Equity Investments – Stock Market Shares

"The most profitable, but also the most volatile"

What are shares, and what are they used for?

- For companies: To obtain financing to grow, develop new projects, or pay off debts.

- For investors: To provide an opportunity to generate profits, either through the increase in share value or dividend payouts.

Why do companies go public?

Advantages:

- Access to capital: Selling shares allows companies to raise funds without taking on debt. When stock prices rise significantly, companies can seize the opportunity to issue new shares. This enables them to secure additional capital without resorting to debt, capitalizing on investor interest in acquiring shares at high prices.

- Visibility: A publicly traded company can gain greater recognition and market trust. Listed companies are often audited by specialized firms that verify the accuracy of their financial statements. The world’s leading audit firms, known as the "Big Four," include Deloitte, PwC, Ernst & Young (EY), and KPMG. These firms ensure that financial statements comply with international accounting standards, such as the International Financial Reporting Standards (IFRS).

- Liquidity: Shareholders can buy and sell shares easily, making them attractive to investors. This level of ease depends on a key concept known as "float," or shares available for public trading. The float refers to the number of a company’s shares that are publicly traded in the markets. The higher the float, the greater the liquidity of the shares, allowing investors to enter and exit positions without significantly impacting the price. However, a low float can lead to greater price volatility, as large purchases or sales can have a disproportionate effect on the market.

Disadvantages:

- Regulations: Companies must comply with strict legal requirements and report financial information periodically. These regulations vary by country and are supervised by government or independent agencies. For example, in the United States, the Securities and Exchange Commission (SEC) regulates stock markets and requires companies to publish quarterly and annual reports. In Europe, each country has its own regulatory body, such as the Comisión Nacional del Mercado de Valores (CNMV) in Spain. These regulations aim to ensure transparency, protect investors, and maintain financial stability.

- Volatility: Share prices can fluctuate significantly, affecting a company’s financial stability. When stock prices drop, some companies choose to buy back their own shares. This strategy, known as stock buybacks, can serve multiple purposes, such as increasing the value per share by reducing the total number of shares in circulation or demonstrating confidence in the company's financial health.

- Loss of control: By selling shares, a company shares decision-making power with shareholders. This is because common shareholders typically have voting rights in key company decisions, such as electing the board of directors or approving major corporate changes. However, some companies issue non-voting shares, known as "preferred shares" or special classes, to raise capital without diluting the control of majority shareholders. These shares often offer other benefits, such as priority dividend payments, in exchange for the lack of voting rights.

Stock Investment Styles

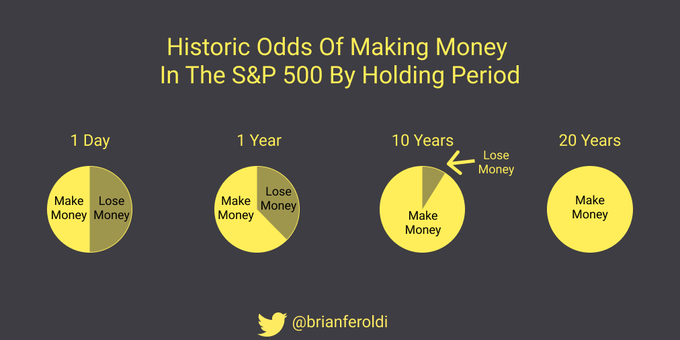

1. Buy & Hold

This strategy involves purchasing stocks and holding them for a long period of time. The idea is to benefit from companies' long-term growth while ignoring short-term fluctuations. This approach is often used by investors who believe in the long-term potential of companies and prefer to avoid the stress of constant buying and selling decisions.

A notable success story is Warren Buffett, who has built his fortune by following this philosophy. Buffett has held shares of companies like Coca-Cola and American Express for decades, trusting in their ability to generate sustainable value.

The Buy & Hold strategy is particularly effective in prolonged bull markets, although it requires patience and confidence in selecting the right companies.

Sourcee: @BrianFeroldi (X), https://brianferoldi.kit.com/99

2. Dividend Investing

This strategy focuses on investing in companies that distribute part of their profits to shareholders in the form of dividends. It is a popular approach among those seeking passive income, as it allows for a steady cash flow regardless of stock price fluctuations.

