What are Financial Asset Bubbles?

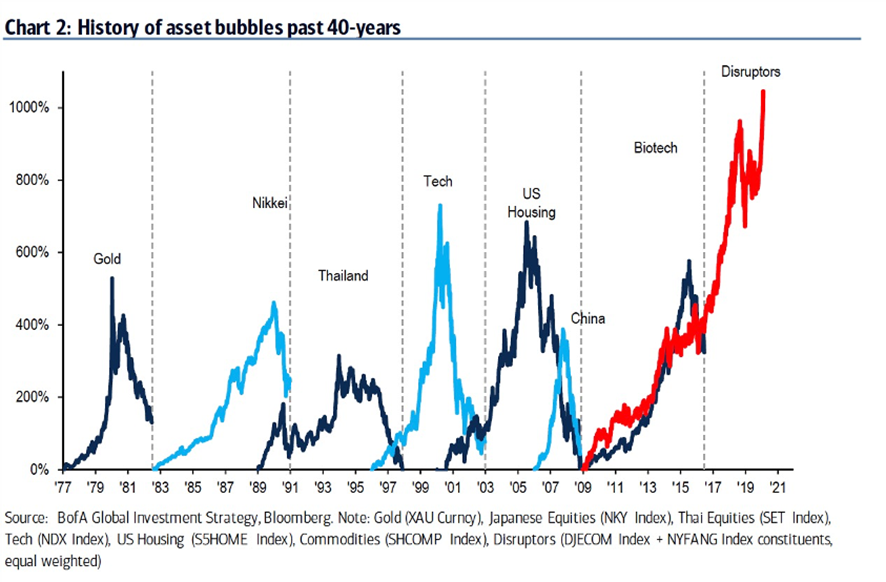

A financial bubble occurs when the price of an asset—such as a stock, real estate, or even cryptocurrency—rises disproportionately and far exceeds its real value. Although these bubbles might seem exciting and lucrative at first, they usually end in a crash that leaves many investors with significant losses.

Financial bubbles are not new; they’ve existed for centuries and always follow a similar pattern. Let’s explore the main characteristics of these bubbles to better understand how they form and why they always end up bursting.

Common Characteristics of Financial Bubbles

- Excessive Optimism

At the start of a bubble, investors feel they’re facing a unique opportunity and that "this time is different." They believe asset prices will keep rising indefinitely, creating an environment of widespread enthusiasm. However, this optimism is often unrealistic and driven more by emotions than by solid facts.

- Uncontrolled Speculation

During a bubble, people are willing to pay extremely high prices for an asset, even when they know its real value doesn’t justify it. For example, someone might buy shares in a company with barely any profits simply because others are doing so, and prices appear to keep climbing.

- Lack of Fundamentals

At this stage, asset prices no longer reflect their real value. For instance, a house or a stock might triple in price without any solid economic reason, such as an increase in profitability or utility.

- FOMO (Fear of Missing Out)

Many people join the bubble out of fear of missing a supposed once-in-a-lifetime opportunity. This impulsive behavior injects more money into the market, further inflating prices.

- The Inevitable Collapse

Sooner or later, reality catches up with speculators. Prices begin to drop as investors lose confidence or realize the asset isn’t worth what they paid for it. This collapse may start gradually but often turns into a sharp and uncontrolled crash. Those who bought at the peak of the bubble are usually the ones who suffer the most.

Image of a typical bubble pattern, discussed in detail in the psychology section.

Historical Examples of Financial Bubbles

- Tulip Mania (17th Century): In the Netherlands, tulip bulb prices reached absurd levels before crashing abruptly.

- The Dot-Com Bubble (Late 1990s): During the internet boom, many tech companies were valued in the billions without generating real profits. When the market corrected, many of these companies disappeared.

- The 2008 Housing Bubble: Housing prices in many countries rose unsustainably due to excessive credit and speculation, leading to the global financial crisis.

How to Avoid Falling into a Financial Bubble

- Research and Analyze Fundamentals: Before investing, make sure you understand the asset’s real value and don’t get swept up in the moment’s hype.

- Avoid FOMO: Don’t invest just because others are doing so. Making impulsive decisions can be costly.

- Be Skeptical of Promises of Quick Profits: If something seems too good to be true, it probably is.

- Diversify Your Investments: Don’t put all your money into one asset. A diversified portfolio reduces the risk of significant losses.

Conclusion

Financial bubbles are recurring phenomena that combine human psychology, speculation, and a lack of economic fundamentals. Understanding how they work and why they eventually burst can help you avoid falling into them and protect your investments. The key is to stay calm, do your research, and resist the urge to follow the crowd. Remember: if something seems like a guaranteed, once-in-a-lifetime opportunity, think twice before investing!