Concepts and Terms

- Stop Loss: An automatic sell order set to limit losses on an investment. It is triggered when the asset's price drops to a predetermined level set by the investor.

- Take Profit: An automatic sell order executed when the asset reaches a target price set by the investor. It is used to secure profits before a potential decline.

- 4% Rule: A withdrawal strategy in investing that recommends withdrawing 4% of the accumulated capital annually from a diversified portfolio to ensure a sustainable retirement without depleting the capital.

- Nano-cap: Companies with a market capitalization of less than $50 million.

- Micro-cap: Companies with a market capitalization between $50 million and $300 million.

- Small-cap: Companies with a market capitalization between $300 million and $2 billion.

- Mid-cap: Companies with a market capitalization between $2 billion and $10 billion.

- Big-cap (Large-cap): Companies with a market capitalization of more than $10 billion.

·

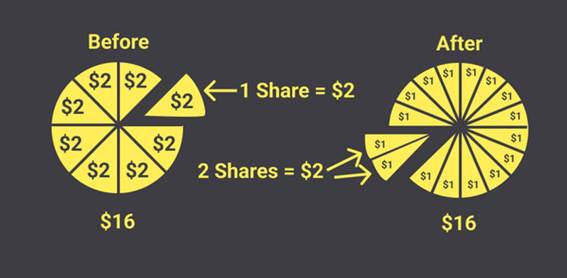

- Stock Split: A process in which a company increases the number of shares in circulation, reducing their price without altering the total value. Example: A 2:1 split doubles the number of shares and halves their price.

- Reverse Split: The opposite process of a stock split, where the number of shares in circulation is reduced, increasing their unit price to improve market perception and avoid excessively low prices.

- Free Float: The number of shares of a company available for purchase and sale in the market, excluding those held by majority or institutional shareholders with controlling positions.

- The margin of safety: It is the difference between a stock's intrinsic value (according to fundamental analysis) and the price at which it is purchased in the market. The greater the margin of safety, the lower the risk of loss if the investment does not perform as expected.

- Markup is the price increase that a seller applies over the cost of a product or financial asset to obtain a profit. It is the difference between the acquisition cost and the selling price, expressed in percentage or monetary terms.

Markup = (Selling Price - Cost) / Cost × 100

-

-

- Example: A retailer buys a product for $50 and sells it for $75. This means the company is adding a 50% margin over the cost to set the selling price. (75−50) / 50 × 100 = 50%

-

- Markdown is the price reduction applied to a product, service, or financial asset when the selling price is lowered below its original value or reference price.

Markdown = (Original Price - New Price) / Original Price × 100

-

-

- Example: A retailer sells a television for $1,000 but discounts it to $800 during the sales season. This means the price has been reduced by 20% to encourage purchases. (1000–800) / 1000 × 100 = 20%

-

- Asset securitization: It is a financial process through which a set of assets, usually non-tradable (such as mortgage loans, consumer credit, accounts receivable, among others), are pooled together and transformed into tradable financial instruments in the capital markets.

- Covenans: Financial covenants are contractual clauses included in loan agreements or bond issuances that establish certain conditions or restrictions for the borrower in order to protect creditors. They can be classified as follows:

-

- Positive covenants: Require the borrower to meet certain requirements (e.g., maintain a minimum level of liquidity or submit periodic financial reports).

- Negative covenants: Prohibit certain actions, such as taking on debt beyond a specified limit or distributing dividends without prior authorization.

- Financial covenants: Related to financial metrics, such as maintaining a debt-to-EBITDA ratio within an allowed range.

- FAANG: It was one of the most widely used terms in tech investing before the concept of the "Magnificent 7" gained relevance. It refers to five tech giants: META, AAPL, AMZN, NFLX, GOO.

- The Magnificent 7: FAANG + (Tesla and Nvidia).

- Nifty Fifty: Refers to a group of 50 large U.S. company stocks that dominated the stock market in the 1970s.

- Blue Chips: These are large-cap companies with a strong track record of growth and stability. They are often considered safe investments due to their financial strength and market leadership.

- Dividend Aristocrats: Companies that have increased their dividends consecutively for at least 25 years.

- Dividend Kings: A level above Dividend Aristocrats. These are companies that have increased their dividends for at least 50 years.