2.1 Types of Dividends

- Regular Dividend: A periodic payment that companies make to shareholders as part of their ordinary profits.

- Special Dividend: An exceptional payment made when the company generates extraordinary profits or has excess cash to distribute among shareholders.

2.2 Dividend Yield

Dividend yield measures the percentage return an investor earns from dividends relative to the stock price. It is calculated as:

Dividend Yield = (Annual Dividend per Share / Stock Price) × 100

For example, if a company pays €2 per share in dividends and the stock trades at €50, the dividend yield would be 4%.

2.3 Impact on Stock Price

When a company pays dividends, the dividend amount is deducted from the stock price on the ex-dividend date. This means that from that date onwards, new buyers are not entitled to receive the dividend.

2.4 Key Dividend Dates

- Ex-Date (Ex-Dividend Date): The date when the stock starts trading without the right to receive the dividend. Investors must own the shares before this date to qualify for the payout.

- Record Date: The date when the company verifies which shareholders are eligible to receive the dividend.

- Payment Date: The date when the dividend payment is made to registered shareholders.

This investment strategy is especially attractive for those seeking stability and recurring income, such as retirees or conservative investors.

2.5 Withholding Tax at Source:

A tax applied to dividends or interest generated by investments in a foreign country. The percentage varies depending on the country of origin of the issuing company and does not depend on where its shares are traded.

-

- Withholding Tax Table by Country:

|

Country |

Withholding Tax on Dividends (%) |

Additional Notes |

|

United States |

30% |

Can be reduced to 15% or 0% with the W-8BEN form (tax treaty). |

|

Spain |

19% |

EU residents may request a reduction. |

|

France |

25% |

Can be reduced to 12.8% with an exemption form. |

|

Germany |

26.375% |

Can be reduced to 15% under tax treaties. |

|

Italy |

26% |

Reduction applicable with tax treaties. |

|

United Kingdom |

0% |

No withholding tax on dividends. |

|

Switzerland |

35% |

Can be reduced to 15% under tax treaties. |

|

Netherlands |

15% |

Reduction applicable under tax agreements. |

|

Portugal |

28% |

Can be reduced to 15% under tax treaties. |

|

Canada |

25% |

Can be reduced to 15% under tax treaties. |

|

Japan |

20.42% |

Possible reduction with tax agreements. |

|

Hong Kong |

0% |

No withholding tax on dividends. |

|

Singapore |

0% |

No withholding tax on dividends. |

|

Australia |

30% |

Can be reduced to 15% under tax treaties. |

|

Brazil |

0% |

Currently, no withholding tax on dividends. |

|

Mexico |

10% |

Applies to non-residents. |

|

Argentina |

7% |

Applies to non-residents. |

|

Chile |

35% |

Reduction possible under tax treaties. |

Key Notes:

- Rates may vary depending on double taxation agreements (DTTs) between countries.

- Some withholding taxes can be reclaimed through tax refund applications or specific forms.

- Rates are subject to change due to tax reforms in each country.

