Phases of Market Psychology

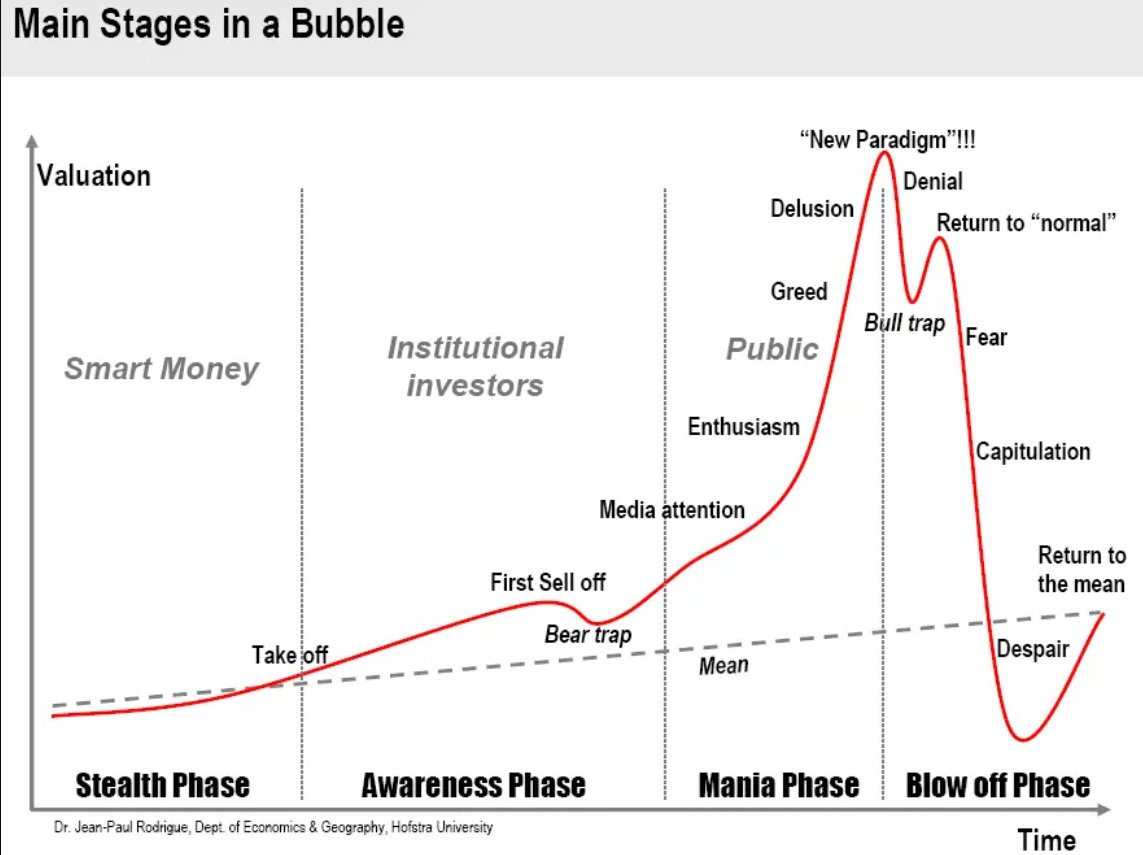

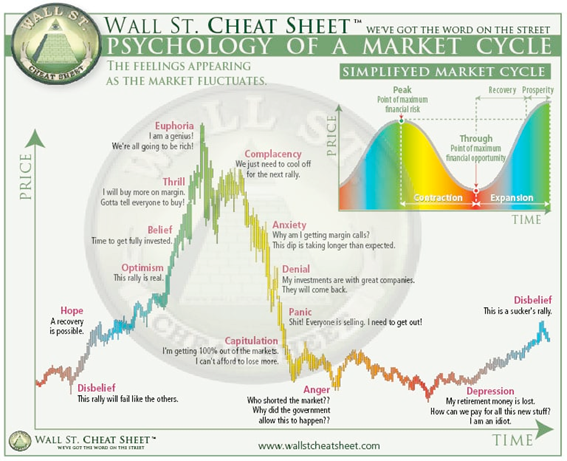

Financial markets do not move solely based on economic data or business fundamentals; emotions play a crucial role in investor behavior. Market psychology describes how investment cycles are driven by collective feelings, which can lead to speculative bubbles and financial crashes.

