VIX: The Market’s Fear Gauge

1. Definition of the VIX

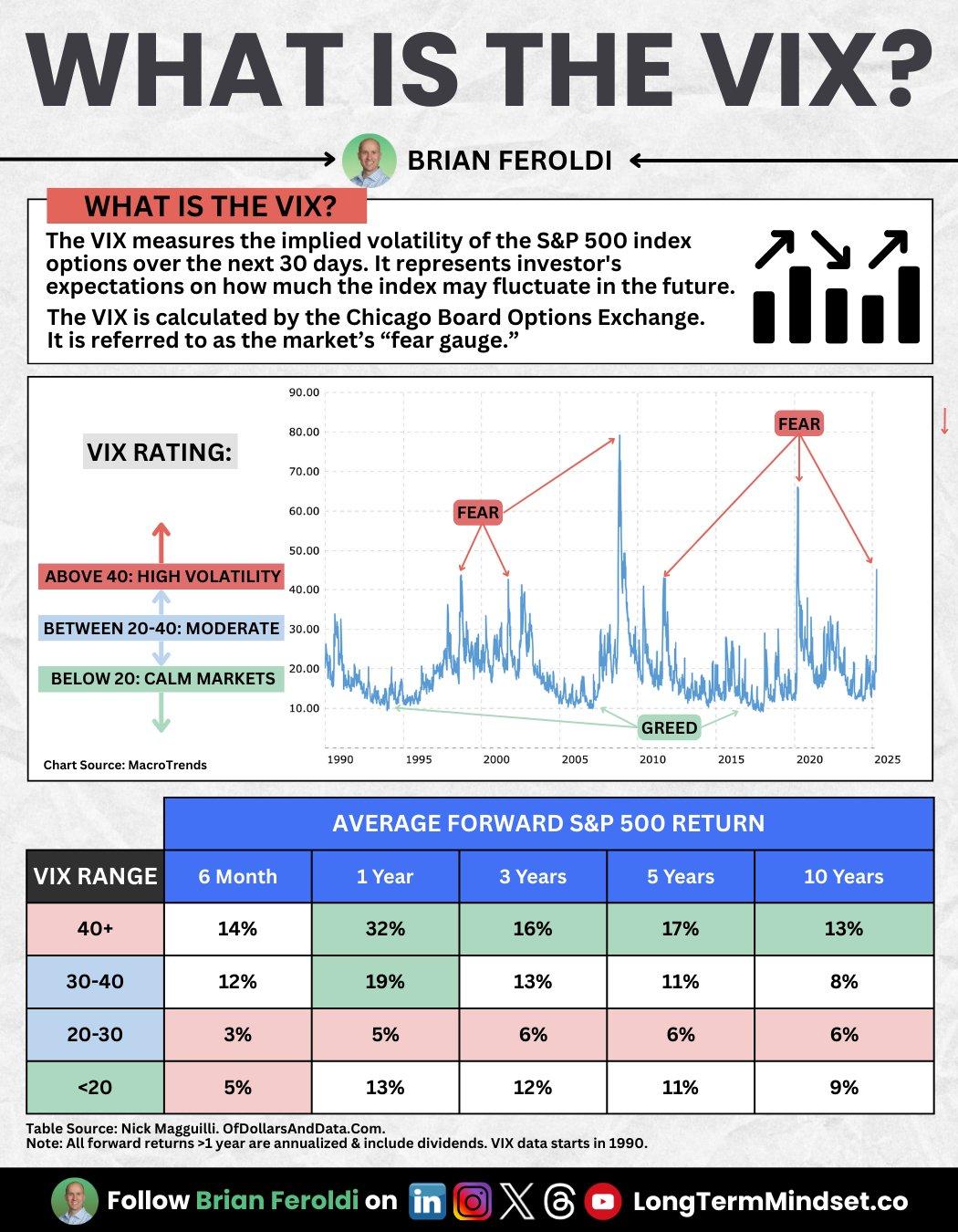

The VIX, also known as the Volatility Index, is a financial indicator that measures the expected volatility of the U.S. stock market over the next 30 days, based on options of the S&P 500 index.

It was developed by the Chicago Board Options Exchange (CBOE), hence it's also called the CBOE Volatility Index.

What does the VIX actually measure?

The VIX doesn’t measure current market volatility, but rather the implied volatility that investors expect in the near term. In other words, it captures the "nervousness" or "calm" among market participants about the future. This is why it’s commonly referred to as the "fear index"—it tends to spike during times of uncertainty, crises, or major market corrections.

2. Origin of the VIX

The VIX was introduced in 1993 by the CBOE, based on academic work by Professor Robert Whaley from Duke University. It was created to provide a barometer of market sentiment and a way to understand how investors were pricing risk.

Historical evolution

-

1993: The original VIX was based on S&P 100 options.

-

2003: The CBOE redefined the VIX to use S&P 500 options, making it more representative of the broader market.

-

Since then, the VIX has become a cornerstone tool in market analysis, spawning an entire family of volatility-based products.

3. VIX Components: How It's Calculated

The VIX is calculated using a wide range of S&P 500 index call and put option prices. These options must meet certain criteria:

-

They expire in 23 to 37 days.

-

They include both in-the-money and out-of-the-money options.

-

They are actively traded with reliable pricing.

Simplified calculation process

-

Collect prices of S&P 500 call and put options with varying strike prices.

-

Estimate the implied volatility across those strikes.