** Withholding Tax Map and Table: PwC Withholding Tax Rates

3. Value Investing

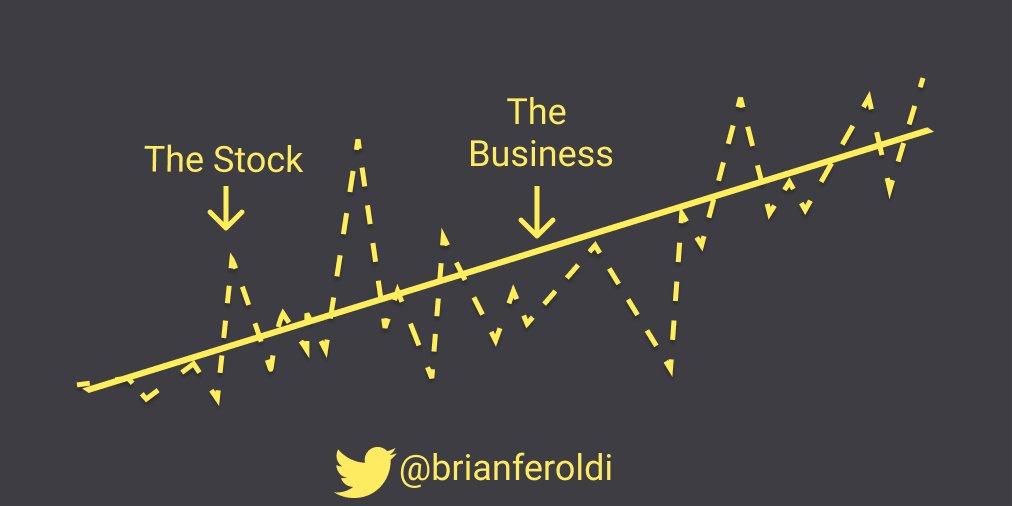

This approach seeks stocks that are undervalued in the market, meaning their current price is lower than their true intrinsic value. Value investors believe that the market can make mistakes when valuing companies—whether due to temporary losses or lack of information—and bet that over time, the market will correct these mistakes, bringing the stock price to its real value.

Benjamin Graham, considered the father of value investing, used an analogy called "Mr. Market" to explain how stock prices can be irrational. Mr. Market is an imaginary character who offers to buy or sell stocks at different prices every day, often influenced by emotions like fear or euphoria. Value investors take advantage of these irrational fluctuations to buy stocks when they are cheap and sell them when they are overvalued.

This approach was popularized by Benjamin Graham and successfully applied by Warren Buffett, one of the world's most recognized investors. Value investors often analyze financial ratios such as P/E ratio (Price-to-Earnings) and Book Value to identify promising opportunities.

4. Growth Investing

This strategy focuses on companies with high growth potential, even if their current profits are low. These stocks tend to be riskier because their valuations are often based on future expectations rather than present earnings. This makes them more sensitive to economic conditions, such as interest rate fluctuations.

For example, when interest rates rise, companies' financing costs also increase, potentially affecting their growth capacity and, consequently, their stock prices. These stocks are also more vulnerable to shifts in market sentiment, as investors frequently adjust their future expectations based on economic news.

A notable investor in this style is Cathie Wood, founder of ARK Invest, who specializes in identifying high-growth technology and disruptive companies. Wood focuses on sectors such as artificial intelligence, biotechnology, and renewable energy, where innovation expectations play a crucial role in valuations.

Long and Short Positions

Long Position – Buy First, Sell Later

This is the most common strategy. It involves purchasing stocks with the expectation that their price will rise so they can be sold later for a profit. Statistically, this strategy tends to be more profitable than short selling for several reasons.

First, stock markets have a historical upward trend in the long run, driven by economic growth and business innovation. This means that investors who take long positions are aligned with this growth dynamic.

In contrast, short positions bet against this trend, making them riskier and less sustainable over time. Additionally, long positions do not incur significant additional costs, such as the interest payments required when borrowing shares for short selling, nor do they carry the risk of unlimited losses in the event of a sudden price increase.

For these reasons, long positions are considered a safer and more consistent strategy for most investors.

Short Position – Sell First, Buy Later

Although it may seem impossible—how can you sell something you don’t own?—it is possible in the stock market. To do this, an investor borrows shares from another investor who owns them, paying an interest fee in exchange.

This is a more advanced and riskier strategy. It involves betting that a stock’s price will decline. The investor borrows shares, sells them at their current price, and later buys them back at a lower price, returning the borrowed shares and profiting from the price difference.

However, statistically, this strategy is not effective for most investors due to several factors:

- Unlimited risk: There is no theoretical limit to how high a stock price can go, leading to potentially massive losses.

- Market volatility: Unexpected price fluctuations make predicting movements difficult.

- Additional costs: Investors must pay interest on borrowed shares and cover commission fees.

Studies show that most investors who attempt short-selling strategies fail to consistently outperform the market in the long run due to these costs and risks. For these reasons, many experts suggest that short-selling is better suited for professional investors with experience.

Short Squeeze (Squeezing Short Positions)

A short squeeze is a phenomenon that occurs in financial markets, particularly the stock market, when a stock that has been heavily shorted experiences a rapid and significant price increase. This forces short sellers to close their positions by buying shares to limit their losses, further driving up the stock’s price.

Context and Explanation:

Short Selling:

- Short selling is a strategy used by investors to profit from a decline in stock prices. It involves borrowing shares, selling them at the current price, and repurchasing them at a lower price, returning the borrowed shares and keeping the price difference as profit.

