Financial Options

Financial options are a versatile tool for investing and managing risk. While they may seem complex at first, understanding their fundamentals can open up a world of possibilities. This article will explain the basics of financial options, their types, and common strategies.

🔹 1. What Are Financial Options?

Options are financial contracts that grant the holder the right (but not the obligation) to buy or sell an asset at a predetermined price within a specific period. The two main types of options are call options and put options.

Call and Put Options

- Call Options: Grant the right to buy an asset at a specific price (strike price) before the contract expires.

- Put Options: Grant the right to sell an asset at a specific price before the contract expires.

Contract Sizes

Options are traded in standard contract sizes. For example, in the stock market, one option contract typically represents 100 shares of the underlying asset.

Types of Contracts: European and American

- European Options: Can only be exercised on the expiration date.

- American Options: Can be exercised at any time before the expiration date.

The flexibility of American options makes them more popular in certain markets, while European options are commonly used for index options.

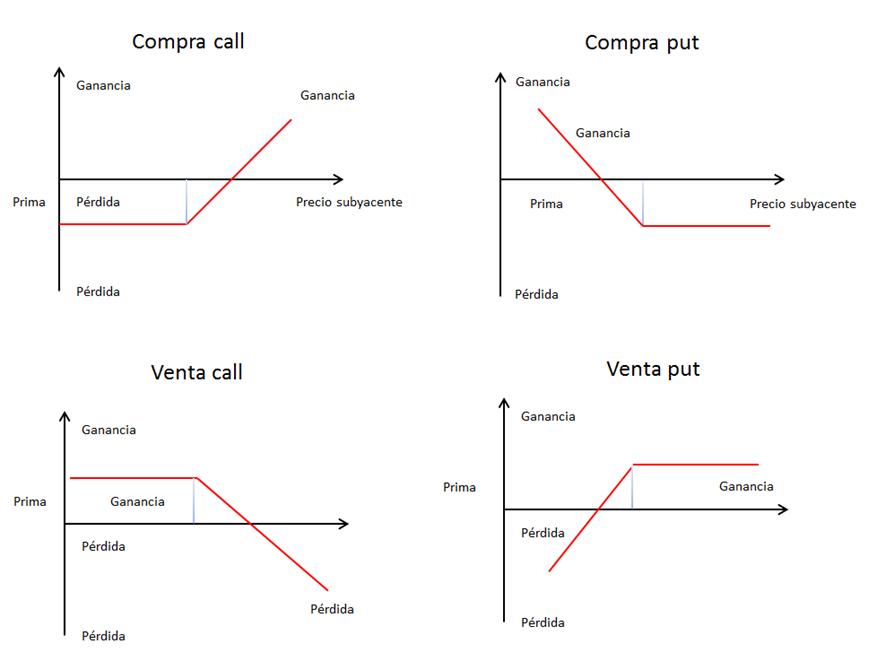

🔹 2. Buying and Selling Options

- Buying Calls: You expect the price of the underlying asset to rise. If the price exceeds the strike price, you can buy the asset at a lower price.

- Buying Puts: You expect the price of the underlying asset to drop. If the price falls below the strike price, you can sell the asset at a higher price.

- Covered Call Selling: You own the underlying asset and sell call options on it, earning the premium while limiting profit potential.

- Uncovered (Naked) Call Selling: You sell call options without owning the underlying asset. This strategy is risky, as losses can be unlimited if the price rises sharply.

- Put Selling: You sell put options, betting that the price will not fall below the strike price. If it does, you may have to buy the asset at the strike price.

🔹 3. Financial Options Chain

The options chain is a visual tool that systematically displays all relevant information about available options for an underlying asset at a given time. It is a table or list detailing the strike prices and data for call and put options associated with each price.

What Information Does the Options Chain Contain?

Each row in the chain corresponds to a strike price, while the columns include key data about call and put options. Here’s what you typically find:

- Strike Price: The price at which the option buyer has the right to buy (call) or sell (put) the underlying asset.

- Premium (Option Price): The current cost of buying the call or put option. It varies based on factors such as volatility and time to expiration.