1. What is Market Psychology?

Market psychology refers to the collective emotions of investors throughout stock market cycles. These emotions tend to follow a repetitive pattern, influenced by:

- The perception of risk and opportunity.

- Economic and geopolitical news.

- Expectations of growth and crisis.

- Herd effect, where investors follow trends without questioning them.

1.1 Why is it important to understand market psychology?

📌 Avoids impulsive decisions: Investors tend to buy during euphoria (market highs) and sell during panic (market lows).

📌 Improves decision-making: Recognizing which phase of the cycle the market is in helps act rationally.

📌 Allows taking advantage of opportunities: The best times to buy are usually during fear and despair phases.

2. Phases of Market Psychology

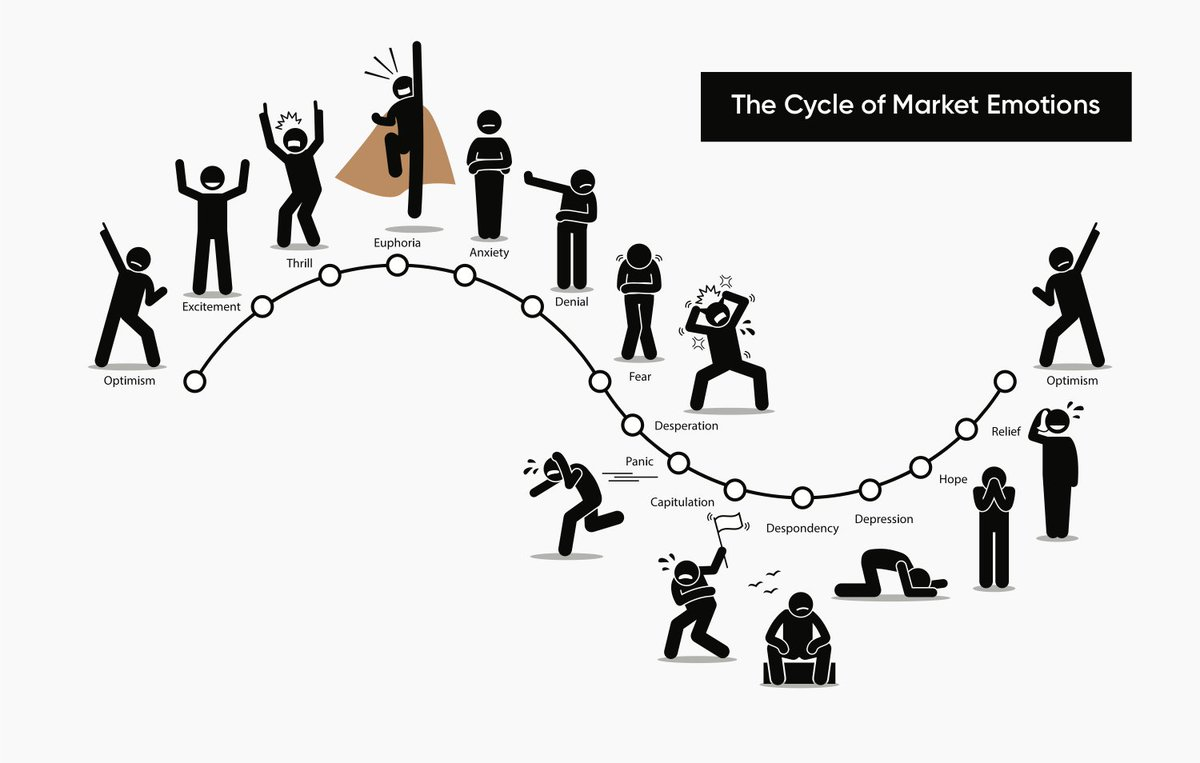

The market cycle follows an emotional pattern that can be divided into 14 main phases.