The Problem:

- If, instead of falling, the stock price rises sharply, short sellers begin to face potentially unlimited losses, as there is no maximum limit on how high a stock can go.

Triggering a Short Squeeze:

- Any positive event, such as strong financial results, a company acquisition, or increased speculative buying, can cause the stock price to rise.

- As the price increases, short sellers feel pressure to cover their positions by buying shares. This mass buying increases demand and further drives up the price.

Chain Reaction Effect:

- As more short sellers cover their positions, the stock price continues to skyrocket, trapping even more short sellers and amplifying the squeeze.

Example: GameStop (2021)

A famous example of a short squeeze occurred in January 2021 with GameStop (GME) stock. A community of retail investors on Reddit (r/WallStreetBets) began massively buying GameStop shares, driving the price up and causing a short squeeze. This led to huge losses for hedge funds that had bet against the company.

Key Characteristics of a Short Squeeze:

- High short interest ratio: A large percentage of a company’s shares are shorted compared to the available supply.

- External catalyst: A specific event or change in market sentiment triggers the price surge.

- Extreme volatility: The stock price experiences dramatic fluctuations in a short period.

A short squeeze highlights the interaction between speculation, risk, and market psychology, leading to both extraordinary gains and significant losses for investors.

Is a More Expensive Stock Better Than Another?

The price of a stock does not necessarily indicate its quality or potential. A stock priced at €1,000 is not inherently better than one priced at €10. This is because the price also depends on the total number of shares issued by the company.

To determine whether a stock is expensive or cheap, investors use financial ratios, which you can explore in the section on company analysis and valuation.

Stock Volatility

Volatility is a statistical measure that indicates the degree of variation in the price of a financial asset over a given period. It is expressed in terms of standard deviation and is commonly used as an indicator of market uncertainty or risk.

Types of Volatility

There are two main types of volatility:

- Historical volatility: Calculated by observing past price movements of an asset.

- Implied volatility: Estimated from options prices, reflecting the market's expectations of the asset’s future volatility.

Calculating Volatility

Volatility is typically calculated using the standard deviation of an asset’s returns over a specific period.

- High volatility implies sharp price movements, which can signal greater uncertainty.

- Low volatility indicates price stability, which is associated with lower uncertainty.

It is important to note that volatility does not necessarily imply losses or gains, but simply price fluctuations.

Beta: A Measure of Market Sensitivity

The beta (β) measures how sensitive a financial asset is in relation to the overall market. It is used to assess systematic risk, which is the risk that cannot be eliminated through diversification.

- β = 1 → The stock moves in line with the market.

- β > 1 → The stock is more volatile than the market. If the market rises 10%, a stock with β = 1.5 will rise approximately 15%.

- β < 1 → The stock is less volatile than the market. If the market rises 10%, a stock with β = 0.5 will rise only 5%.

- β < 0 → The stock has an inverse correlation with the market, meaning it tends to move in the opposite direction.

Investor preferences based on beta:

- Conservative investors may prefer low-beta assets to minimize exposure to market risk.

- Aggressive investors may seek high-beta stocks to take advantage of market movements.

Risk: Beyond Volatility

Risk in investments refers to the uncertainty about the future returns of an asset. It can be classified into:

- Systematic risk: Cannot be diversified away; it affects the entire market (e.g., economic crises, interest rate changes).

- Unsystematic risk: Can be reduced through diversification; it is specific to a company or sector (e.g., poor corporate management, regulatory issues).

Difference Between Volatility and Risk

- Volatility measures price fluctuations, but does not necessarily indicate high risk.

- Risk implies the possibility of permanent capital loss, which is not always related to volatility.

Example:

- A stable stock with poor financial fundamentals can be riskier than a volatile stock with strong financial fundamentals in the long run.

Risk Management Methods

Some methods to mitigate risk include:

- Diversification: Investing in different assets reduces exposure to specific adverse events.

- Hedging strategies: Options and futures can protect against unfavorable market movements.

- Position sizing: Avoid overexposing capital to a single asset.

- Fundamental analysis: Evaluating the strength of an investment before making decisions.

Conclusion

- Volatility is a measure of price fluctuations, not a synonym for risk.

- Beta measures a stock’s sensitivity to market movements.

- Risk involves uncertainty and is not always linked to volatility.

Source: @BrianFeroldi (X), https://brianferoldi.kit.com/99