MOAT and How It Affects Valuations

MOAT, or competitive moat, is the advantage that protects a company from its competitors and allows it to maintain a dominant position in its sector. Popularized by Warren Buffett, this term refers to a company's sustainable competitive advantage that enables it to hold its market position and generate high returns over an extended period.

In simple terms, a MOAT is similar to a medieval castle with a deep moat that prevents invaders from entering. In the business world, the deeper and wider this moat is, the harder it is for competitors to erode a company's market position.

1. Characteristics of a Strong MOAT:

- Protects market share against new competitors or established firms.

- Difficult to replicate: A true competitive moat cannot be easily imitated.

- Long-term sustainability: It is not a temporary advantage but one that persists over time.

- Ability to generate superior profitability: Allows the company to achieve a high ROIC (Return on Invested Capital) above the cost of capital for years.

- Barrier to entry for new competitors: Reduces the threat of new entrants into the market.

- Ensures stable and growing cash flows, translating into higher shareholder value.

- Increases the predictability of future profitability, reducing perceived risk for investors.

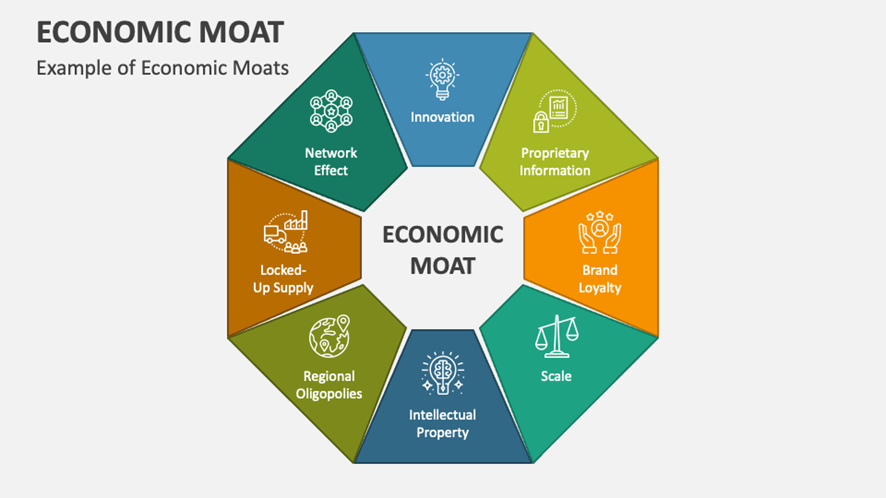

2. Types of MOAT

2.1 Cost Efficiency

There are various ways a company can develop a competitive moat. Below, we analyze the main types:

2.2 Cost Efficiency

Companies with significantly lower production costs than their competitors can offer lower prices without sacrificing profitability, creating a barrier to entry.

Example: Walmart and its optimized supply chain, which reduces operational costs.

2.3 Network Effect

Occurs when the value of a product or service increases as more people use it.

Examples:

- Meta (Facebook, Instagram, WhatsApp): The more people use these platforms, the more valuable they become for new users and advertisers.

- Visa and Mastercard: The large number of merchants and banks using these payment networks makes it difficult for new competitors to gain market share.

2.3 Switching Costs

When customers face high costs (financial or learning-related) to switch providers, the company gains a significant competitive advantage.

Examples:

- Microsoft and its suite of enterprise products like Office and Azure.

- SAP and Oracle (ERP Software): Companies that implement these systems face high costs if they want to migrate to another provider.

2.4 Brand and Intellectual Property

Strong brands and patents can provide a lasting advantage by preventing competitors from imitating products and services.

Examples:

- Coca-Cola and its secret formula and globally recognized brand.

- Pfizer (Pharmaceutical Industry): Patent protection allows exclusivity in selling innovative medicines.

- Disney: Owns exclusive rights to franchises like Marvel, Star Wars, and Pixar, ensuring revenue protected by intellectual property.

2.5 Regulations and Licenses

Regulatory barriers prevent new competitors from entering certain sectors.

Examples:

- Tobacco companies like Philip Morris, BAT, or Altria.

- Businesses with limited licenses like Rick Hospitality.

3. Impact of MOAT on Company Valuation

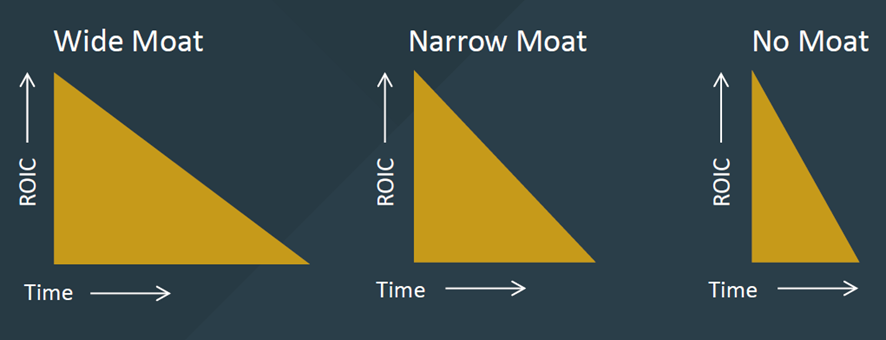

MOAT has a direct impact on a company's valuation because it influences its ability to generate sustainable future cash flows. Let's examine how this is reflected in valuation.

3.1 Relationship with the P/E Ratio (Price-to-Earnings Ratio)

Companies with a strong MOAT typically trade at a higher P/E ratio because investors trust their ability to maintain growing earnings over time.

Example: Companies like Apple or Google have higher P/E ratios due to their strong MOATs.

3.2 Impact on Intrinsic Value

The intrinsic value of a company is calculated using models like DCF (Discounted Cash Flow). Companies with a strong MOAT have:

- More predictable and sustainable cash flows.

- Lower risk of profitability decline.

- A lower cost of capital (WACC).

3.3 Relationship with the Risk Premium

Companies with a strong MOAT usually have a lower risk premium since investors perceive less uncertainty in their future revenues. This reduces their cost of capital and increases their valuation.

3.4 Measuring MOAT with Financial Indicators

Some key metrics that help evaluate a company's MOAT include:

- ROIC vs. WACC: A consistently higher ROIC than WACC indicates a strong MOAT.

- Gross Margin and Net Margin: High and stable margins signal a competitive advantage.

- Market Share and Revenue Growth: Companies with a MOAT tend to maintain or increase their market share.

4. Identifying and Evaluating a MOAT

To assess whether a company has a MOAT, the following steps can be taken:

- Analyze the competitive advantage: Identify if the company possesses any of the characteristics mentioned earlier.

- Evaluate MOAT sustainability: Determine whether the advantage is temporary or sustainable over time.

- Compare with competitors: Assess whether the company holds a significantly stronger position than its rivals.

- Review key metrics: ROIC, gross margin, net margin, and revenue growth are strong indicators of a durable MOAT.

5. Conclusion

Investors should carefully analyze a company's MOAT before making purchasing decisions, ensuring that the advantage is real, sustainable, and significant compared to the competition. The valuation of companies with a MOAT should consider not only current financial statements but also long-term growth potential and competitive protection.