-

Apply a weighted formula to derive a single figure that reflects expected market volatility over the next 30 days.

⚠️ Important: The VIX calculation is complex and uses adapted versions of the Black-Scholes model, but it’s not necessary to understand the exact formula to learn how to use the index as an investment tool.

4. Historical VIX Peaks: Crises and Opportunities

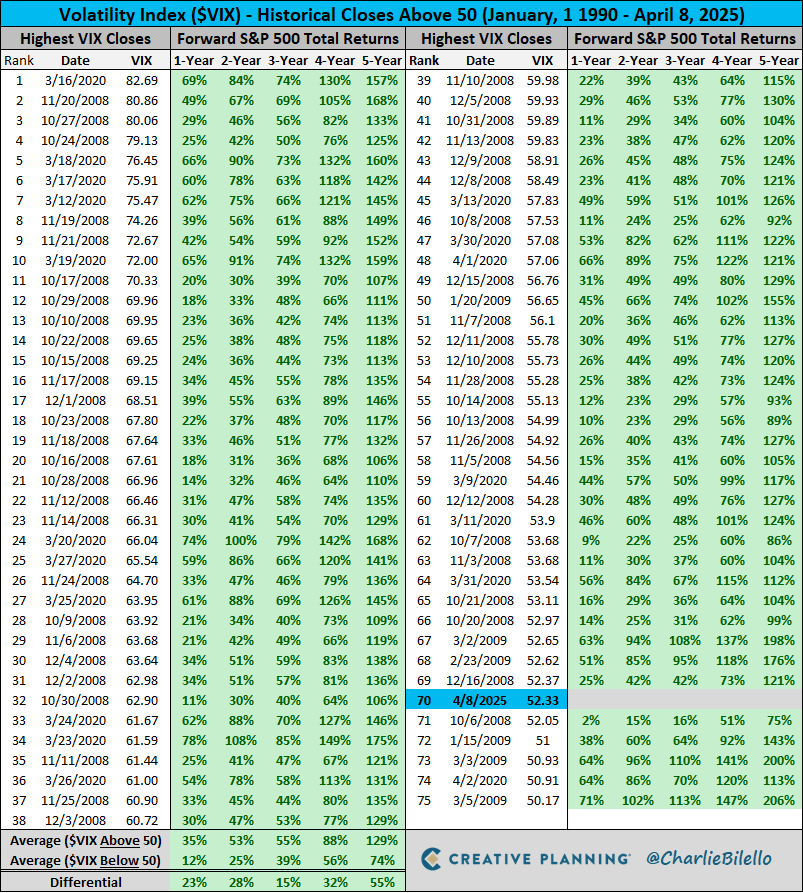

The VIX tends to spike dramatically during times of economic and geopolitical distress. These peaks help us understand how the market reacts under fear.

Major historical spikes

Low levels (troughs)

The VIX can remain low (below 12) for extended periods during economic growth and market stability. Examples:

-

2017: A year of global growth and geopolitical calm. The VIX hovered around 9–10.

🧠 Tip: A low VIX doesn’t necessarily mean the market is bullish, but it does suggest that investors are relaxed and not expecting major turbulence.

5. How to Use the VIX to Buy Stocks

The VIX is a powerful market timing tool. While not infallible, it helps identify extreme sentiment—both fear and complacency—that often precede market turning points.

Basic strategy: Buy when others are fearful

-

When the VIX spikes sharply (e.g., above 35–40), it indicates panic in the markets. Many investors are dumping stocks.

-

These moments often present excellent opportunities to buy high-quality companies at discounted prices.

Real-life example:

-

In March 2020, the VIX hit all-time highs due to COVID-19 panic.

-

Stocks like Apple, Amazon, and Microsoft dropped significantly.

-

Investors who bought during this fear-driven selloff saw gains of over 100% within two years.

Contrarian strategy: Low VIX = Caution

-

An extremely low VIX can signal excessive complacency, which sometimes precedes a correction.

-

It’s a good time to review your positions and consider taking profits.

6. Can You Invest Directly in the VIX?

Short answer: not directly. But you can gain exposure to the VIX through various financial products built around it.

Ways to invest in the VIX:

-

ETNs/ETFs based on volatility:

-

Examples: VXX, UVXY, SVXY

-

These attempt to replicate VIX movements using futures contracts.

-

Warning: These products have high costs and are designed for short-term trading. Holding them long term may erode your capital due to contango.

-

-

VIX Futures:

-

Traded on the CBOE Futures Exchange.

-

Useful for speculative or hedging strategies.

-

Require expertise and significant capital.

-

-

VIX Options:

-

Allow for more advanced strategies like volatility spreads or portfolio hedging.

-

Is it recommended to invest in the VIX?

✅ Yes, if:

-

You have experience with derivatives.

-

You want to hedge your portfolio during uncertainty.

-

You’re a short-term trader looking to capitalize on fear spikes.

❌ No, if:

-

You’re a beginner or long-term investor.

-

You don’t understand concepts like contango or backwardation.

Conclusion: Why Teach the VIX in an Investment School?

The VIX is an essential tool for understanding market sentiment and risk perception. Learning how to interpret it enables investors to make smarter, more rational decisions during volatile periods.

Learning about the VIX provides:

-

A deeper understanding of market psychology.

-

The ability to spot hidden opportunities.

-

An edge over investors who only look at prices and fundamentals.

Source: @BrianFeroldi (X), https://brianferoldi.kit.com/99

Source: https://x.com/charliebilello