a company, investors can purchasebuy LEAPS call options forto gain exposure to the asset with a lower investment.

Example:

Instead of investing $10,000 in 50 Microsoft shares at $200 each, an investor could buy LEAPS call options with a $220 strike price for a total cost of $2,000.

If the stock price rises to $300 in two years, the return from LEAPS options could be significantly higher than directly purchasing the shares.

📌 7.4.2. Hedging with LEAPS Puts

Investors can buy LEAPS put options to protect their portfolios from long-terma prolonged market downturns.decline.

Example:

If an investor holds a portfolio of tech stocks, they can buy LEAPS put options on the QQQ ETF (which tracks the Nasdaq 100) to offset losses in case of a market correction.

📌 7.4.3. Selling LEAPS forOptions to Generate Income

Investors can sell LEAPS options with out-of-the-money LEAPSstrike optionsprices to collectgenerate additional income through premiums.

UnderstandingExample:

If financialan optionsinvestor is willing to buy Apple (AAPL) stock at $180, they can providesell investorsa LEAPS put option with powerfula tools$180 forstrike speculation, income generation,price and riskreceive management.a premium.

📖 Glossary of Terms

- Strike Price: The predetermined price at which the option can be exercised.

- Expiration Date: The date when the option contract expires.

- Underlying Asset: The asset (stock, index, or commodity) that influences how this metric behaves under different market conditions.