- Volume: The number of contracts traded during the current session.

- Open Interest: The total number of open contracts that have not yet been closed or settled.

- Expiration Date: The date the option expires.

- Implied Volatility: An estimate of the future volatility of the underlying asset based on the option price.

- Delta, Gamma, Theta, Vega, and Rho (The Greeks): Indicators that show how the option price is expected to change in response to various factors, such as changes in the underlying asset's price, time decay, or interest rates.

Simplified Example of an Options Chain

Suppose you are viewing the options chain for a stock trading at $100. You might see something like this:

| Strike Price | Call Price | Put Price | Open Interest (Call) | Open Interest (Put) |

|---|---|---|---|---|

| $95 | $6 | $1 | 1,000 | 500 |

| $100 | $3 | $3 | 2,500 | 1,800 |

| $105 | $1 | $6 | 1,200 | 700 |

This example shows the purchase prices (premiums) for call and put options at different strike prices, along with open interest.

🔹 4. What Is the Premium?

🔹 5. The Greeks: Measuring Option Risks

The "Greeks" are mathematical tools used to measure the risks associated with options. Each Greek represents a specific factor affecting an option’s price:

- Delta: Measures how much the option price will change for a $1 change in the underlying asset.

- Gamma: Measures the rate of change of Delta for a $1 change in the underlying asset.

- Theta: Measures the rate at which an option loses value over time (time decay).

- Vega: Measures sensitivity to changes in market volatility.

- Rho: Measures sensitivity to changes in interest rates.

🔹 6. Common Options Strategies

Options offer a wide range of strategies, from simple to complex:

- Protective Put: Buying a put option to protect against a potential drop in the price of an asset you own.

- Covered Call: Selling a call option while holding the underlying asset to generate additional income.

- Straddle: Buying both a call and a put option with the same strike price and expiration to take advantage of significant price movements in either direction.

- Iron Condor: Combining multiple call and put options to profit in low-volatility markets.

- Butterfly Spread: Using multiple strike prices to limit risk and maximize potential gains within a specific price range.

🔹 7. What Are LEAPS Options?

LEAPS (Long-Term Equity Anticipation Securities) are call or put options with extended expirations, typically ranging from one to three years. These options allow investors to speculate on an asset’s future price or hedge against adverse portfolio movements with greater time flexibility.

Example:

An investor who believes Apple (AAPL) stock will rise significantly over the next two years could buy a LEAPS call option instead of purchasing the stock directly, gaining exposure to price movements with a lower initial investment.

🔹 7.1. Key Features of LEAPS Options

- Long Duration: Unlike standard options that expire in a few months, LEAPS have longer expiration periods.

- Lower Time Decay: LEAPS experience less time decay than short-term options.

- Higher Premium Costs: Due to the extended expiration, LEAPS tend to have a higher premium.

- More Stable Market Sensitivity: LEAPS reflect price movements more steadily over time.

🔹 7.2. How Do LEAPS Options Work?

LEAPS operate similarly to standard options:

- LEAPS Call Option: Grants the buyer the right to buy the underlying asset at a specific price before expiration.

- LEAPS Put Option: Grants the buyer the right to sell the underlying asset at a specific price before expiration.

🔹 7.3. Pros and Cons of LEAPS Options

✅ Advantages

✔ Slower Time Decay

✔ Ideal for Long-Term Investing

✔ Less Immediate Volatility

✔ Lower Risk of Total Loss

❌ Disadvantages

✖ Higher Premium Cost

✖ Long-Term Commitment

✖ Less Liquidity

🔹 7.4. Investment Strategies with LEAPS

📌 Stock Substitution with LEAPS Calls

Instead of buying shares, investors can purchase LEAPS call options for exposure with a lower investment.

📌 Hedging with LEAPS Puts

Investors can buy LEAPS put options to protect their portfolios from long-term market downturns.

📌 Selling LEAPS for Income

Investors can sell out-of-the-money LEAPS options to collect premiums.

Understanding financial options can provide investors with powerful tools for speculation, income generation, and risk management.