Investment Scams

The world of investing is an attractive environment for those looking to grow their wealth. However, it is also fertile ground for fraud and scams. Below is an in-depth analysis of how the main scams operate, how to identify them, and how to protect yourself.

1. Multilevel Marketing Companies: A Controversial Model

Multilevel marketing (MLM) companies are business structures in which participants earn money both by selling products and recruiting others to join. While not all MLM companies are fraudulent, many operate as disguised pyramid schemes.

Example: Herbalife and Bill Ackman's Bet

- Herbalife, a nutritional supplements company, has been at the center of controversies over its business model. Bill Ackman, a hedge fund manager, claimed that Herbalife was a pyramid scheme and bet $1 billion against it.

- Ackman argued that Herbalife's revenues primarily depended on recruitment rather than product sales.

- Ultimately, another investor, Carl Icahn, bet in the opposite direction, defending Herbalife. Although Ackman lost his bet, the case highlighted the inherent risks of MLM companies.

Red Flags in Multilevel Marketing Companies:

· Excessive emphasis on recruitment over actual product sales.

· Promises of easy and quick profits.

· High initial costs to join the scheme.

2. Ponzi Schemes: An Empty Promise

A Ponzi scheme is an investment fraud that pays returns to earlier investors with money from new investors, rather than generating real profits.

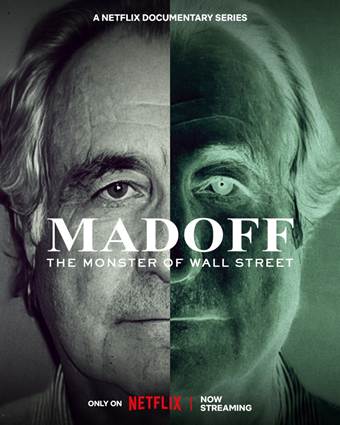

Bernard Madoff

Bernard Madoff orchestrated one of the largest Ponzi schemes in history, defrauding investors of more than $65 billion. This case was documented in a powerful Netflix documentary that details how his fraud network operated and the devastating consequences for thousands of investors.

He offered consistent and high returns, even during economic crises, which turned out to be too good to be true.

Indicators of a Ponzi Scheme:

· Consistently high returns, regardless of market conditions.

· Lack of transparency about the business model or investment strategy.

· Difficulty withdrawing funds.

3. Pump and Dump: Market Manipulation

"Pump and dump" is a common scam in which the price of an asset (usually a low-value stock or cryptocurrency) is artificially inflated through misleading or exaggerated information.

How It Works:

- Scammers buy large amounts of an asset.

- They promote the asset on social media, forums, or investment channels, generating artificial enthusiasm.

- Once the price rises, they sell their holdings, leaving others with losses.

Recent Example: In the cryptocurrency market, some coins have been the target of "pump and dump" schemes organized on platforms like Telegram and Discord.

How to Detect It:

· Sudden and unexplained price growth of an asset.

· Excessive promotion in informal channels or by individuals without credibility.

4. Promises of High Returns: A Red Flag

Investment scams often lure victims with the promise of very high and guaranteed returns, something that is rarely possible in finance.

Example: Fraudulent Forex or cryptocurrency platforms promise to double or triple capital in just a few days.

Watch Out For:

· Guarantees of high returns with no risk.

· Use of fake or manipulated testimonials.

· Pressure to invest quickly (FOMO).

5. Pressure to Invest: The FOMO Hook

Fear of Missing Out (FOMO) is a psychological tactic used to push investors into making hasty decisions.

Common Strategies:

- Limited-time offers or exclusive opportunities for a select group.

- Messages like "You don't want to miss out on this opportunity."

Protection Against FOMO:

· Never make financial decisions under pressure.

· Evaluate the opportunity with impartial information.

6. Lack of Credibility and Regulations

Many frauds operate outside regulatory oversight or use deceptive tactics to appear legitimate.

How to Identify Scams:

· Reviews and Opinions: Reviews on sites like Trustpilot can be manipulated. Look for repetitive patterns or artificial language.

· Domain Confirmation: Verify if the website domain matches the official organization.

· Registration with Regulators: Check if it is registered with the CNMV or the regulatory body in your country.

· Use of Bots: Spot automated comments on social media through repetitive language or accounts with no real activity.

7. Practical Tips to Avoid Scams

- Ask Questions Relentlessly:

-

- If promoters get annoyed or try to rush you, it's a red flag.

- Request detailed information about the investment.

-

- Research the People Behind It:

-

- Look up information about the founders or project promoters.

- Check their LinkedIn profiles, financial history, and reputation in the market.

-

- Verify the Business Model's Viability:

-

- Analyze whether the company generates real revenues or depends solely on recruitment or inflated promises.

-

- Consult Experts:

-

- Speak with certified financial advisors before making significant investments.

-