2.1 Disbelief

📉 Early stage of the bullish cycle. The markets have been in a downtrend, and many investors still do not believe in a recovery. Any small rise is met with skepticism.

💡 Example: After the 2008 financial crisis, the first gains in 2009 were ignored by many, who thought it was just a "dead cat bounce."

2.2 Hope

📈 Beginning of recovery. The first investors start noticing positive signs in the economy or markets. New opportunities appear, and confidence begins to return.

💡 Example: After the cryptocurrency market crash in 2018, Bitcoin started recovering in 2019, generating hope among investors that the market could rise again.

2.3 Optimism

📈 Developing uptrend. More investors begin entering the market. Economic news is positive, and companies report strong earnings.

💡 Example: During 2020 and 2021, after the pandemic, markets recovered rapidly, driven by government stimulus, generating optimism among investors.

2.4 Belief

📈 Confidence phase in the market. Investors firmly believe in the bullish trend. Most institutional funds start entering, and prices continue rising steadily.

💡 Example: Tech stocks like Apple, Amazon, and Tesla surged in 2021, supported by strong investor confidence.

2.5 Thrill

🚀 Market euphoria. Investors feel like they "can’t lose." There is excessive confidence, and everyone seems to be making money. Valuations reach very high levels.

💡 Example: In 1999, during the dot-com bubble, many investors believed that technology stocks would continue rising indefinitely.

❌ Risk: This is the point where the risk of a bubble increases, and many inexperienced investors buy without evaluating the true value of assets.

2.6 Euphoria

🚀 Market peak. Everyone is investing. The media reports success stories, and assets seem unstoppable. However, overvaluation is extreme, and any bad news can trigger a correction.

💡 Example: Bitcoin reached $69,000 in 2021 driven by euphoria before collapsing in 2022.

⚠️ Warning: This is the worst time to buy and the best time to take profits.

2.7 Complacency

📉 First signs of weakness. Markets start to wobble, but investors believe it is just a temporary correction.

💡 Example: In 2007, markets showed signs of weakness, but many investors ignored warnings about the housing crisis.

⚠️ Strategy: Be cautious and evaluate exposure to risk.

2.8 Anxiety

📉 Continuous decline. Markets keep falling, and investors start to worry.

💡 Example: In 2018, markets dropped after a big rally, creating anxiety about a potential recession.

2.9 Denial

📉 Persistent decline. Investors deny that there is a real problem and believe the market will recover soon.

💡 Example: In 2008, before the collapse of Lehman Brothers, many investors thought the crisis was manageable.

2.10 Panic

📉 Massive sell-off. Investors panic and sell at any price, causing even greater crashes.

💡 Example: The March 2020 crash due to COVID-19 was a clear example of market panic.

✅ Opportunity: This is the moment when experienced investors buy at low prices.

2.11 Anger

📉 Frustration and blame-seeking. Investors look for someone to blame—governments, banks, and analysts—for their losses.

2.12 Depression

📉 Resignation phase. Investors lose confidence in markets and avoid new investments.

✅ Strategy: This is the best time to enter the market before a new recovery begins.

2.13 Disbelief (New Disbelief)

📈 The cycle repeats. The market begins to recover, but few believe it, thinking it’s a false rebound.

3. Conclusion

- Identifying the market phase helps make better investment decisions.

- Avoiding buying during euphoria and selling during panic is key to profitability.

- Emotions are cyclical, and recognizing them allows investors to seize opportunities.

💡 The best investors buy when there is fear and sell when there is greed. 🚀

Source: @BrianFeroldi (X), https://brianferoldi.kit.com/99